bensib/iStock Editorial via Getty Images

bensib/iStock Editorial via Getty Images

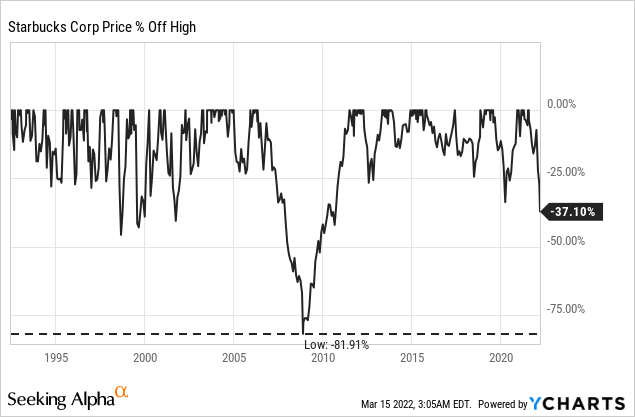

Starbucks Corporation (NASDAQ:SBUX) is one of the stocks, that clearly underperformed the broader market in the last few weeks and the stock declined 37% from its previous all-time high. And although Starbucks suffered during the pandemic and there are still some risks for the company right now, the stock could be a good long-term investment and seems to be trading for a discount to its intrinsic value right now. We take a closer look at the company and stock and start with the quarterly results.

When looking at the first quarter results for fiscal 2022, Starbucks generated a total net revenue of $8,050 million and compared to $6,749 million in the same quarter last year, this is resulting in 19.3% YoY growth. And while revenue from company-operated stores increased 17.4% YoY, licensed stores revenue increased even 38.6% YoY. Operating income also increased from $913.5 million in Q1/21 to $1,178 million in Q1/22 – reflecting an increase of 28.9% year-over-year. And finally, diluted earnings per share increased from $0.53 in the same quarter last year to $0.69 this quarter resulting in 30.2% YoY growth.

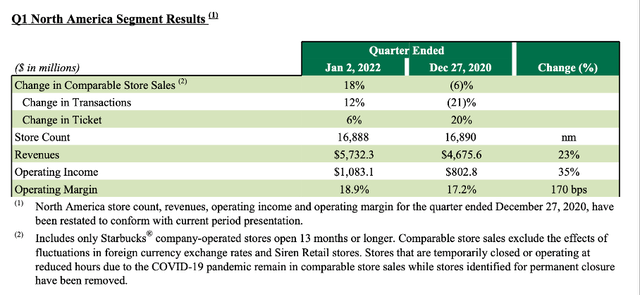

Starbucks could also improve some other metrics, like its operating income which increased from 13.5% last year to 14.6% this quarter. And while the International Segment reported a 3% decline in comparable store sales (5% decline in ticket and 2% change in transactions), the North America Segment reported strong growth rates. Comparable store sales increased 18% with the average ticket increasing 6% and transactions increasing 12%.

Starbucks Q1/22 Results

Starbucks Q1/22 Results

In the last few quarters growth was simply driven by the fact, that Starbucks reopened many of its stores again and when considering that fiscal 2020 results were horrible, it is quite easy to report high growth rates when we are comparing the numbers to extremely bad results. But we also must point out, that revenue as well as earnings per share are already above pre-pandemic levels (fiscal 2019 or fiscal 2018).

And while Starbucks probably can’t report 30% growth for its bottom line in the years to come, we can expect growth in the high single digits or even double digits for several years (or maybe even decades) to come. And Starbucks can grow its bottom line in several different ways.

