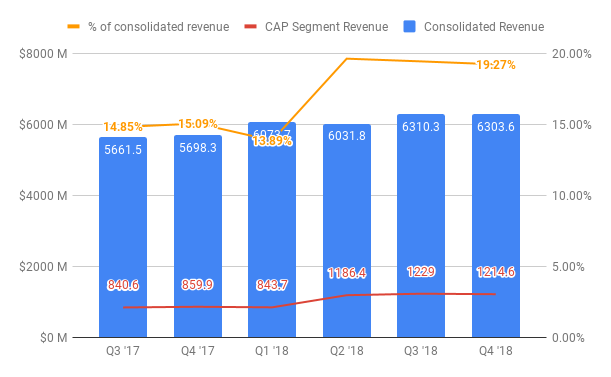

There’s a strong likelihood that Starbucks’ (NASDAQ:SBUX) growth will slow down in FY 2019. It has to seriously watch its back for the new competition from Luckin Coffee in China, its second-largest and fastest-growing market with 41% YoY net revenue growth as of Q1 2018. Starbucks China/CAP segment has contributed 15% of the total SBUX revenue. It is on track to contribute up to 20% of the total revenue by FY 2019.

Apart from its unique business model, which centers around digital payment, on-demand delivery, and lower price point, there are two points we believe important to highlight from this new competition:

Luckin Coffee has been expanding aggressively, just like how a venture-funded startup in a winner-take-all market (like Ride-hailing) would operate. As of Q4 2018, it has opened 1,500 stores in more than 20 cities across China. That is almost half as much stores as what Starbucks China has already opened since it first entered China in 1999. The target is to open 2,000 stores by end of FY 2018. The company, indeed, has received a $200 million venture capital funding at a unicorn valuation to achieve this ambition.

Luckin Coffee is made to beat Starbucks in China. First of all, we don’t think competition is a new thing for Starbucks. It has faced competitions from the 3rd wave coffee players like Blue Bottle Coffee in the US or other similar chains such as Peets, Caffe Bene, Costa, or even McDonalds. However, we believe that Luckin is a whole different beast. Examining Luckin’s value propositions in more detail, we have become more aware that they are meant to exclusively nullify Starbucks’ key advantages in China.

Luckin Coffee was started in October 2017 by a former ride-hailing company (UCAR, Uber China’s and Didi’s competitor) executive in China. With $200 million venture capital funding, Luckin Coffee launched its service in Q1 2018. As of Q3 2018, it has had more than 500 sit-in and delivery pickup stores across major cities in China. By Q4 2018, it has opened 1,500 stores and by the end of year, it wants to open 2,000 stores. We think we have to agree with the author of this article, who clearly states that Luckin Coffee’s main goal is to be the Xiaomi (Apple’s competitor in China) of the coffee market. It aims to provide high-end coffee drinking experience at a more affordable price and ease through convenience. To summarize, these are what we believe to be Luckin’s key differentiation to Starbucks:

Affordability. The prices of Luckin’s beverages are 20% – 30% cheaper than Starbucks’. In addition to that, Luckin Coffee has also been very aggressive in providing extreme discounts to customers with “buy one get two free” or even “buy five get five free” vouchers. This allows them to acquire price-sensitive users and first-time coffee drinkers.

Asset-light. Majority of Luckin’s stores are delivery and pick-up outlets with minimal or no seating at all. This allows them to offer its beverages at lower prices.

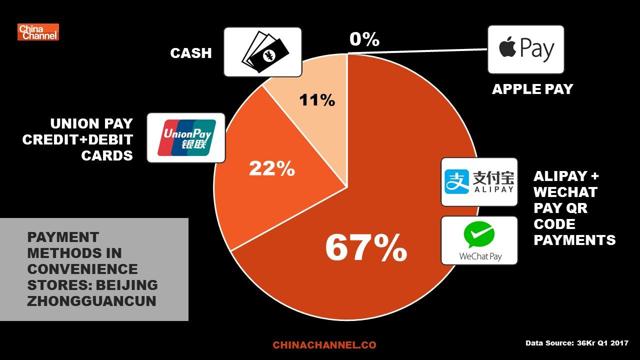

Convenience. All orders for Luckin coffee can only be made through its smartphone app. Cash is not accepted as Chinese customers mostly pay using Wechat/Alipay smartphone app anyway. Luckin coffee also gives customers an option to either pick up their orders in-store or have them delivered with a guarantee of a 30-minute delivery timeline. With this delivery model, it also achieves both convenience and store cannibalization.

