jetcityimage/iStock Editorial via Getty Images

jetcityimage/iStock Editorial via Getty Images

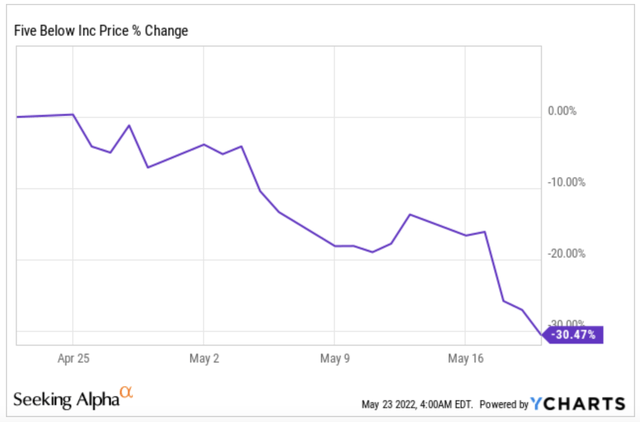

We decided to write this article to shed some light on Five Below, Inc.’s (NASDAQ:FIVE) recent stock performance. Five Below has dropped more than 30% in just one month:

YCharts

YCharts

At first glance, this looks really worrying, but it really isn’t (of course, it all depends on your investment horizon, which we think should be longer than one month, preferably 5 years and longer). If you build your positions slowly, price declines should not worry you, you should even welcome them. It’s much better to build a position when prices are going down than when prices are increasing. Psychologically speaking, the opposite may be true. But from a returns perspective, this is the way, in our opinion.

This article aims to help you understand why the recent price action is no reason for panic at all. Nothing has fundamentally changed for the company, but the market thinks that the unfolding macro environment will weigh heavily on future earnings. We think this might be true over the very short term, but that Five Below will benefit from this situation over the long term.

Before explaining our thought process, we would like to go superficially over Target’s (TGT) and Walmart’s (WMT) earnings, as these triggered the recent sell-off in Five Below.

On Wednesday last week, retail stocks got a big hit. The drop was probably caused by the earnings releases of two of the largest retailers in the U.S.: Target and Walmart.

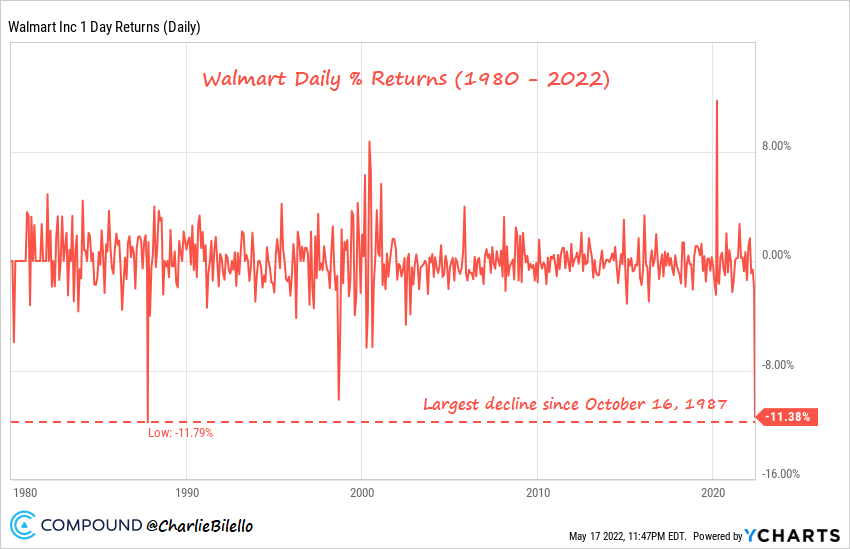

The day after reporting earnings, Walmart’s stock dropped by 11% in its largest one-day decline since 1987. Yes, you read that right. It was 35 years ago the stock had suffered such a one-day drop:

