phive2015/iStock via Getty Images

Over the past decade, investors who invested in big tech names have generated stellar returns. In fact, simply putting $100,000 in the tech-focused Invesco QQQ ETF (NASDAQ:QQQ) in 2011 would’ve turned into $583,500 by now. That’s an impressive return compared to the S&P 500 (SPY) and Dow Jones (DIA), which generated respectively 269.9% and 200.8% returns during this timeframe.

This outperformance does not look to be slowing down anytime soon. In fact, after its amazing 7.09% return in October the QQQ is potentially starting the biggest rally you will witness during your lifetime. In this article, we will discuss why this might happen and how we believe you should invest accordingly.

Earnings season for the third quarter of 2021 is developing very well. Over 80% of S&P 500 companies beat earnings estimates so far, significantly outpacing the 71.7% historical average.

Once again, big tech companies are among the strongest performers. As you can observe in the table below, out of the 10 biggest QQQ constituents only one has missed estimates (Amazon.com).

The average annual revenue growth rate of 31.7% for the 10 biggest QQQ positions is impressive given that these companies are generating billions in sales per year.

This strong growth can be attributed to the accelerated shift toward a digitized economy, in which these companies play a key role. Also, the financial stimuli by the central banks has significantly lifted both consumer and business confidence. As such, economic activity skyrocketed over the past quarters, particularly in industries where big tech is present (digital ads, SaaS, etc.)

(Source: Insider Opportunities based on company disclosures, Nvidia and PayPal haven’t reported Q3 earnings yet)

At a forward price/earnings ratio of 22.8x, the S&P 500 index is valued at highly elevated levels compared to history. The top 10 constituents of the QQQ look to be priced to perfection with an average fwd P/E ratio of 62.7x (leaving out Tesla would put that number at 47.6x).

It’s very typical for the stock market to only reward richly-priced stocks if they’re blowing away estimates. Interestingly, during this earnings season such a blow-out wasn’t necessary to send stocks soaring.

On average, the top 10 QQQ holdings gained 9.10% in value since their earnings report, while they were only moderately strong. Even more interesting is the fact that disappointing earnings from Apple, Amazon and Facebook (both in terms of earnings and guidance) were very quickly followed by a recovery of their share price.

The fact that despite elevated valuations, solid earnings were followed by outsized returns and disappointing earnings weren’t followed by a correction, is a strong indicator that momentum is running hot in the stock market.

Once again, it looks like stock price movements don’t seem to make sense anymore. Is Tesla really worth $112 bln (+13% gain on October 25) more because they might receive a $4.2 bln order from Hertz Global Holdings (OTCPK:HTZZ)? Or what about the outlandish 12% rise ($79 bln in market cap) of Nvidia on November 4 just because a Wells Fargo analyst touted its potential Metaverse prospects?

The extremely bullish price action in major tech stocks is not the only indicator of increasing investor greediness. We’re witnessing a return of meme stocks with meteoric rises of stocks like Avis Budget (CAR) (+125% last month), Plug Power (PLUG) (+65% last month) and GameStop (GME) (+27% last month). Some tech stocks are rising to extreme valuations again such as Asana (ASAN) (EV/sales of 81x) and Bill.com (BILL) (EV/sales of 125x) despite their lack of a substantial moat. And lastly the IPO market is running red-hot again with both a high number of new offerings and elevated first-day returns.

Stock market momentum clearly turned extremely bullish once again.

History never repeats itself, but it oftentimes rhymes

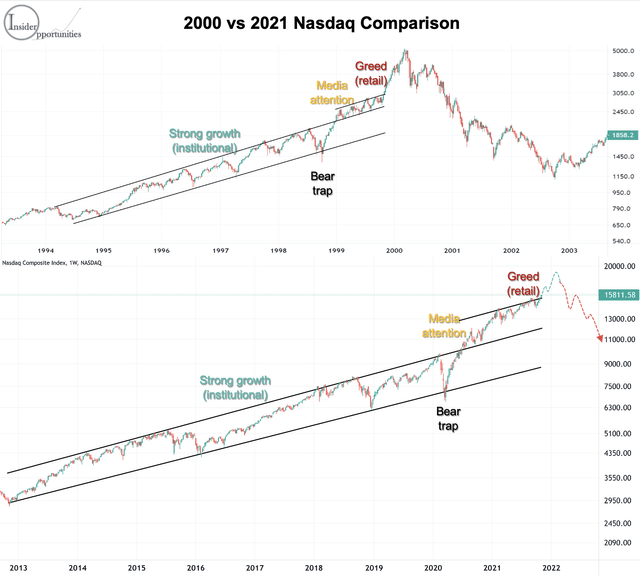

(Source: Insider Opportunities with TradingView)

It’s easy to say that the recent stock market events are irrational. However, history proves that during times of extreme investor greediness, this might extend for a prolonged time. Remember 1999-2000.

While I have been skeptical about the recent long-term bull market, I always kept underscoring that we will first experience a meteoric rise before the music stops.