In a nutshell, Starbucks’ main strategy is to offer convenience to coffee drinkers by only operating company-operated or licensed store locations with high-traffic and high-visibility. In that sense, they partly operate like a real-estate investment company. This is clearly stated in their 10-K annual report:

“Starbucks ® company-operated stores are typically located in high-traffic, high-visibility locations. Our ability to vary the size and format of our stores allows us to locate them in or near a variety of settings, including downtown and suburban retail centers, office buildings, university campuses and in select rural and off-highway locations”

As we’ve observed when we travel across Asia and Australia, Starbucks has done the same thing in any market, including in China. As the market-leading company, Starbucks indeed has the means and capacities to invest heavily to get the prime locations for its stores. Starbucks’ main assets are its stores, which consistently represent more than 30% of its total assets on average.

(Source: Author, data compiled from SBUX’s financial reports. Comparison between Net PP&E of Starbucks to its total assets)

This strategy allows them to deter other smaller competitors to beat them on acquiring the mindshare of potential customers and to be consistent with its vision to be the “third place in between home and work”. As it stands, many of its competitors’ stores are not located in as prime locations.

In China, Luckin Coffee rides on the wave of increasing coffee consumption and cashless mobile payment trends. We soon learned that those two trends alone allow them to bypass the need for prime locations in order to beat Starbucks in its own coffee-retailing game in China.

(Source: Chinachannel.co. Most popular payment method in China as of 2017)

China’s coffee consumption per-capita today of 5 cups per-year is much lower than those of US or UK with 400 cups and 250 cups per-year respectively. International Coffee Organization’s research has shown that coffee consumption in China increases on average 16% annually. This means there is a great upside for all competitors in the coffee market in China. The new retail trends in China, which merges the best of in-store and online experience in the form of mobile payment or order placement, is another important driver for the rise of Luckin Coffee.

Luckin Coffee was started in October 2017, though it had only been widely known after Q1 2018 when it aggressively launched hundreds of stores within a very short period of time and a lawsuit against Starbucks China.

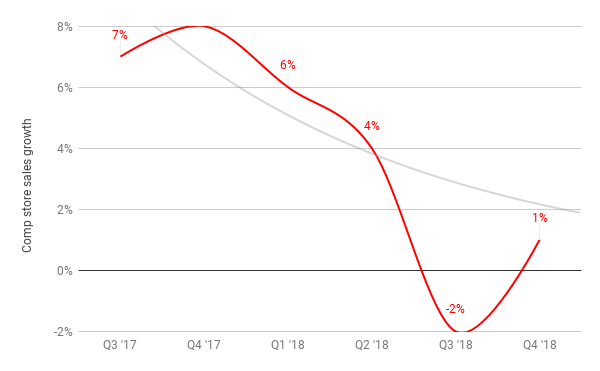

How does Luckin Coffee affect Starbucks China? The short answer is it hurts them a lot. We’ve learned that Starbucks China has been struggling to maintain its same-store sales growth in almost every quarter after Q1 2018.

(Source: Author’s notes and Starbucks quarterly results data. Starbucks China-only quarterly same-store sales growth Q3 2017 – Q4 2018, excluding CAP segment)

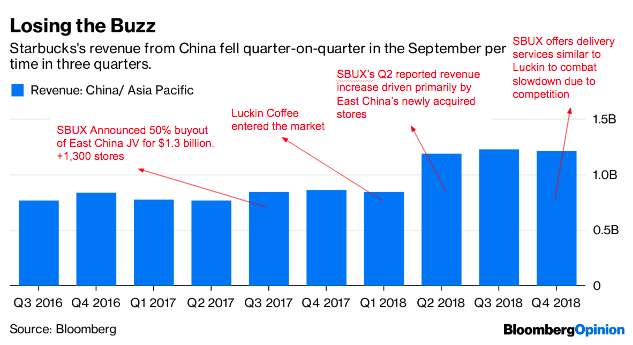

During the time frame in which the rapid decline in same-store sales growth happened, Starbucks made a strategic move to acquire the stake of one of its Joint Venture franchisees in East China.