YCharts

YCharts

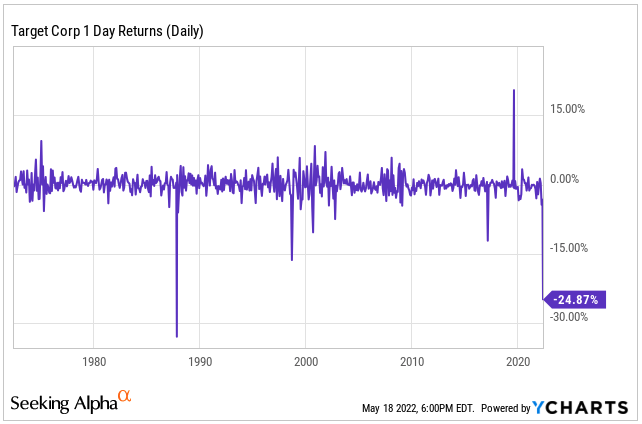

The same goes for Target, a company that dropped almost 25% after releasing earnings, suffering its largest one day decline since 1987, too:

YCharts

YCharts

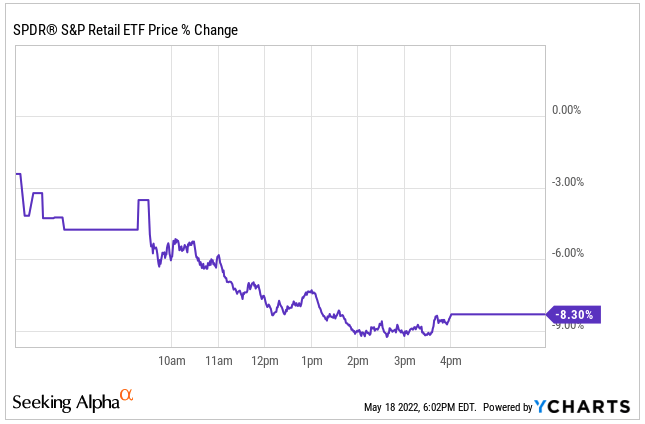

Being two of the largest retailers out there, Target and Walmart are pretty important in driving investor sentiment in the retail industry. As a result, they both carried the retail sector (XRT) with them, which declined more than 8% during the day:

YCharts

YCharts

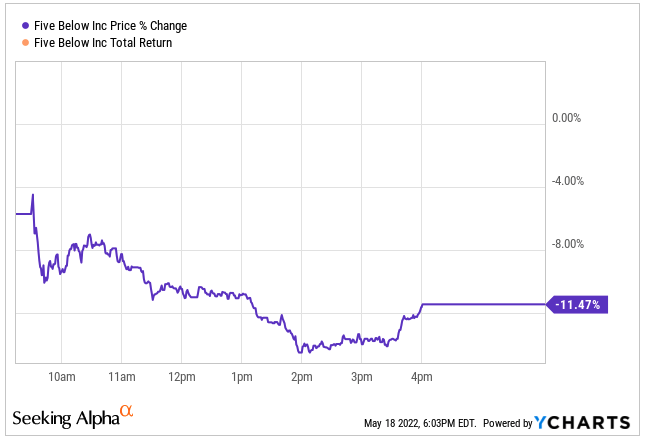

Of course, Five Below was no exception and dropped considerably, too:

YCharts

YCharts

One could argue that this is normal market activity during a downtrend, but we think that two large companies suffering their most significant declines since 1987 clearly demonstrate that we are not living in “normal” times at all. Over the short term, no stock is safe out there right now, and we must acknowledge this, remain long-term oriented and accumulate slowly.

The first question that comes to mind is…were Target’s and Walmart’s earnings that bad? By the looks of it, these companies didn’t flag company-specific issues, more so general industry issues. Let’s take a look.

We do not consider ourselves experts in Target or Walmart, but we will try to highlight here those things that might have created such a steep drop in their stock prices and the retail industry as a whole.

