24K-Production

24K-Production

This is the moment that we have been waiting for, the ultimate trap to ensnare the bearish investors/short-sellers/hedgers. We gleaned that the market had set up the bearish conditions to form the most potent bear trap (indicating the market denied further selling downside decisively) in our arsenal last Friday (September 30), when the Invesco QQQ ETF (NASDAQ:QQQ) re-tested its June lows.

Accordingly, it joined the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) in its quest to attract sellers into their June bottom by breaking below it. Therefore, it created the optimal conditions for sellers to be drawn deep into peak bear market pessimism, taking out the stop losses from buyers who picked June’s lows, creating massive panic.

As discussed below, we also observed critical observations from Wall Street strategists who maintained their bullish views until last week’s re-tests. Hence, even the most resilient bullish equity strategists are now unsure of their posture, adding to the score of already pessimistic Wall Street strategists.

Notwithstanding, our analysis suggests that the market has set up such re-test conditions several times to form significant bear market bottoms before. These are conditions designed to force weak buyers who thought they picked the lows in June to abandon their thesis entirely at the worst possible moment. They are also intended to fan the flames in the media, who have been touting bearish ideas during these volatile times to attract eyeballs.

While we have yet to glean a validated bullish reversal signal that could confirm that this is the ultimate bottom, we are cautiously optimistic. Notwithstanding, no one can predict precisely how the market will move in the next four to five weeks, which is critical to our thesis. However, even if you really want to cut exposure, we urge you not to jump ship now at the worst possible time of peak pessimism. Sell at the next relief rally if you desire, but not here and not now.

We reiterate our Buy rating on the SPY and QQQ.

In our daily update for our members, we observed several indicators that highlighted peak pessimism in the market last week. We noted that the put/call premium reached a record high that was unseen over the past fifteen years. We accentuated:

[The put/call premium] reached an extreme [level] well above the highs in June [2022] and at levels not seen over the past 15 years. That means it’s even higher than the levels last seen in the 2008/09 financial crisis. The fear and panic have reached a crescendo. Note that this contrarian indicator is very consistent in its predictive potency of a significant bottoming process when it reaches extreme levels. It’s incredible; markets have finally turned extremely panicky, much more than in June, and at the highest levels over the past 15! (Ultimate Growth Investing 28 September 2022 Daily Market Analysis)

Furthermore, we also gleaned that previously bullish strategists have started questioning their conviction levels. For instance, JPMorgan’s (JPM) Marko Kolanovic, who is noted to have been “a steadfast bull throughout the stock market’s more than 20% decline this year, but now some big risks are forming that he can’t ignore.” He highlighted:

Most of the risks in 2022 are a result of policies: escalation of geopolitical tensions and violence, mismanagement of the energy crisis, damaging (instead of nurturing) of global trade relationships and supply chains, fanning internal political divisions, and more. It all amounts to throwing rocks in glass house. While we remain above-consensus positive, these [year-end] targets may not be realized until 2023 or when the risks ease. – Insider

Even market strategist Edward Yardeni, who has been calling for a “rolling/growth recession” instead of a full-blown one, is also considering revisiting his thesis, as it could have been “too optimistic.” He articulated:

The latest economic indicators suggest that the economy is doing better than expected but also that inflation remains too high. That alignment increases the odds of more Fed tightening than previously expected, a higher terminal fed funds rate, and a Fed-induced hard landing. A hard landing isn’t currently our economic forecast-we see the growth recession continuing through year-end. But fears of a Fed-induced hard landing are increasing bearishness in both bond and stock markets. We are assessing whether our forecasts for both S&P 500 earnings and valuation might be too optimistic. (Yardeni Research October 3 morning briefing)

The point we are trying to make is not to call out these two well-respected strategists. But, we believe it’s necessary to point out that even some of the most optimistic market strategists are now questioning their conviction levels. It corroborates our indicators that suggest that the market could have reached peak pessimism, as we suggested.

Investors need to understand that the market is a complex machinery. But, we believe experienced investors generally concur that the most significant market bottoms are formed at levels of peak pessimism. That includes the depths seen in the dotcom bust in the early 2000s or the global financial crisis of 2007-09.

But is the current bear market bottoming process any different? We don’t think anyone can tell you exactly how the current bottom would pan out. Notwithstanding, they often demonstrate similar price structures that unveil significant clues about their bottoming process. Let’s see.

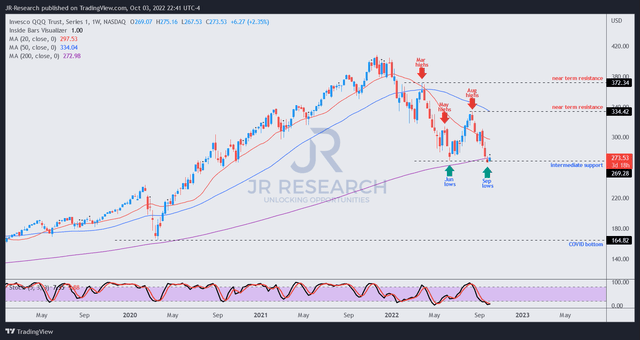

QQQ price chart (weekly) (TradingView)

QQQ price chart (weekly) (TradingView)

As seen above, the market forced the QQQ down rapidly to its June lows through September after posting its August highs, forming the re-test.

We believe the summer rally from the initial June bottom cajoled investors into covering their hedges and investors waiting on the sideline to join the momentum surge, as it broke above May’s highs. As a result, it created a “higher-high” structure, giving these investors’ confidence that June’s bottom could have marked the market’s ultimate lows.