With the 7.09% gains for the QQQ in October (the 11th strongest month over the past decade), it looks like the tech index is just starting this new “greed phase”.

As you can see in the chart above, the Nasdaq 100 (the index that the QQQ ETF tracks) price movement over the past 7 years resembles to the 1994-2000 period. We experienced many years of strong gains, fueled by both earnings growth and multiple expansion. The bear trap in March 2020 tricked many investors into selling just like in 1998, but was followed by an unprecedented rally which caught enormous amounts of media attention.

Right now, we’re experiencing another acceleration of stock prices as we enter the “greed phase,” similar to November 1999. During this phase, even the most skeptical investors will start losing attention about the fact that stock prices could fall. Many retail investors will start taking excessive amounts of risks as they believe nothing could go wrong.

During such times of extreme investor greediness, prices can move very quickly. In fact, the greed phase of 1999-2000 saw a 70% increase of the Nasdaq 100 index in only four months.

If the future keeps rhyming with history, we might experience an unprecedented surge of the Nasdaq to over 20,000 points by the spring of 2022. When you think about it rationally this seems totally crazy, but investor greediness can do weird things with markets. Note that the QQQ rallied by almost 80% in five months after the Covid-19 bottom.

As we’re entering the greed phase in which it appears stock prices can’t fall, your first reaction might be to join the crowd in betting on a continuing acceleration of the Nasdaq.

This strategy implies a big challenge: Market timing. To make a profit on an investment, you also need to sell out the position. The question is: When?

While I’m confident in my expectation of a rise of the Nasdaq in the coming months, I have no clue when the bull market will end. The problem is that most investors believe warning signs will tell them when to get out, but in reality the end of a bull market is extremely unpredictable. Nobel prize winner Shiller explains this perfectly in his book “Irrational Exuberance” by comparing stock market movements with avalanches:

Those who predict avalanches look at snowfall patterns and temperature patterns over long periods of time before an actual avalanche event, even though they know that there may be no sudden change in these patterns at the time of an avalanche. It may never be possible to say why an actual avalanche occurred at the precise moment that it did. It is the same with the dramatic movements of stock markets and other speculative markets.

A stock market collapse is preceded by several events which are building up for many years prior to it. But the timing of the actual collapse is unpredictable as it does not necessarily need a trigger to occur. As a consequence of this timing problem, most investors who buy into this rally will be the bagholders of the next bear market instead of generating strong returns.

So what about buying some of the highest-quality names in the tech sector? Powerful companies like Microsoft should be able to continue growing at double-digit rates and therefore generate strong returns even at elevated valuations, right? It might seem like this is the case after their extremely strong financial performance in the past years, but history proves otherwise.

Even with the highest-quality companies, you should always be prepared for a significant growth deceleration. The leaders of “the dot come age” like Cisco Systems and Oracle Corp were growing at a CAGR of respectively 53.8% and 20.8% prior to 2000 and printing billions of dollars in free cash flow. Despite their seemingly immortal businesses, their growth rates turned negative after the dot.com burst. The problem was that due to extreme optimism, investors never thought this would be possible. As greediness sent valuations to sky-high levels, it took Oracle 15 years to recover to its dot.com highs and Cisco has yet to reach these levels despite their strong financial performance after the dot com dip.

Amazon is another very interesting case study. Despite the fact that it was able to continue growing at high double digit rates after the dot.com collapse, the stock took nine years to recover back to its 1999 top due to sky-high valuations.

(Source: Insider Opportunities based on company filings; sales numbers in $mln)

Bottom line, try not to be greedy during this extreme greed phase. Succeeding in a long position on the Nasdaq for the short term is extremely hard due to the timing issue. If you want to play the game, only do it with a small position of your portfolio. Buying quality tech stocks at elevated valuations might be worth it in the very long term, but you should be prepared for a lost decade by doing so. Be highly conservative with your estimates.

If joining the crowd by investing in the Nasdaq is not a good strategy, how should you invest during the upcoming greed phase? Invest like you always should. Search for stocks which are undervalued compared to their future growth prospects. However, start putting more emphasis on the “valuation” part of the equation as value stocks might start outperforming drastically in the mid-term (1-3 years).

In contrast to the popular believe, times like these actually are a blessing to find undervalued stocks in the market. As all attention goes to the skyrocketing growth stocks, many smaller value stocks are forgotten by Mr. Market and set to soar once they receive more attention. Note that the iShares S&P Small-Cap 600 Value ETF (IJS) returned 85% in the 2000-2005 period vs. -65% for the QQQ. But how do you find the best stocks in this asset class?

For that, you might be interested in discovering the power of following insider purchases. Insiders (CEOs, CFOs, board members, etc.) are the leaders of the firm who know their company better than anyone else. Following the personal purchases of this “smart money” (on average 30/day), which are reported by the SEC, gives you an edge to find winning stocks given the superior information they possess.

