The impressive growth enjoyed by Starbucks over most of the past decade is now a thing of the past. Across its nearly 27,000-unit restaurant base and in virtually every key geography, current and forecast demand is weaker than at any point in the current cycle (since 2009). And while the global economy appears less vulnerable to downturn than 10 years ago, SBUX’s much larger store base makes it more vulnerable to further weakness than at any time in its history.

With more than 10,000 units located outside its ‘Americas’ unit, Starbucks is considered a global brand. But, in fact, close to 90% of the company’s profits are generated from this one geographic segment – and the bulk of that arises from the US.

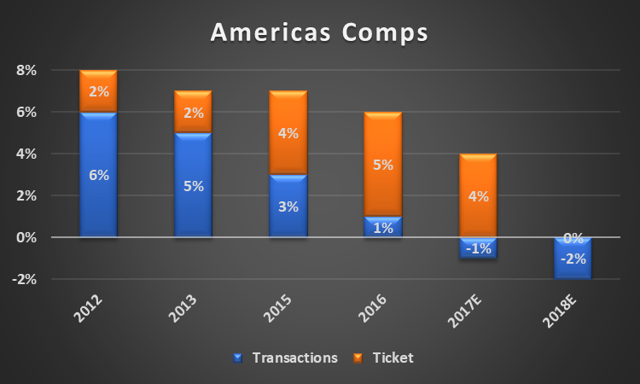

This primarily domestic demand had grown solidly through most of the current cycle (post-’09), with comparable sales rising in the mid-to-upper single digits (%). Until the past two or three years, Starbucks’ customers showed little resistance to menu price hikes that started out modest – as evidenced by corresponding increases in traffic (i.e., guest counts, transactions).

Source: Company SEC filings.

Source: Company SEC filings.

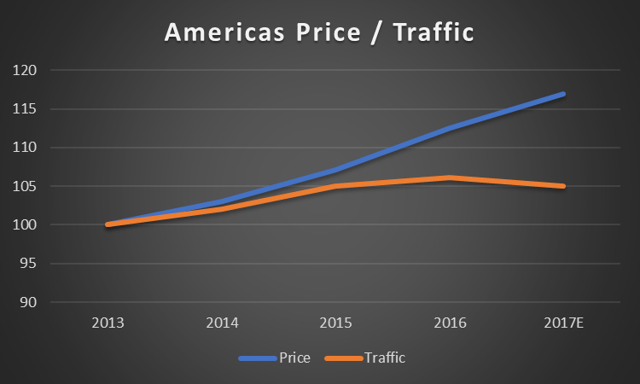

But then after widening each year from 2013-2016 (i.e., 2%, 3%, 4%, 5%), menu price changes have faced increased ‘friction’ by customers. In fact, in 2017, guest visits into US stores are falling for the first time since 2009, even as SBUX ramps up this key region’s store expansion.

Traffic into the typical US restaurant has now regressed to the 2015 level, partly in response to heightened competition, but largely due to menu prices that have risen about 17% in just four years (2-3 times US inflation). Source: Company SEC filings.

Source: Company SEC filings.

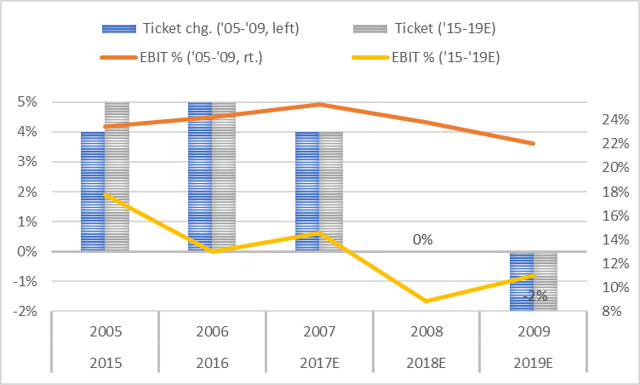

Starbucks has been down this road before. It didn’t end well then. Recall, the 5% overall US comparable sales drop in 2008 was followed by another 6% decline in the next year. During that time, as US guest counts flattened (vs. -1% thus far in 2017), domestic margins plummeted, and store-closures proliferated.