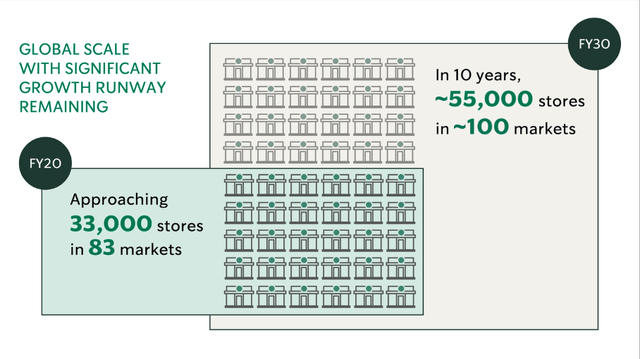

First, the company can increase its top line. And revenue growth can again stem from several different sources. It can stem from increasing the number of stores in several countries around the world. In fiscal 2021, the company could increase its total stores from 32,660 (16,637 company-operated stores and 16,023 licensed stores) one year ago to 33,833 (17,133 company-operated stores and 16,700 licensed stores) right now. And Starbucks is expecting the number of stores to increase to 55,000 in fiscal 2030. When assuming that the new stores will generate the same average revenue as the existing stores, the additional stores will increase revenue with a CAGR of 5.5% in the next years.

Starbucks Investor Presentation

Starbucks Investor Presentation

Second, Starbucks can increase its same store sales in the years to come. In the past, Starbucks has been proving, that it was quite innovative: Aside from just selling coffee to-go and serving coffee at the Starbucks locations, the company introduced new products like offering breakfast or introducing Drive Thru. All these are driving same store sales as it might lead to more people visiting the stores and the average ticket size might increase.

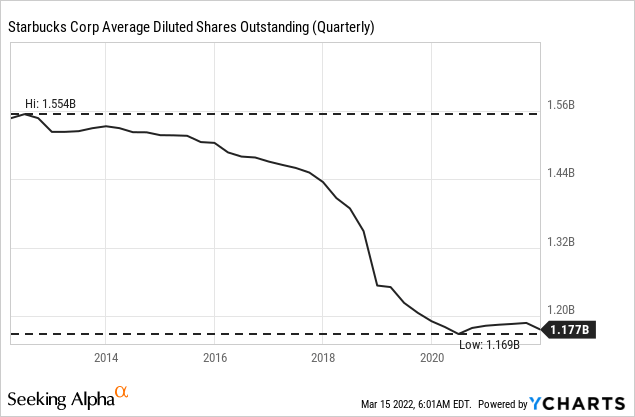

Third, the company can grow its bottom line by using share buybacks – like it did in the last 10 years for example. From early 2012 to today, the company decreased the number of outstanding shares from 1,554 million to 1,177 million – resulting in a CAGR of 2.74% with which Starbucks decreased the number of outstanding shares. In the first quarter of fiscal 2022, Starbucks repurchased 31.1 million shares and under the current authorization, about 17.8 million shares remain available.

Overall, Starbucks is still quite positive about its long-term earnings per share growth potential. According to investor presentations from the recent past, management is still expecting annual growth rates between 10% and 12% for earnings per share over the long run.

Starbucks Investor Presentation

Starbucks Investor Presentation

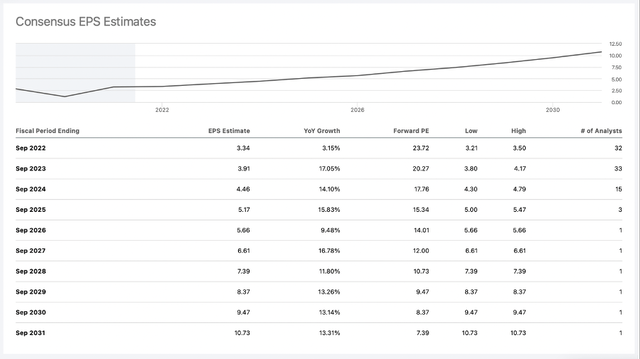

And analysts are similar optimistic about the growth potential in the years to come. Analysts are expecting earnings per share to grow with a CAGR of 12.72% until fiscal 2031.