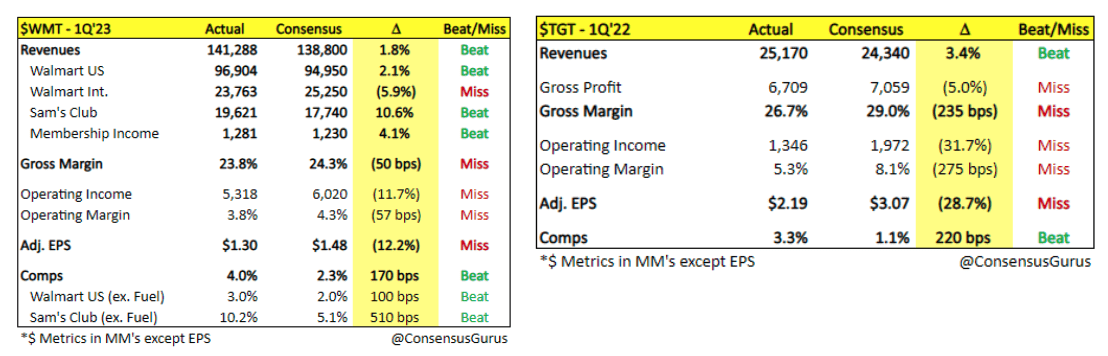

Looking at the headline numbers, we see a clear trend. Both companies managed to beat the top line but missed the bottom line by a considerable margin:

Consensus Gurus

Consensus Gurus

In the current macro environment, this can only have one interpretation: inflation is driving sales higher while contracting margins.

Walmart’s management claimed that there was upward pressure on costs coming from three sources:

Wages: the company was over-staffed during the quarter;

Inventory levels: the company grew inventory levels faster than it would’ve liked to;

Fuel costs: no explanation necessary for this one.

The problem wasn’t rising costs per se, but the fact that they rose quicker than previously anticipated. This didn’t give management much time to pass these increased costs to customers:

As we managed the quarter, we generally passed on cost increases from suppliers at the category cost of goods level, but fuel costs accelerated during the quarter faster than we were able to pass them through creating a timing issue.

Source: Doug McMillon (Walmart CEO) during Q1 2023 Earnings Call

We have to also dig a bit deeper into the top line because inflation also has the effect of lifting sales nominally, which doesn’t necessarily imply that demand is strong. Under an inflationary environment, customers might be purchasing more expensive products (due to inflation) but a lower number of these. Sales might increase under this scenario, but not because of the reason that should matter: demand. In Walmart’s case, there seems to be underlying strength in the consumer despite rising costs:

Inflation is lifting the average ticket and our transaction count in stores went up slightly versus last year. Overall basket size is up as you would expect, but units per basket are down a bit.

Source: Doug McMillon (Walmart CEO) during Q1 2023 Earnings Call

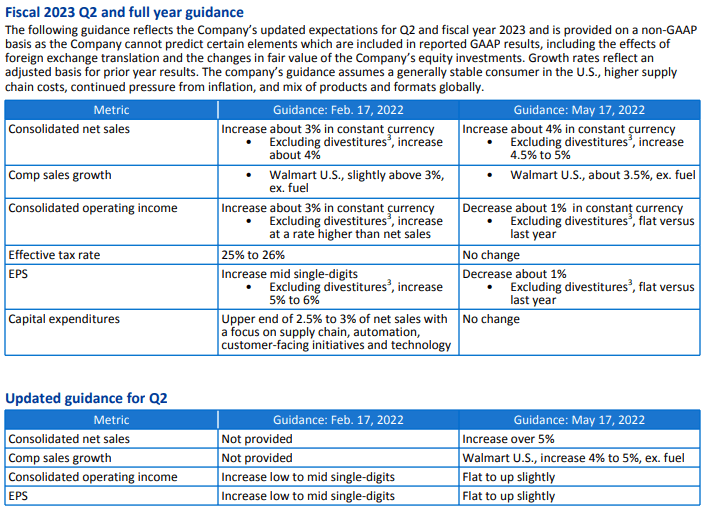

When explicitly asked about consumer health, management argued that they cater to a broad set of customers, so there’s a mixed bag. Some consumer segments remain strong while others are shifting towards cheaper items. All in all, nothing points to a worrying weakening demand. There’s further evidence of this if we look at the company’s guidance for the year:

Consensus Gurus

Consensus Gurus

The company revised its sales guidance for the year upwards, although it brought down the EPS guidance. This is somewhat in line with the earnings that were reported for Q1.

