The lower volatility sectors did it again. They held up much better than market in the COVID-19 correction. Many investors seek the generous growth of the stock markets, but would also prefer a much smoother ride. We might include retirees who seek lower volatility and lesser drawdowns to lessen the impact of the sequence of returns risk. That said, given the opportunity, MOST investors would prefer better risk-adjusted returns.

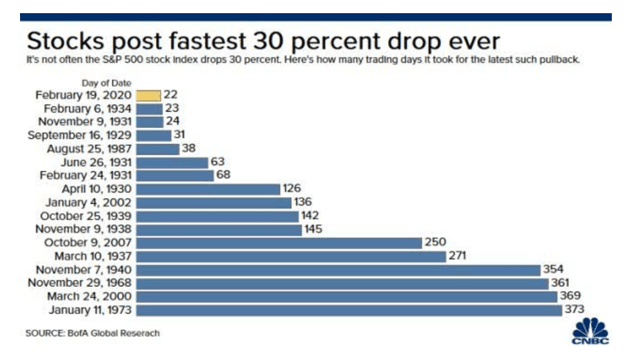

The stock market correction in March was the most violent downturn in stock market history.

Yup, just 22 days to drop 30%. Remember that? Remember what that felt like? That first roller-coaster-inspired drop even eclipsed a few of the Great Depression drops. Hang on.

And of course, the markets were not done yet after 30%; they tacked on another several points of decline.

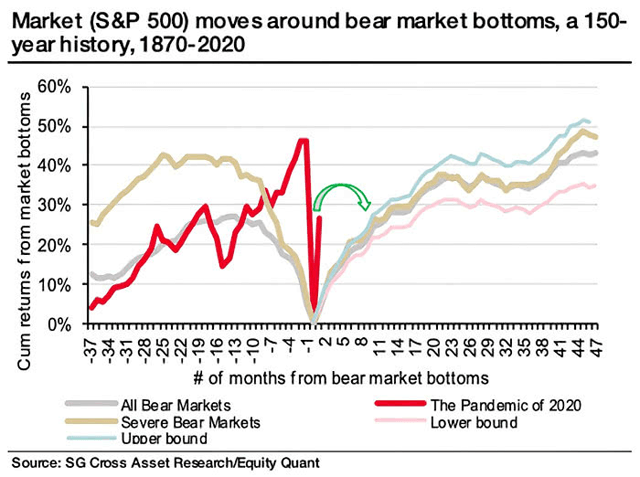

But, of course, just as fast as she dropped, there was a record-breaking ascent. Record up. Record down. Isn’t investing exciting? Or maybe it’s more like – pass the Pepto-Bismol?

It was certainly an atypical market “recovery.”

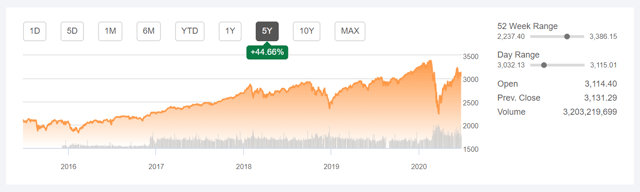

A 5-year chart for the S&P 500 from Seeking Alpha puts that historical ride in perspective. And of course, it may be early innings. We don’t know if this was a stock market correction, or if we’ve entered a bear market.

Perhaps, the stock market has much further to fall from here, or not.

The Fed is doing everything in its power to ensure that we do not experience a sustained stock market decline. Though economists are now mostly in agreement that we will not see a V-shaped economic recovery.

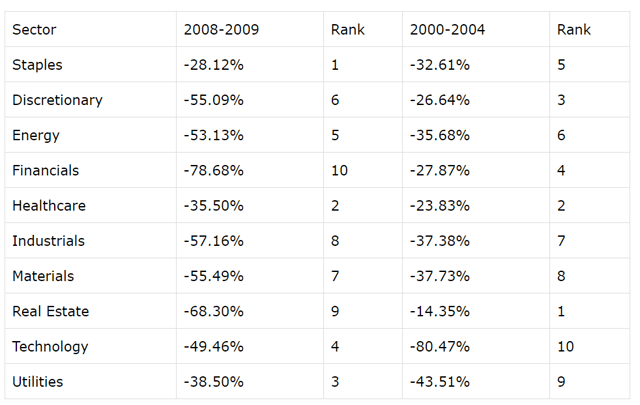

In September of 2017, I looked at the performance of S&P 500 sectors through the last two major stock market corrections.

