Robert Way/iStock Editorial via Getty Images

In this busy Holiday Season, I hope most of my followers found time to read my recent Seeking Alpha article advising: don’t give-up on big tech growth stocks. That article was specifically about the Schwab U.S. Large-Cap Growth ETF (SCHG). This article will be about a similar fund that I have covered before on Seeking Alpha: the Vanguard Mega Cap Growth ETF (NYSEARCA:MGK), which is up 7.5% since my BUY rating in October – outperforming the S&P500 by 1%. Yesterday (Monday) the market sold-off and it was a great time to pick-up large-cap growth companies at attractive prices. Indeed, today they are bouncing back (MGK is currently up ~2%), but guess what: these stocks are still attractive despite all the noise about inflation and rising interest rates. Here’s why.

My followers probably get tired of hearing it, but as I have said many times this year, the biggest companies today:

It’s really as simple as that. For investors who want to keep a well-diversified portfolio built for the long-term and to take advantage of what the market is more than willing to give you, you must be adequately exposed to the very best (and typically the biggest) companies that America has to offer the world.

So let’s take a look at the Vanguard Mega Cap Growth ETF to see how it has positioned investors for success going forward.

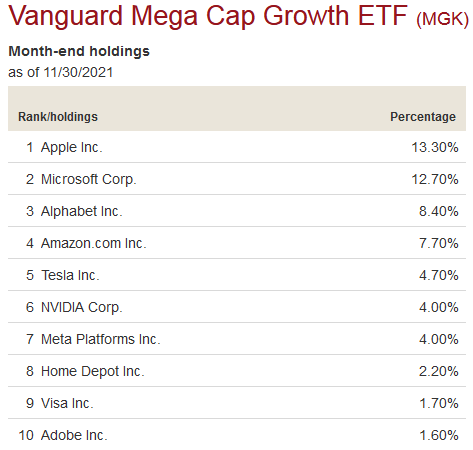

The top 10 holdings in the MGK ETF are shown below and equate to what I consider to be a concentrated (for good reason) 60.3% of the entire 107 company portfolio: Source: Vanguard

Source: Vanguard

As can be seen by the graphic, well-known Apple (AAPL) and Microsoft (MSFT) combine for 26% of the total portfolio and are so well-covered I won’t comment further other to acknowledge that both companies have market-caps substantially over $2 trillion. That being the case, if you are not bullish on the outlook for Apple & Microsoft going forward, this is not the ETF for you.

The #3 holding with a 8.4% weight is my current favorite mega-cap growth company: Alphabet (GOOG) – or as I still prefer – Google. As I pointed out in my previously referenced article on the SCHG ETF:

GOOG’s recent Q3 EPS report was arguably the strongest of all the mega-tech companies. Revenue of $65.1 billion was up +41% yoy. Net income of $27.99/share soared +70.7% yoy. Better yet, GOOG generated free-cash-flow of $18.7 billion (an estimated $27.64/share). Yes, that’s correct: in a single quarter. Google ended the quarter with a whopping $142 billion in cash or an estimated $210/share in cash.

Q1 of this year was so strong it gave Google management the confidence to launch a whopping $50 billion stock buyback plan. Yet despite an excellent 2021 (GOOG is up 62.6% YTD), the company is trading with a forward P/E of only 26.3x. I find lots of “value” in a company that is growing at the rate Google is, generating tons of FCF, while having over $210/share in cash.

I ask the simple question: what threat does inflation or the current U.S. 10-Year Treasury yield of ~1.5% pose to a company like Google? My opinion: little to none. GOOG is a strong BUY and you can get diversified exposure to the company through the MGK ETF.

A possible near-term catalyst for Google would be spinning off its Waymo subsidiary – similar to what Intel (INTC) recently announced it would do with MobileEye.

Amazon (AMZN) made the cut to be part of Barron’s Top-10 Stocks For The New Year in last weekend’s edition. The article said:

With more than $60 billion in annual sales, Amazon Web Services could be worth $1 trillion alone. That means investors are paying about $700 billion for the rest, which includes the leading online retail business, offline shopping (including Whole Foods Market), advertising, media (Amazon Prime Video, Audible), and logistics, including warehouses, trucks, and planes.

That being the case, a spin-off of AWS would likely unleash tremendous shareholder value. AMZN has been a laggard this year (only up 4.4%) but that’s because it is currently going through a major cap-ex expense cycle to expand its global platform and reduce delivery time. Next year, I expect AMZN to reap the rewards of the current investment cycle and for the stock to out-perform the broad market returns.