Seeking Alpha

Seeking Alpha

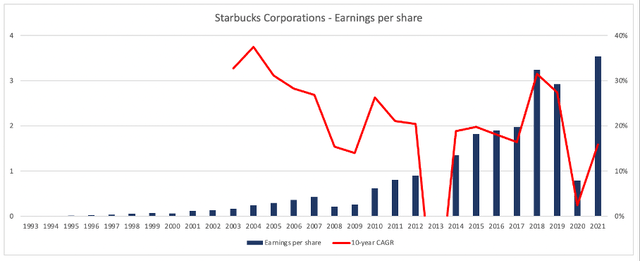

When looking at the growth rates in the past, Starbucks could clearly grow in the double-digits and although we can’t deny, that growth will slow down in the years to come, it seems realistic that Starbucks will be able to grow in the double-digits in the years to come. In the last 20 years, Starbucks could grow with a CAGR of 18.44%.

Author’s work

Author’s work

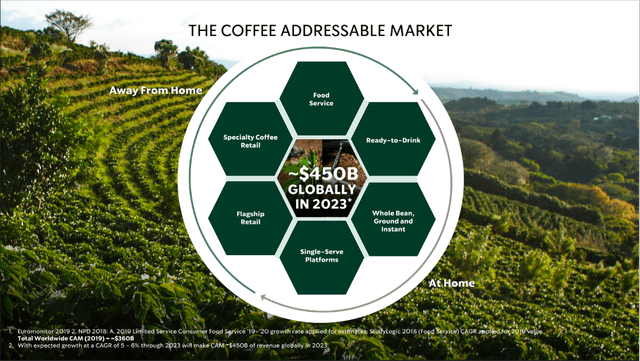

And finally, the total addressable coffee market is gigantic. In 2023, Starbucks is expecting a total market of $450 billion and with current sales of $30 billion, the company should have enough possibilities to grow by increasing its market share. This is including the “away from home” market as well as the “at home” market.

Starbucks Investor Presentation

Starbucks Investor Presentation

Starbucks might also be interesting for dividend investors – not necessarily for its dividend yield (which is not so high), but for the ability to increase dividends with a high pace in the years to come. Starbucks raised the dividend quite aggressive in the last few years and the 5-year dividend CAGR is 15.87%. Starbucks started paying a dividend in 2010 and has been raising the dividend for 11 consecutive years. Right now, Starbucks is paying a quarterly dividend of $0.49, which is resulting in a dividend yield of 2.4% (might be a bit lower now).

When comparing the annual dividend of $1.96 to the earnings per share of the last four quarters ($3.70), we get a payout ratio of 53% for Starbucks, which seems acceptable. And when comparing $2,167 million in dividends Starbucks paid in the last four quarters to a free cash flow of $4,461 million in the same timeframe, the payout ratio is about 48.5%.

Despite the strong quarterly results, the growing dividend, and the growth potential in the years to come, the stock is struggling right now. At the time of writing, Starbucks has already declined 37% from its previous high and when excluding the 82% decline during the Great Financial Crisis, this is one of the steepest declines in Starbucks’ history and the steepest decline since the Great Financial Crisis.

And especially when considering, that Starbucks declined extremely steep during the Great Financial Crisis, we must ask the question if this could happen again and if Starbucks is a stock that gets punished during recessions.