We don’t know how much of the sales increase will come from rising prices and how much will come from quantity increases, but it doesn’t look too worrying at first glance.

Target’s explanation was somewhat in the same line, although it was a bit more negative:

Throughout the quarter, we faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time.

Source: Brian Cornell, Target CEO in Q1 2022 results PR

Some of the reasons for these increased costs were somewhat similar to those of Walmart, but there seems to be a problem with the execution here:

This year’s gross margin rate reflected higher markdown rates, driven largely by inventory impairments and actions taken to address lower-than-expected sales in discretionary categories, as well as costs related to freight, supply chain disruptions, and increased compensation and headcount in our distribution centers.

Source: Q1 2022 results PR

Despite the differences, there seems to be a common theme in both earnings reports: sales are fine, but rising costs are impacting margins.

It goes without saying that if two of the largest retailers are suffering these impacts, they will probably affect every retailer. The question is, how large of an impact will they have on Five Below?

Five Below is unique in the retail value space and there’s no real direct peer to it. It goes without saying that it’s clearly different from Walmart and Target.

This said, there are obviously things that affect the retail space as a whole. One of these things is inflation. Every retailer needs to get goods supplied from their distribution centers to their stores, so all companies are impacted by rising costs in the supply chain (some more than others). Five Below is by no means immune to these rising costs, so we should probably expect some sort of margin contraction in the coming quarters too. The market seems to be discounting this as we speak in Five Below’s stock price.

There are two ways to “fight” margin contraction: raising prices or reducing costs. All else equal, we should prefer option 1 over 2 because cost-cutting impacts long-term growth and demonstrates a lack of pricing power. Unfortunately, this is precisely where discount stores might be under significant pressure. When your value proposition is one of “low” prices, there’s not much flexibility to raise these.

Five Below suffers from this limitation, but less so than its peers. First, Five Below operates at a higher price point than other discount retailers such as Dollar General and Dollar Tree (especially the latter). This should give Five Below more flexibility to raise prices, especially for those items that are still priced below $5.

Secondly, Five Below introduced Five Beyond some years ago, a category where merchandise can be priced higher than $5 and even $10. While Five Beyond has not been rolled out to all stores, it has a two-fold benefit. On the one hand, it further increases the price point at which the company operates, giving it much more flexibility to raise prices. On the other hand, it has “educated” Five Below’s customers to expect all kinds of prices, not just prices below $5. This is important because if you are a pure discount store and your customers go to you because prices are low, then they are not mentally prepared for price increases; higher prices clearly erode the value proposition. This takes us to the third reason.

Five Below’s value proposition is one of value too, but the essential part of it is that it is a fun experience. Customers know that prices are low at Five Below, but what really keeps them coming back is the shopping experience. Last week, a user from an investment community we participate in went to Five Below for the first time and shared his experience with us. First, he went on his own:

Went to a Five Below for the first time today. It’s a dollar store on crack for tweens. Very nice setup. Taking my kids tomorrow. Not sure how familiar y’all are with dollar stores over here, but they’re generally poorly lit and full of old people and/or folks who work blue collar jobs just trying to save a few dollars on basic needs. Most are also messy from what I’ve experienced. Five Below was the exact opposite. Well lit, full of young people and the shelves were fully stocked. Everything screamed “TWEENS!!!!” and I was pleasantly surprised. No grocery isles, but a huge candy section, toys everywhere, tech accessories for gamers/streamers, and lots of seasonal items. Very much like walking into a tourist shop at a beach (in a good way). Excited to see how my kids react tomorrow.