Of course, the market had other ideas, as the steep selling through September helped create another opportunity to draw in sellers rapidly, as market pessimism reached feverish levels.

Notwithstanding, the re-test also created a potential double bottom opportunity, predicated on the lows in June. So, June lows are still valid, but the market needed to force another round of massive panic by taking out the summer gains before reversing the momentum.

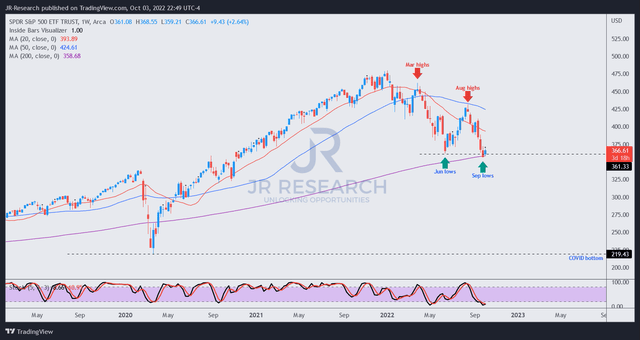

SPY price chart (weekly) (TradingView)

SPY price chart (weekly) (TradingView)

We also gleaned similar price action in the SPY, which re-tested its June bottom ahead of the QQQ last week.

Hence, the stage is set for the double bottom to be validated over the next four to five weeks. Therefore, we believe price-action-based investors will be carefully poring over the market dynamics over this period to discern buyers’ resilience to create the potential bullish reversal price action, leading to the next sustained uptrend.

Investors could also ask whether the price action in March was considered a double bottom. The answer is no. Because the market was not in a prior downtrend, market conditions are not considered bearish enough to validate a double bottom.

However, the length and extent of the bear market since its November 2021 highs have formed a medium-term downtrend in the current re-test. Therefore, we have the critical condition of a downtrending market to validate the double bottom in our arsenal.

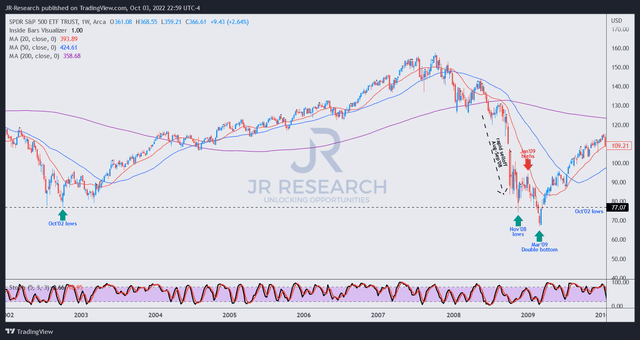

SPY price chart (weekly) (TradingView)

SPY price chart (weekly) (TradingView)

We bring you back to the global financial crisis of 2007-09 to help investors glean the market’s bottoming process, which also formed a double bottom.

As seen above, the rapid capitulation from August to September 2008 led to an initial bear trap in November 2008, not long after Berkshire Hathaway (BRK.A, BRK.B) CEO Warren Buffet’s famous op-ed in The New York Times (NYT), accentuating:

What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over. – NYT

Actually, Buffett’s timing of his commentary was logical and spot on. However, the market had other ideas, as it needed to create another massive panic wave to force the ultimate lows: the double bottom.

As seen above, the market then went on another selling overdrive over the next four months forcing investors to flee to the hills and drawing in sellers on peak pessimism. Alas, the double bottom formed and was validated at the lows in March 2009.

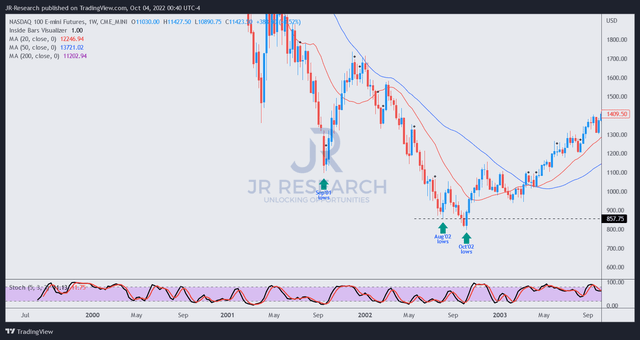

NASDAQ price chart (weekly) (TradingView)

NASDAQ price chart (weekly) (TradingView)

We also gleaned another double bottom in the significant market bottoming process at the dotcom bust in the early 2000s. As seen above, the NASDAQ (NDX) formed its initial lows in September 2001, coming right after the WTC terrorist attacks. However, the bear trap only occurred in August 2002.

Notwithstanding, the market needed to force another low to create massive panic by forming a double bottom in October 2002, effectively taking out the lows from August’s bear trap. Subsequently, the index never looked back until the Great Financial Crisis in 2007.

We have discussed critical market turning points that often culminated in double bottoms in the most significant bear markets over the past twenty years.

Therefore, the SPY and the QQQ are given the opportunity to demonstrate that we are on the cusp of another double bottom, trapping bearish investors/short sellers at the worst possible moments.

The market action over the next four to five weeks will be critical to validating our thesis.

We remain cautiously optimistic given the massive pessimism seen in the market, coupled with constructive price action. Accordingly, we reiterate our Buy rating on the QQQ and the SPY.

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Unlock the secrets of successful investing with JR Research – led by founder and lead writer JR. Our dedicated team is laser-focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular marketplace service – specializing in a price-action-based approach to uncovering the hottest growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.