All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident. – Arthur Schopenhauer

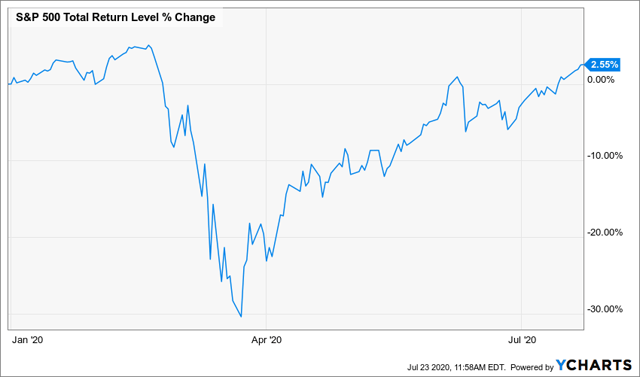

It is a wild time in the markets. Despite a crippling global pandemic, where the US is failing miserably at a response with daily record after daily record cases being broken, and a US economy that seems to be teetering on the edge of yet another Federal Monetary Policy response, stock markets have not seemed to blink when recovering. It’s not every year you can say you have had a 30%-plus crash and a 47%-plus gain in just under eight months, but here we are. And while I have been bullish since late March when I argued at the time it was a rare opportunity to buy, conditions in the market are changing, and that’s the purpose of this piece – to highlight some key indicators that are yelling at us that the conditions have changed and may be favoring another severe collapse in stocks.

My objective here is not to scare anyone, but to update you on conditions that have changed in my analysis of intermarket signals built off four papers I co-authored which document leading indicators to higher or lower volatility regimes. A full list of indicators can be found in The Lead-Lag Report here on Seeking Alpha.

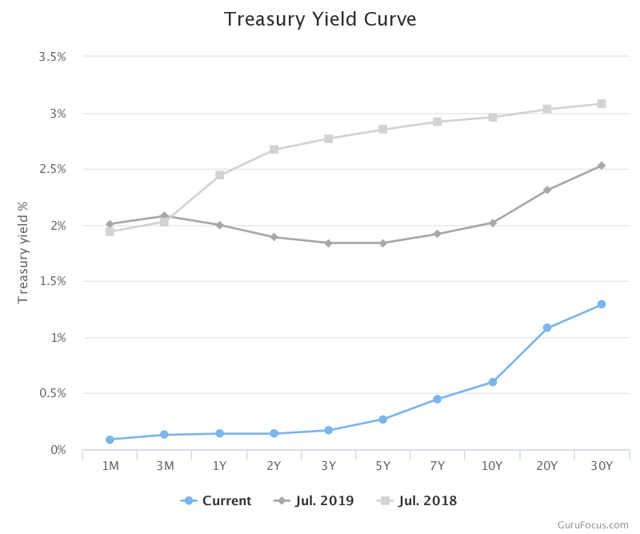

Source: Gurufocus.com

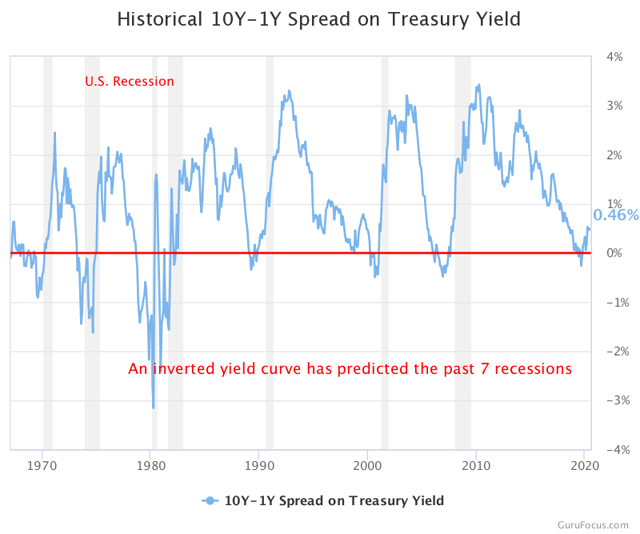

First indicator that has changed massively – Treasury Yields. While last year the concern was over the inversion of the yield curve, after the Fed cut rates everyone simply forgot about that and moved on. But as we see above, one thing that’s glaring here is how low yields have gotten. The 10-year is taking aim at 0.5% and the 30-year is under 1.5%. While the Fed can certainly control the short end of the curve, long-term duration yields are generally set by growth and inflation expectations. Those expectations are for a decade of miniscule growth right now. Yields this low means that valuations can increase, yes, but now that we are at these low levels, there’s more likely to be a reversion to the mean here, in either the bond market or the stock market.