So what are the most interesting stocks that the smart money is buying heavily today? I’ll provide you one of our favorite stocks…

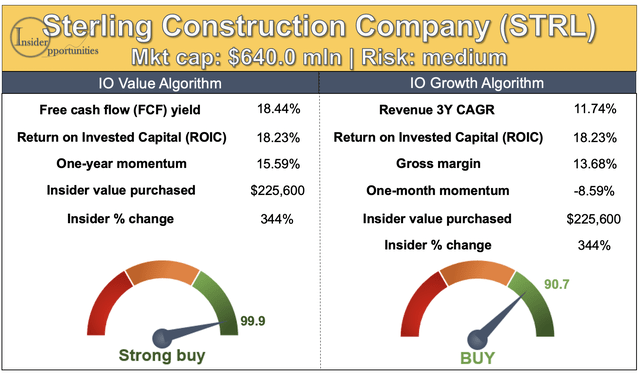

In October we wrote an in-depth review for our members on why they should take a significant position in Sterling Construction Company (STRL). You most certainly have not heard about Sterling, but you might have heard about its customers to whom it provides specialized construction services: Amazon, Facebook, Home Depot… It’s also a play on the recently passed $1 trillion Infrastructure Bill as it provides infrastructure construction services to governmental agencies.

Sterling has grown its EPS by a CAGR of 51% over the past three years, outperforming Amazon (42%), Facebook (37%) and Home Depot (22%). You would expect the company to be trading at an elevated multiple, right? Well, here is the good news… it doesn’t! Sterling trades at just 13.1x earnings and 6.6x free cash flows.

How did we find out about this stock? Director Dill, a highly-respected businesswomen in the industry, purchased $226,500 shares and our IO Golden Value Algorithm picked the stock based on its fundamentals and valuation the day after:

(Source: Insider Opportunities)

Our position is up 30% since the recommendation less than a month ago. I’m not sure whether Sterling will continue outperforming the Nasdaq in the very near term. It most certainly won’t. However,our members and myself are highly confident that it will provide outsized return in the mid-term. Our price target of $59 implies another 99% upside from today’s levels.

As a consequence of solid big tech earnings and extremely strong stock market momentum, the Nasdaq index has been soaring recently.

It looks highly probable that the technology index just entered its “greed phase.” As such, we might experience the biggest rally of our lifetime in the coming months with the Nasdaq potentially soaring through 20,000 points.

Despite the bullish near term outlook, profiting from a rise of tech stocks will be challenging given the dependency of proper market timing. Therefore, I don’t recommend chasing the rally with a large part of your portfolio.

In contrast, looking for significantly undervalued small caps through the insider strategy might be both a much more profitable and less risky strategy in the coming years. Undiscovered gems like Sterling Construction will generate you a lot of wealth going forward.

Are you struggling to generate wealth in this challenging market environment? Discover how following insiders can improve your returns drastically by becoming a member of our private investing community.

Don’t hesitate to sign up for a 14-day FREE trial now to discover our revolutionary strategy and stock recommendations with strong upside. Prices will get raised on December 1 due to unprecedented demand.

This article was written by

Voor Nederlandstalige beleggers – bezoek beleggersuniversity.com als je wil uitgroeien tot een succesvolle belegger

Founder of Insider Opportunities / A new way of investing (insiders+algos) with 43.6% annualized returns since 2010 / Made hundreds of investors successful and confident in this challenging market environment

During my Master of Business Administration at the University of Ghent (Belgium), I got passionated by finance. When writing my master’s thesis I got attracted by the under-appreciated power of the insider investment strategy.

The theory is simple: by following insider (CEOs, CFOs, board members…) purchases, well-respected researchers have proven that you can outperform the market significantly. That’s because this “smart money” knows better than anyone else when their stock is undervalued.

But adopting it in your investment practices is not easy: there are 850 purchases reported by the SEC each month, off which only a small fraction is valuable to follow up. As I enjoy challenges, I decided to dedicate my life into building a strategy around this very promising theory.

After years of empirical research, I discovered a revolutionary strategy based on insiders and algorithms which generated 47.2% annual returns since 2010 (3x the S&P 500). My IO Golden Value, Growth and Biotech algorithms pick out the winning insider purchases (on average 6 per month) based on fundamentals and valuations.

I understood this unique strategy could be extremely valuable to investors like you, enhancing returns and strengthening one’s confidence in the market. To start improving investors’ wealth generation, I decided to find Insider Opportunities in 2020.

Click here to discover Insider Opportunities 14 days for FREE.

By joining our community, you’ll have an edge compared to other investors to find undiscovered, undervalued stocks. You’ll get exclusive access to our daily Insider at Breakfast articles, outperforming portfolios, weekly market updates, group chat with other investors, and much more.

I’m always happy to talk with other like-minded investors and help them out. Don’t hesitate to contact me any time!

Yours sincerely, Robbe

Disclosure: I/we have a beneficial long position in the shares of QQQ, STRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.