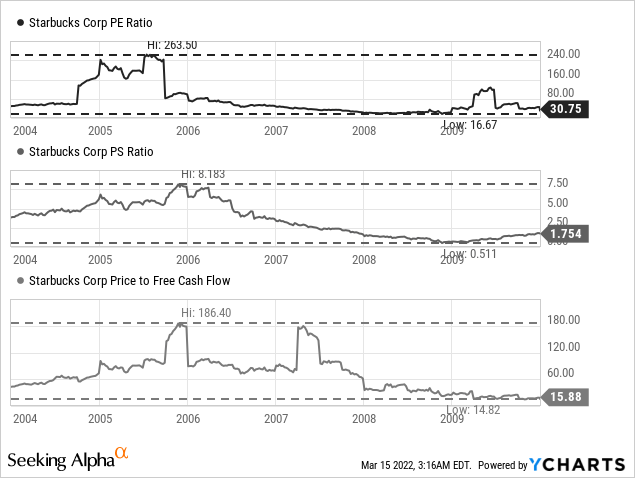

First, when looking at the years before the Great Financial Crisis, we can see, that Starbucks was trading for extremely high valuation multiples. During 2005, Starbucks was trading for 260 times earnings and in 2006, the P/E ratio was still around 70 to 80 for several months. At the end of 2005, the stock also peaked at 8.2 sales as well as 186 times free cash flow. Hence, when we like to identify one difference, it would be the valuation multiples for Starbucks. Right now, Starbucks is trading for 3.1 times sales as well as 21 times earnings and free cash flow. And while we can’t make the argument, that Starbucks is ridiculously cheap, we also can’t make the argument that Starbucks is extremely overvalued.

And we can make the argument, that Starbucks is trading at much more reasonable valuation multiples right now, which is making an extremely steep decline rather unlikely. But we also must remember that Starbucks was hit quite hard again by the pandemic in 2020 – an event, that was clearly visible in the company’s top and bottom line. And when looking at the Great Financial Crisis, that recession was also visible in the top and bottom line. Trailing twelve months revenue declined about 6%, but TTM earnings per share declined 86% in 2008 and 2009. On the other hand, in early 2010, trailing twelve months earnings per share already exceeded pre-crisis levels again.

Although Starbucks is certainly not trading at extreme valuation multiples (like before the Great Financial Crisis), a potential recession could lead to an EPS contraction and send the stock much lower.

And aside from a recession in the years to come and the risk of Starbucks’ stock declining rather steep in case of a recession, the current geopolitical uncertainties – including the rising COVID cases in China as well as the invasion of the Ukraine by Russia – are also posing risks for Starbucks. Like many other restaurant chains – including McDonald’s Corporation (MCD) – Starbucks also announced it would close all of its locations in Russia. The company has about 130 stores in Russia (wholly owned and operated by a license partner) and about 2,000 employees and Russia is only responsible for a fraction of the business.

Additionally, investors seem to be worried about the COVID-19 cases in China, which are the highest since the original outbreak of the pandemic in Wuhan in late 2019/early 2020. China has reported “only” about 2,000 cases (compared to Germany for example, which is reporting about 200,000 cases daily on average), but China has not officially moved off its zero-tolerance COVID policy. Therefore, the increase in daily cases could result in strict lockdowns again, which would have an impact on Starbucks’ business again. And China is certainly an important market for Starbucks as the company generated $3,675 million in revenue (12.6% of total revenue) in China. However, we most likely won’t see a similar decline as in 2020 again – even if Starbucks must close several of its locations in China for several weeks or months again.

Without much doubt, Starbucks is facing some short-term risks and a potential recession could lead to stagnating (or declining) revenue as well as lower earnings per share. And I already mentioned above that Starbucks seems to be fairly valued when looking at simple valuation multiples – like the price-earnings ratio or the price-free-cash-flow ratio.

When looking not only at simple valuation metrics, but using a discount cash flow calculation, we come to the conclusion, that Starbucks is undervalued right now. As basis for our calculation, we are not using the free cash flow of the last four quarters ($4,461 million), but instead we assume a free cash flow of $4 billion. According to its own guidance, Starbucks is expecting capital expenditures to be approximately $2 billion (compared to $1,562 million in capital expenditures in the last four quarters), which will probably result in a lower free cash flow.

In the next ten years, I will assume only 9% growth. It is not like I can’t imagine Starbucks growing in the double digits (it can and probably will) – I am just trying to be a bit more conservative. For perpetuity, I will assume 6% growth and when using these assumptions (as well as 1,176 million outstanding shares and a 10% discount rate), we get an intrinsic value of $105.16 for Starbucks. And although the stock could rebound in the last few days, Starbucks is still trading clearly below its intrinsic value.

Starbucks is without doubt a great business with a wide economic moat. And right now, the stock seems to be trading below its intrinsic value and can maybe even be called a bargain. I don’t want to ignore, that there are some risks right now, but over the long run, Starbucks seems to be a good long-term investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SBUX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.