It’s often said that bond market investors are the smart money and tend to lead the stock market in anticipating economic activity. The fact that yields have not risen meaningfully (quite the opposite) in the very short term is quite troubling as historically such short-term movement has tended to precede major periods of equity stress.

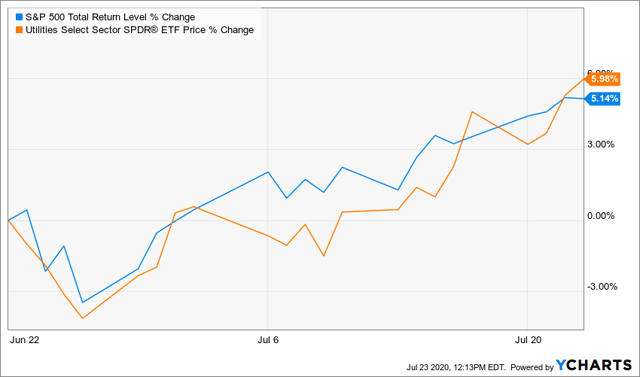

The next indicator that’s also arguing for a potential imminent market pullback lies in the action of the utilities sector. Generally, utilities are seen as safe-haven, recession-proof investments that likely outperform in any economy. Because of that, they tend to rally ahead of significant market pullbacks. Above you can see how these defensive investments have done in the last month, outperforming even the S&P 500 in that time. That should raise some red flags as an equity investor, and frankly this alone gives me pause. A similar movement occurred right before the COVID crash this year.

Source: CNN Money

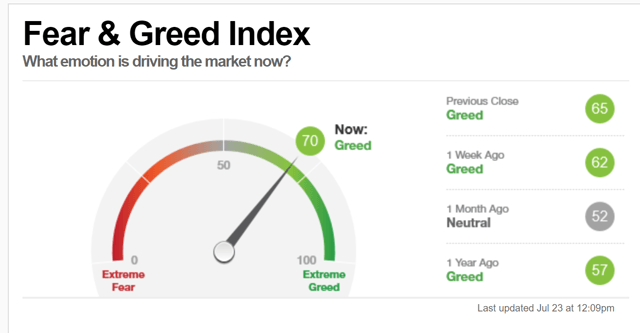

Another thing that’s scary is how complacent investors are getting. The S&P 500 (SPY) is now positive in a year that is expecting economic catastrophe. The Nasdaq (QQQ) is flying. And no one seems to think the market can ever go down. The Fear and Greed index is getting to dangerous levels of greed, again. Robinhood traders, not seen as market stalwarts, are making crazy bets on stocks, and winning. It sure feels like everyone forgot that investing in stocks carries risk – and the conditions are changing so rapidly right now, it looks like risk might come back into full force.

It’s looking eerily similar to what happened in late February, when I said the same things about these same conditions and made the case on Feb. 27 that we may be in a crash. As an investor and mutual fund manager, I recognize that true outperformance doesn’t come from being up more. Alpha, unequivocally, comes from being down less, and managing risk. Yes – Utilities and Treasury behavior could be a false positive. Maybe volatility doesn’t come. But then again, maybe it does as historically has been the case when such strength typically occurs.

Conditions change, and my expectations will change with them. Remember – all I do in my writings is give voice to match and historically proven quantitative, objective indicators. Will we see a Summer Crash? I’ll let you know in the Fall. But the reality is when you see a storm coming in front of you, doesn’t it make sense to slow down in case the conditions do indeed favor a nasty accident ahead?

*Like this article? Don’t forget to hit the “Follow” button above!

Subscribers warned of COVID crash Feb. 27. Now what?

Subscribers warned of COVID crash Feb. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.