Here’s the sector scorecard. A number 1 rank means that it was the best performer in that correction.

Source: Dale Roberts

In a cumulative scoring system, we see that Healthcare (XLV) and Consumer Staples (XLP) are the best performing sectors. In third place, we have Consumer Discretionary (XLY).

Could an investor survive on these three sectors, alone? Here’s the drawdown scorecard for the recent correction.

For the period, the S&P 500 (IVV) was down 35%

An equal weight portfolio of the 3 lowest volatility sectors would have been down less than 30%.

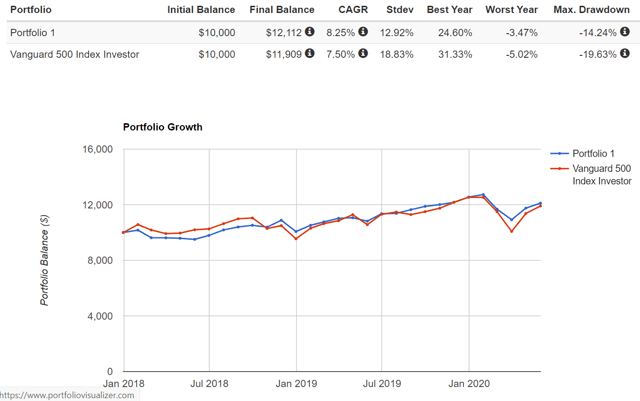

If we go back to the beginning of 2018, we can see the performance of the lowest volatility sectors through the minor correction December of 2018 and the COVID-19 correction.

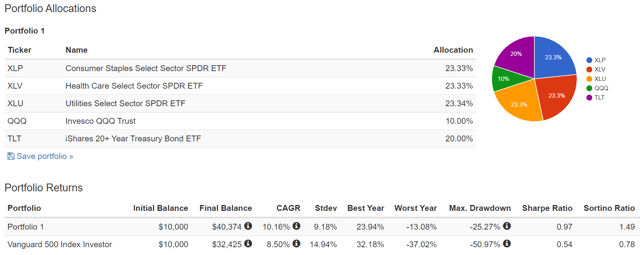

The lowest volatility sector is Portfolio 1.

Charts courtesy of portfoliovisualizer.com

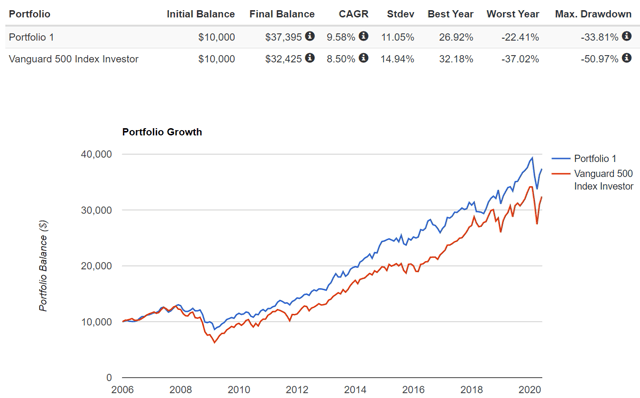

And if go back to allow that lower volatility portfolio to run through the financial crisis?

We certainly don’t give up any growth. And the portfolio decline is considerably better. We have consumer spending and healthcare driving the portfolio.

Once again, one may build around that core of Consumer Staples and Discretionary and Healthcare. One can concentrate on those sectors or overweight to a considerable degree. The investor who creates their own portfolio of individual stocks can practice the same as those who employ the sector ETFs.

There is also great merit in the ‘tech as staples’ argument. And it’s no surprise that they had already taken over the core large-cap weighted indices.

In Why Indexing Works, I had suggested the index was almost clairvoyant.

The technological and consumer shift that was already under way went into warp speed during the COVID crisis. That’s not a coincidence. The index reacts to the changing world.