(Source: Author’s notes and Bloomberg. Starbucks’ quarterly revenues Q3 2016 – Q4 2018)

This move allowed Starbucks China to earn an incremental revenue of almost 50% from Q1 to Q2 2018 due to the newly recognized sales from then 700 East China JV franchisee-operated stores. Though this has improved Starbucks’ top line revenue, we think that this is more of a temporary measure as opposed to an organic strategy to combat the new competitor.

In Q3 2018, however, Starbucks partnered with Alibaba to introduce a delivery service to level the playing field with Luckin Coffee. We think that this competitive response might have helped to bring up the same-store sales growth to 1% in Q4 from previously -2% in Q3 2018.

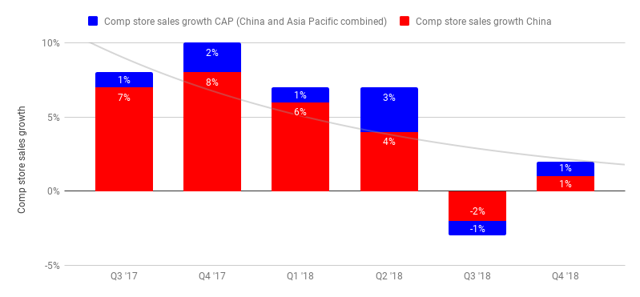

(Source: Author’s notes and Starbucks quarterly results data. Comparison of Starbucks China vs CAP segment quarterly same-store sales growth Q3 2017 – Q4 2018)

Up until Q3 2018, we can see that Starbucks China has been the darling of its Asia Pacific operations. In no time within the last twelve months, it had lower same-store sales growth than the whole segment. This implies that Starbucks China has been the growth driver of CAP (China and Asia Pacific) segment. Clearly, as China’s growth decreased by 2%, it brought down the whole region’s growth by a similar magnitude. With 1% same-store sales growth as of Q4 2018, Starbucks China segment now has the same level of growth as the CAP segment.

As Luckin Coffee will likely begin firing on all cylinders in their second year in business, we think that FY 2019 will be one of the most challenging years ever in the history of Starbucks China. The management team have bought themselves some time to figure out their next competitive move in 2019 by bumping up their reported revenue through East China buyout in Q2 2018:

Net revenues for the China/Asia Pacific segment grew 54% over Q2 FY17 to $1,186.4 million in Q2 FY18, primarily driven by incremental revenues from the impact of our ownership change in East China, incremental revenues from 759 net new store openings over the past 12 months, favorable foreign currency translation, and a 3% increase in comparable store sales.

Such strategy has its limit, however. It depends on how many well performing franchisee-operated Starbucks stores are left in the market. The stakes are really high for Starbucks. China/CAP segment has always been the second largest market for them after the Americas which contributed on average 15% – 19% of their total revenue. With $1.2 billion revenue generated in Q4 2018, CAP segment is now on track to contribute up to 20% of overall consolidated revenue.

(Source: Author’s notes and Starbucks quarterly results data. Comparison of Starbucks CAP segment revenue contribution to consolidated revenue Q3 2017 – Q4 2018)

So far, the East China move has successfully created an impression that Starbucks China has just had a great year with 54% YoY growth compared to 2017. Fundamentally, we think that this inorganic growth strategy barely moves the needle when it comes to actually prevent Luckin Coffee from disrupting Starbucks China further.

Luckin Coffee, in the meantime, will continue opening up new stores aggressively in 2019 to pursue its plan to open up 6,000 stores by 2022. It will still continue burning cash while undercutting Starbucks by 20% – 30% and offering extreme discounts to their customers.

(Source: Radiichina article. Starbucks’ vs Luckin Coffee’s expansion plan by 2022)

Looking at the FY 2019, the biggest concern we have for Starbucks is there has not been a strong competitive response aside from buying up existing franchisee stores or opening up more stores. We would argue that the Alibaba partnership move which copied the Luckin Coffee’s delivery feature was an impulsive and less-than-strategic one. Two things that make the delivery strategy works for Luckin are the network of pickup stores and smartphone app with great user experience, both of which Starbucks China doesn’t have.

We strongly believe that Starbucks China will experience a slowdown in 2019 due to tough competition from the $1 billion venture-funded unicorn Luckin Coffee. The battle between Luckin vs Starbucks China could be as interesting as Uber China vs Didi back a few years ago. Didi was the winner then.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.