He then returned with his kids and shared the following:

In terms of what you’re envisioning compared to a Dollar Tree/General, etc… It’s night and day. Everything is under $5 (Hence Five Below), so lots of smaller sized merchandise. Think stuff like backpack buddies for your kids school backpack, smaller sized toys that you’d find at a grocery store, basic board games, outdoor toys for pools and the beach, an entire section of beauty care for tweens, workout gear like 10lb dumbbells, yoga mats, jump ropes… I could go on. It’s the environment and the vibe of the place that changes everything. Like I said, it’s a “dollar store” for kids and that just makes the place happier. It doesn’t smell like mushrooms and everybody doesn’t look like they wanna kill you. It’s full of whatever the latest kid craze is (squishmallows, pop-its, etc). You just gotta go in one of these and definitely take your kids. Lots of “wow, daddy, look at this!” Super fun to shop at.

These unique experiences should help Five Below differentiate from the “discount” store category and give it more flexibility to raise prices without disturbing its value proposition.

There’s no denying that the short to medium term is uncertain. So is the long term, but we assume that some macroeconomic trends should subside over a longer period, as they always do.

Five Below just announced today its Q1 Earnings Date (June 8th), so we’ll find out in around two weeks what the company reports. We don’t know what actions management has taken to tame inflationary pressures, but it looks like it will likely suffer from margin contraction, just as the rest of the retail sector.

This said, we still expect margins to expand over the long term, aided by several trends:

(1) In the most recent investor day, management claimed that the current distribution network supports more stores than what the company operates today. Therefore, if the network were to operate at max capacity over the long term, it should create an uplift in margins.

(2) A larger scale should allow Five Below to enjoy better terms with vendors, and a better brand should allow it to have better leasing terms. Both of these things should create an uplift on margins going forward.

(3) Expanding throughout the US should also bring an added benefit: higher efficiency in advertising costs. Once brand campaigns start to be national rather than local, they become cheaper on a performance basis (i.e., they become more efficient). Lower advertising costs mean higher margins.

(4) The expansion of Five Beyond to an increasing number of stores is also an important lever to drive margin expansion over the long term. Five Beyond gives more flexibility to the company when it comes to margins and also serves as a testing category to test higher price points.

(5) Yet another lever for margin expansion is Assisted Self Checkout. In many stores, Five Below is implementing ASC to reduce headcount and/or to redirect employee efforts to what matters the most: customer experience. Not needing to have a human being in all checkout positions should also be accretive to margins going forward.

There’s nothing thesis-changing here, and we never thought the path would be smooth. There are always bumps, and Five Below will almost surely need to go over plenty of them in the coming decade. The landscape for retail is not the best, and there seems to be pain ahead. What can we do? Remain calm, evaluate the long-term thesis continuously and accumulate slowly.

We wanted to leave the good news for the end. This way, you’ll end the article on a positive note. In one of our marketplace articles, we said the following:

Dollar stores typically do very well during both inflationary and recessionary environments. The rationale behind this is straightforward. When the budgets of more consumers are constrained (which can happen by either a recession or inflation), they tend to look for cheaper alternatives.

We still believe this is true, of course. When consumer budgets are under pressure, they typically look for cheaper alternatives, and they can find this in value retailers. In Five Below’s case, you also have to consider that spending on their kids is typically one of the last things that parents cut. In this environment, Five Below offers a great value proposition: have fun with your kids at a low price. As a result, traffic at Five Below might even increase.

If management is capable of making new customers stick, then the effect of this inflationary period might end up being a net positive for Five Below over the long term.

Not all is bad!

We hope this article helped you understand what might come for Five Below in the coming months or even during the next year. We do think the company might suffer margin contraction over the short term, but we also think that the long-term thesis is intact and there are significant opportunities for margin expansion going forward.

In the meantime, keep growing!

Best Anchor Stocks helps you find the best growth stocks to outperform the market with the lowest volatility. They can anchor your portfolio on the stormy market sea, still allowing you to outperform.

Best Anchor Stocks have a long track record of revenue growth combined with below-average volatility. The first pick is up 16,000% from its IPO but has never been down 30%, not even during in 2008-2009.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FIVE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.