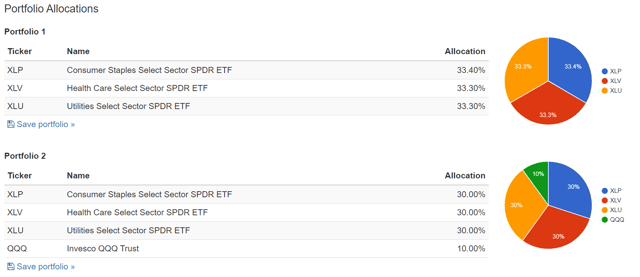

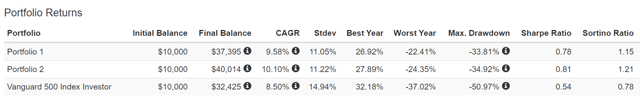

An investor might build a lower volatility portfolio and add that growth kicker by way of the Nasdaq 100 (QQQ). It would not take much as that is a very explosive fund and group of holdings.

Defense and a growth kicker

From portfoliovisualizer.com

My readers will know that I appreciate that purist approach to indexing and portfolio construction, but I know that we can shape our portfolio by way for various factors and slants. We can also shape by sector allocation.

I use Dividend Achievers for our retirement-focused portfolio. They were more than ready to take on the COVID-19 correction.

I like the idea of using higher quality stock in tandem with those shock absorbers known as bonds. As I had previously described…

Bonds are the adult in the room.

Here’s a low volatility portfolio mix that also calls on those bonds to keep an eye on those unruly stocks.

From January of 2006, through to end of May 2020

From portfoliovisualizer.com

One may use those treasuries that punch above their weight as risk managers. In that case, you can use less of them. That’s an incredible portfolio combination that only fell some 25% in the most severe correction of our lifetime – during the financial crisis.

One can dial up or down the risk level, of course. And you may decide to use other bond combinations or a core bond fund (AGG).

We all suffer from a home bias. This might be a good time to remind US investors that, historically, they benefit from adding a healthy international component. One can find much greater earnings (these days) in Canadian and international markets.

For consideration – here’s the more ‘complete’ portfolio for US investors.

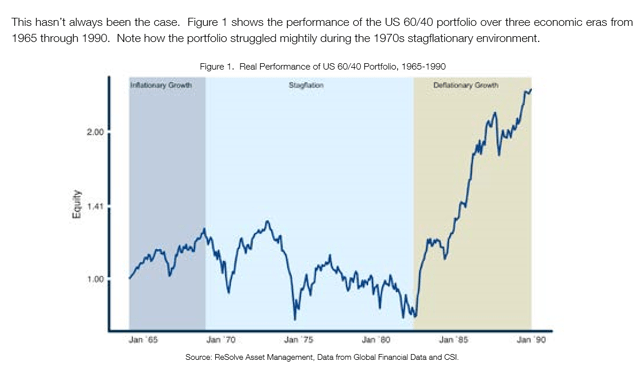

You may also decide to add that unloved asset class known as gold (GLD). That can potentially protect against inflation or stagflation and the debasement of fiat currencies. That’s a personal decision, I’ll leave that up to you.

I think it’s wise to have some gold. Many suggest you start at a 5% weighting and perhaps take it up to 10%.

There are times when even the traditional Balanced Portfolio did not deliver in real dollar terms.

Yes, we know retirees love their income. The current crisis taught us once again that, in times of stress, it is quality that counts. We see the higher income approach getting hit on a daily basis. Be careful out there.

I certainly use dividend income for my Canadian stock segment. So far, I’ve cruised through with no dividend cuts for our Canadian and US dividend payers. The US contingent is designed for quality, not higher, income. You’ll see those holdings are largely in the tech, healthcare, staples, and consumer sectors.

Ensure that your income holdings are of higher quality. You may decide to shade in more of the lower volatility sector ETFs, or shape your stock portfolio in that fashion.

Once again, the lower volatility sectors were up to the challenge.

Defense wins championships.

We’ll see you in the comment section. How did your portfolio hold up? How do you think your portfolio is positioned for the new normal?

Author’s note: Thanks for reading. Please always know and invest within your risk tolerance level. Always know all tax implications and consequences. If you liked this article, please hit that “Like” button. Hit “Follow” to receive notices of future articles.

Dale

This article was written by

Disclosure: I am/we are long BNS, TD, RY, AAPL, BCE, TU, ENB, TRP, CVS, WBA, MSFT, MMM, CL, JNJ, QCOM, MDT, BRK.B, WMT, ABT, BLK, NKE, PEP, LOW, OTIS, CARR, RTX, BTC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.