With FY17 set to be the third straight year of 4% to 5% price increases, its current pricing strategy is a repeat of 2005-’07. Over the coming years, the results of these cumulative menu-price hikes could be just as costly to SBUX as 2008-09.

Source: Company SEC filings.

There is no getting around the fact that a $5 latte is a discretionary purchase. Increasingly competitive – if not commoditized – coffee demand in the US is now easily met through significantly more choices than at any time in the past. And, after opening an additional 5,500 domestic stores since 2009, it won’t take another 2008-like economic crisis for these important domestic profit margins to decline materially from today’s peak levels.

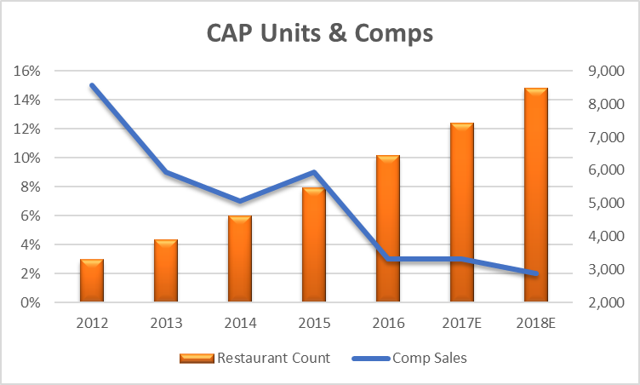

Demand in China / Asia Pacific (CAP), once a hyper-growth region for Starbucks, has slowed even more dramatically than in the US. And yet despite this marked slow-down in Asian demand, Starbucks is redoubling its new store investments in the region, especially China where it continues to dramatically increase its ownership of formerly fee-paying licensees.

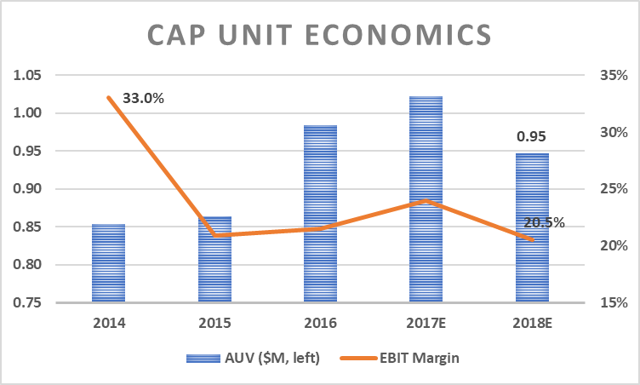

Discretionary growth that slow sharply across core China units in 2013-15 was compounded by SBUX’s acquisition of its Japanese franchisees in early 2015. Trading highly profitable licensing royalties for ownership and control, margins at SBUX’s CAP region (China, Asia Pacific) have fallen from the mid-30’s (%) to recent levels of around 20% (before central overhead, etc.).

As with the purchase of Japan, similar margin pressure will result from shifting low-growth franchisees to low-profit owned units set for early (calendar) 2018. That’s when SBUX’s $1.3 billion acquisition of its remaining 50% interest in (>1,100) mainland China licensed stores is expected to be completed.

Source: Company SEC filings.

Even as highly successful peers (McDonald’s (MCD), Yum! (YUM)) are selling / re-franchising operations in China – to reduce risk and boost returns – Starbucks is employing an ‘asset-heavy’ strategy in acquiring these far-flung operations.

If the rationale of this strategy is questionable, the timing is especially dubious, as same-store comparisons in the CAP region have slowed to only about 3% in 20016-17E, versus double-digit average increases from 2012-14. Moreover, menu price increases – which have a direct impact on profitability at these units now operated by the company – are limited to around 2%, well below relative inflation.

Starbucks has always had difficulty achieving higher prices in Asia. But when licensees were 82% of its units there (in FY11) and guest counts were rising rapidly, the net profit impact from relatively modest price hikes comparisons was negligible. But in 2018, with majority of CAP profits from Starbucks-operated units, an inability to push through price increases that match corresponding operating costs will further pressure on the region’s margins.

Source: Company SEC filings.

Separately, because SBUX units in China have unit volumes and profit margins that trail similarly owned Starbucks restaurants across the rest of Asia, the effect of accelerating company-operated unit growth there will further dilute overall profitability and returns.

