Jess Bray/iStock via Getty Images

Jess Bray/iStock via Getty Images

In my last (NYSEARCA:SPY) article, I said that we had set the low for a sharp rally in stocks. The market did rally and has now hit resistance, so I will discuss the next path and the recent talk of bubbles.

In a recent investment note, GMO co-founder Jeremy Grantham was very bearish on markets. The veteran investor talked of an epic finale to a ‘superbubble’ across the financial sector.

“The U.S. stock market remains very expensive and an increase in inflation like the one this year has always hurt multiples, although more slowly than normal this time. But now the fundamentals have also started to deteriorate enormously and surprisingly: between COVID in China, the war in Europe, food and energy crises, record fiscal tightening, and more, the outlook is far grimmer than could have been foreseen in January. Longer term, a broad and permanent food, and resource shortage is threatening, all made worse by accelerating climate damage.”

I recently wrote a book called The Stock Market is Easy, and therein lies a chapter on “Phase Transitions” in markets. Grantham notes that phenomenon when he discusses the recent bull market:

“It is as if there is a phase change in investor behavior. After a long economic upswing and a long bull market, when the financial and economic systems look nearly perfect, especially with low inflation and high-profit margins, as does the friendliness of the authorities, especially toward cheap leverage, there gets to be a flashpoint, like that summer evening when every last flying ant takes off simultaneously. This effect luckily creates measurable events in the market. So you can see the explosion of confidence and speculation and crazy wishful thinking regardless of value however you wish to define it.”

However, as he summarizes: “These superbubbles, as well as ordinary 2 sigma bubbles, have always – in developed equity markets – broken back to trend. The higher they go, therefore, the further they have to fall.”

Grantham states that the first leg down from the bull market excess can be “explained” by inflation. He suggests that complacency over inflationary effects on earnings, and overconfidence in central banks may have created a lag from higher inflation to the January 2021 high in stocks.

He adds:

“The next leg (down) for the model is likely to be driven by falling margins. Our best guess is that the level of explained P/E will fall toward 15x, compared to the current level of explained P/E of just under 20x, while the actual P/E just rose from 30x to 34x in mid-August in what was probably a bear market rally. Of course, if the model is indeed driven by falling margins in the near future, then the E will fall as well as the P/E… this would imply a substantially lower market than even we have suggested!”

GMO uses its “explaining P/E” model to highlight overvaluation based on inputs of ROE, inflation volatility, and GDP volatility.

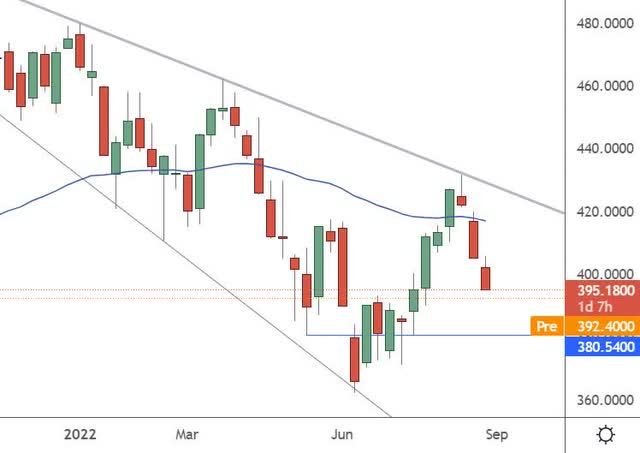

SPY (W) (TradingView)

SPY (W) (TradingView)

The stock market rallied around 9% from my last bullish article and hit resistance at $430. Looking at the SPY weekly chart, we can see that it was a perfect rejection from the downtrend resistance created by the January highs. The SPY has also closed on a bearish tone starting for September, and the question is: Where do we go now?

In GMO’s research, Jeremy Grantham said of two recent papers that he wrote:

“…in the U.S., the three near-perfect markets with crazy investor behavior and 2.5+ sigma overvaluation have always been followed by big market declines of 50%.”

If we look at the monthly chart using Fibonacci levels, we can see that a 50% decline would bring the SPY back to the 273 level. The market would first look for support at the 322 level, and that would be the target if the market breaches the recent lows near 380 in September.

SPY (M) (TradingView)

SPY (M) (TradingView)

Despite the doom and gloom predictions of many in the market, it is not the end of the world if stocks correct by 50% during a time of economic upheaval. However, investors need more than the current attention-seeking headlines and require a real plan for dealing with skewed valuations in different market sectors.

As far as you are concerned, the stock market does not exist. Ignore it. – Warren Buffett

If the stock markets really were to lose 50% of their value from the January highs, then investors have an opportunity to rebalance their portfolios and move to a cautious footing. The reason for doing so would be to capture the bargains that will exist at the lows.

As the quote from Warren Buffett states, no two sectors are the same, and investors should not get too caught up in the idea of the stock market. That is the real flaw when we continually hear of market bubbles and impending crashes. Investors need to know how to position for potential problems and where to look for investments in a downturn.

To consider the implications for different sectors, we can go back to GMO’s research, where they highlight their near-term problems:

The near-term problems highlighted above serve to warn investors about the current economic outlook and the risks to their portfolios. First, European stocks are at risk from an acute energy crisis.

I warned subscribers to my weekly marketplace newsletter back in June that Dutch gas futures were turning higher again. The price recently surged to new highs and has led to European government intervention. But the kicker here is that we have only exited the month of August. Temperatures have not even dropped in the European countries, and European citizens are already facing eyewatering energy bills. Investors holding European stocks, or those with big exposure to European markets should make adjustments. Likewise, investors should reconsider stocks with high levels of food/energy inputs. As GMO also mentions, countries such as Sri Lanka have seen political and economic turmoil, and this leaves emerging markets vulnerable. Finally, stocks with big China exposure or a business plan that relies on Chinese expansion are also at risk.

The real estate turmoil in China is one that is starting to filter outward into other countries. As Grantham says:

“This real estate weakness is mirrored around the world, with U.S. homebuilding for example now declining rapidly to well below average levels, as perhaps it should given the record unaffordability of new mortgages. The situation looks even worse in those countries where mortgages are typically floating rates. Historically, real estate has been the most important asset class for economic stability.”

In summary: The recent market rally has stalled and is retreating back to the lows of June and July. This is a time to be defensive, but it is also a chance to exit stocks that could languish at the lows longer than others. What the market Cassandras fail to mention is that the right stocks will be going at bargain prices in another market drop. Domestic U.S. stocks that have little foreign currency exposure, can benefit from higher commodity prices and have higher operating margins and cash to provide a cushion are a good starting point.

GMO co-founder Jeremy Grantham has said that we are at the end of a Superbubble in financial markets, and he predicts an ‘epic finale’. This can affect stocks with up to a 50% washout possible, but that would be an opportunity for investors. The January highs and the subsequent downturn have already cleared the excesses from company valuations, and any further losses in the market would create bargain entry points for companies that can weather the current economic turmoil.

My Global Markets Playbook Marketplace service can save investors from the common investment mistakes that are driven by psychology. My technical analysis, proprietary timing model, and sentiment studies can help you time the markets better and hang onto valuable capital. Sign up now for a 14-day free trial to the service and join us in 2022.

This article was written by

Author of “The Stock Market is Easy – How to Avoid the Pitfalls of the Average Investor”.

I am an active trader in stocks, FX and commodities with over 15 years’ market experience. I hold a master’s degree in finance and have developed a strong skill base in technical analysis. I run the Global Markets Playbook on Seeking Alpha’s Marketplace.

Disclosure: I/we have a beneficial short position in the shares of MU, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.