Tesla (TSLA) is the #5 holding with a 4.7% weight. Tesla CEO Elon Musk has been very critical of the Biden administration’s Build Back Better (“BBB”) plan, saying:

I would just can this whole bill. That’s my recommendation.

Source: The Guardian

But of course Elon is only talking his book. Musk doesn’t want more incentives for other EV makers (like the government incentives his company has used to grow his empire…) and charger competition because it is clear that Tesla is already facing more and more competition – both in China and here in the US from domestic companies like Ford (F) and Rivian (RIVN). The stock has actually held up better than I would have expected given the billions of dollars in stock sales Musk has recently been making. That said, note the stock is still way off its high and dropped bigtime on Monday after it was clear Senator Joe Manchin was going to hand a Christmas gift to China and stymie Biden’s BBB plan:

Due to oncoming and strong competition, Tesla is currently my least favorite mega-cap growth stock.

Nvidia (NVDA) is an emerging AI powerhouse which, of course, is very symbiotic with its leading high-performance semiconductor designs – the two go well hand-in-hand. NVDA is +109% over the past year and trades with an arguably rich forward P/E = 64x. In my opinion, the valuation is much more a reflection on Nvidia’s stellar future growth prospects than it is of a market “bubble”. Nvidia is the #6 holding in the MGK ETF with a 4% weight.

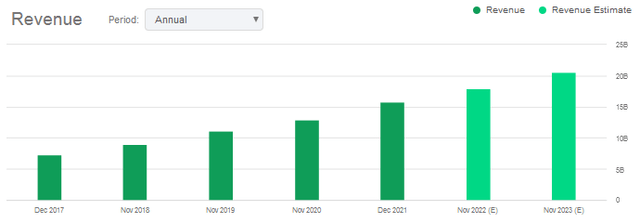

Adobe (ADBE) is the #10 holding with a 1.6% weight. Adobe stock recently went through a sharp correction after it disappointed investors with its forward guidance:

Yet one reason Adobe has a relatively rich valuation (40x forward EPS) is because it has a long track record of solid revenue growth and has built a strong global platform: Source: Seeking Alpha

Source: Seeking Alpha

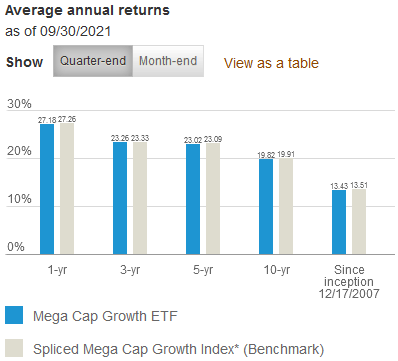

The Vanguard Mega-Cap Growth ETF has a strong 10-year performance track record of 19.7% annual returns: Source: Vanguard

Source: Vanguard

A $10,000 investment 10-years ago would be worth ~$60,000 today.

The following graphic compares the MGK fund’s three-year price chart with that of SCHG ETF and the S&P500 and Nasdaq-100 markets as represented by the (SPY) and (QQQ) ETFs, respectively:

As can be seen, the QQQ’s win, but the MGK ETF has significantly outperformed both the SCHG and S&P500 ETFs.

Covid-19 continues to be a risk to the US and global economies as well as to the supply-chains that many of these companies rely on.

Despite the recent pull-back, the market is still relatively close to all-time highs. Heading into an environment of high inflation and expectations for interest rate hikes sooner rather than later, the market could be in for a period of weakness and/or a significant correction. Yet – as I have been saying all year – what better way to fight inflation and rising interest rates than by owning companies that will out-grow both and that are so cash rich (with the possible exception of Tesla) that they don’t need to borrow money at any interest rate.

That said, given recent market volatility, I would advise investors looking to initiate – or increase – a position in the MGK ETF do so by easing in over time, perhaps taking a few weeks (or even months) to establish a full-allocation. That way, you won’t be going “all-in” at or near the top, and can take advantage of market volatility along the way.

The Vanguard Mega-Cap Growth ETF is an excellent and cost efficient (expense fee is 0.07%) vehicle for investors to gain exposure to the world’s top growth companies. The fund has a very strong 10-year performance track record of just under 20% annual returns. While the near and mid-term macro environment will likely see higher than normal inflation and rising interest rates, part of my portfolio strategy is to out-grow both of these headwinds by being exposed to these large cash-rich companies that have strong global brands and will grow for many years to come.

MGK is a BUY and an excellent stocking stuffer.

I’ll end with a 10-year price chart for the MGK ETF versus the S&P500:

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMZN GOOG SPY QQQ SCHG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.