In this once high-growth region it’s hard to say which is more concerning: 1) a near-doubling of company-operated CAP units 2015-2018E; 2) traffic that has stagnated post-2015; or 3) SBUX’s inability to push through price increases necessary to even maintain existing margins.

EMEA: Returns < Capital Costs

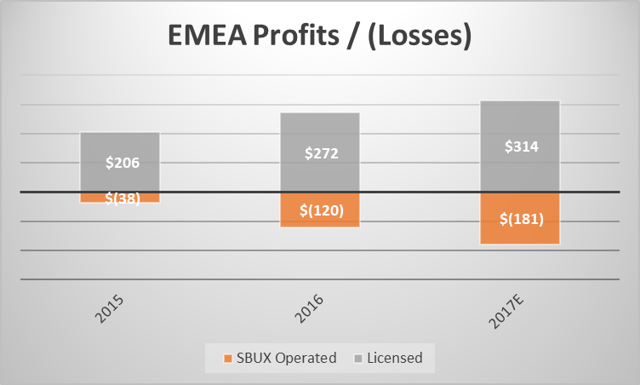

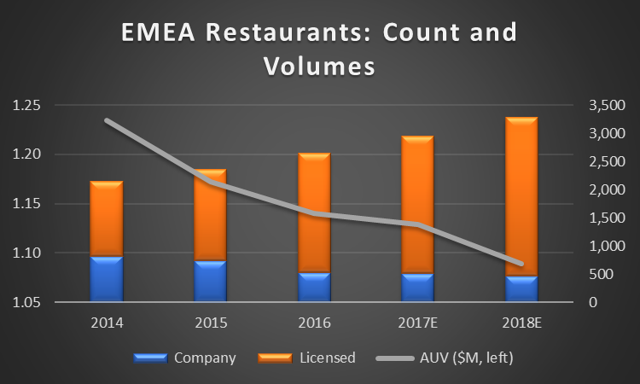

Results have gone from bad to worse in EMEA (Europe, Middle East, Africa), its smallest region. In just two years through September (2017) SBUX will report an estimated 20% drop in segment operating profit, despite a 25% jump in restaurant count.

Indeed, based on trends reported through the first three-quarters of FY17, EMEA’s total segment operating profit (before overhead) will finish at under $135 million (excluding impairments), down from $152 million in the prior year. Because the region’s licensed revenue – where profit margins exceed 80% – should by itself approach $400 million, we can assume these remaining 500 or so company units are operating at steep losses.

Source: Company SEC filings.

So far, the company’s antidote to long-term demand weakness through Europe (mainly) has been to shift these loss-making, owned units onto licensees, even as it accelerates the opening of new licensed units. This raises the question, if Starbucks-operated stores do not make an adequate return, how might this be done by a licensee – which must also cover its royalty fee (of about 6%)?

Indeed, in only the past 18 months, the company has essentially gutted its two largest European markets, re-franchising (or closing) about 200 UK and German units. At Q317, more than 82% of the region’s 2,870 stores (or all but ~500) were operated by licensees, as its base of owned EMEA restaurants continues to shrink.

Source: Company SEC filings.

That’s nearly double its licensed units in the region since the massive build-out began in 2014 – the same time EMEA comparable sales growth peaked (at 5%). Since then, comparable sales (which include company units only) have fallen to zero in 2016 – 2017. Recent traffic declines suggest overall comps there will turn negative in the fiscal year just begun (FY18).

From the US to China, demand at Starbucks is slowing significantly across every key geography. Yet the company’s answer to the ongoing weakness (since 2015) is, oddly, to aggressively expand its base of stores. And while rapid recent asset and sales growth invites comparisons to its prior peak (2007), prospective overall profitability and returns at Starbucks might also resemble 2008-09.

Given weakening demand trends highlighted above across each of its three regions, Starbucks’ profits in FY18 are likely to finish only slightly above the current-year’s level (reported Nov. 2).

I value SBUX at $48, based on PE and EV multiples of 22 times and 12.5 my 2018 forecasts for EPS (of $2.20) and EBITDA ($5.65 billion). These assigned multiples are in line with past averages at SBUX yet exceed virtually every comparable restaurant operator.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in SBUX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.