In December 1999, Yahoo joined the S&P 500 index. In a stunning move, in the 9 days before the index inclusion, the stock rallied nearly 50 percent. Two years after its index inclusion, Yahoo had dropped close to 70 percent. What happened? During the tech bubble, Wall Street banks, hedge funds, and proprietary trading firms were able to take advantage of the constraints of index funds in what basically amounted to a redistribution of wealth on passive investors that rebalanced.

Source: Business Insider

The index funds didn’t have Yahoo stock and had to buy no matter the price, so the traders proceeded to drive up the price massively in the days and weeks before the inclusion, and sell their stock back into the forced buying, profiting billions of dollars in the process at the expense of index fund investors. This type of index front running is now back in full force in the 2020s, with the Tesla (TSLA) inclusion looking like it will go down in history as another massive wealth transfer.

While Tesla is not a pure meme stock, the Tesla inclusion on December 21 forced the S&P 500 to buy nearly $80 billion in stock, which the index funds bought in the weeks before and after, finishing by early January. By January, Tesla had topped and is now down over 20 percent from where the index bought in. What does this have to do with Tesla’s business? Nothing, and that’s the point–it’s just a game Wall Street plays to get index funds to overpay for stocks.

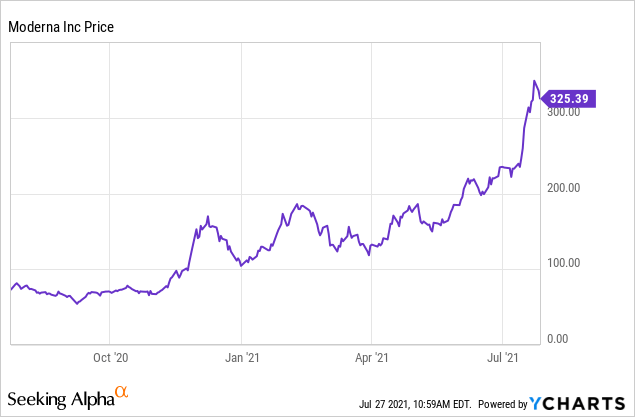

Moderna (MRNA) similarly was driven up by nearly 100 percent in a matter of weeks before its recent index inclusion. Keep an eye on this one.

A widely quoted NYU study on index construction found that front-running of index additions and deletions cost the S&P 500 index about 0.28 percent annually in return over the time period studied. However, during the tech bubble, the costs were triple the long-run average. Over the last 20 years, the S&P 500 has returned 7.9 percent annually, so the index front-running cost is anywhere from 1-10 percent of the total economic profits of the index, depending on the year. The bigger indexing gets relative to the size of the total market, the bigger of a problem this will be.

One finer point of this was that small-cap indexes were particularly victims of this hedge fund game, with the Russell 2000 index estimated losing nearly 4.5 percent of its value in a single year (2000) to front running. To this point, the Russell 2000 (IWM) has always struggled with poor index construction and the S&P 600 (IJR) index is not a whole lot better at present. This is a problem since 401(k) providers tend to have the Russell or the S&P 600 as their default index, which leaves you swimming with sharks if you check the box to put money in it.

Interestingly, in 2021 the growth in indexing has interacted with another trend, speculation in meme stocks. To this point, the top holding in the Russell 2000 is AMC (AMC), at nearly a 1 percent index weight. The top holding in the S&P 600 is GameStop (GME), with a little over a 1 percent weight. Ironically, the top holding in the Russell 2000 Value ETF (IWN) is also AMC, which has a massive valuation and mounting losses. While it’s difficult to predict what will happen in the short run regarding meme stocks–in the long run, they are highly unlikely to add value to the index. A better option to avoid your money going into as many speculative companies is the Vanguard Small Cap ETF (VB), which tracks a CRSP small-cap index that’s specifically designed for lower turnover. Traditionally, the S&P 600 index is soundly constructed, but the meme stocks are likely to drag on the index, while the Vanguard index is more broadly diversified.

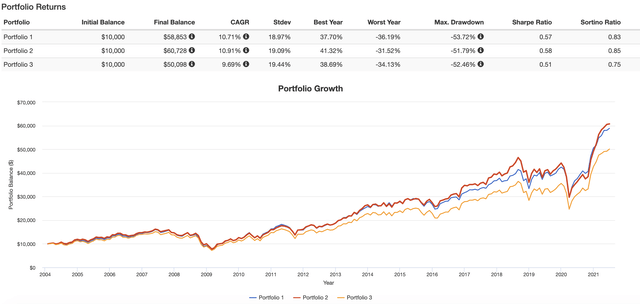

Small-cap backtest (Vanguard small-cap= blue, S&P 600= red, Russell 2000= yellow)

Source: Portfolio Visualizer

AMC and GameStop were both Russell 2000 holdings prior to the meme stock surge, so there was no harm done here, and the index actually benefitted from the surge. However, since the weights have now changed, those buying into these indices with new money based on reading academic research about small-cap stocks may be taking unintended risks. The consensus from research about small-cap investing is that you can only make higher returns from small-caps in the long run if you can effectively control your allocation so that you invest in quality, profitable companies and avoid speculative, money-losing companies.

The current situation in the stock market has drawn plenty of comparisons to the market in the late 1990s, but another apt comparison might be to the Nifty Fifty bubble in the 1960s and early 1970s. The Nifty Fifty stocks traded at over 40x earnings, compared with a little under 20x for the S&P 500 at the time. Among the Nifty Fifty were consumer stocks like McDonald’s (MCD), Coca-Cola (KO), Walmart (WMT) as well as the big tech names of the day such as IBM (IBM) and Texas Instruments (TXN). Then, the bottom fell out as inflation rose and the economy slowed.

From a Forbes magazine article a few years later:

The delusion was that these companies were so good, it didn’t matter what you paid for them; their inexorable growth would bail you out. Obviously the problem was not with the companies but with the temporary insanity of money managers — proving again that stupidity well-packaged can sound like wisdom. It was so easy to forget that no sizable company could possibly be worth over 50 times normal earnings.

In the following years, these stocks went down in many cases over 75 percent in value as retail investors lost interest in the stock market. A good account of the speculative boom and bust in the Nifty Fifty is John Brooks’ book, The Go-Go Years, originally published in 1973. Brooks is better known for his 1969 book Business Adventures, which both Warren Buffett and Bill Gates have said in interviews is their favorite business book of all time.

I don’t know how long the current speculative boom in stocks will last. With student loan payments starting again in September, expanded unemployment benefits ending, and foreclosures and evictions restarting while the Federal government debates raising corporate taxes, the odds seem good that the speculative portions of the stock market will probably wash out.

There are two main ways to manage index front running, and they’re related.

As passive indexing continues to grow, the unintended consequences are increasing. With many of the top holdings in large and small-cap indices being highly speculative companies trading on momentum, long-term investors may consider taking some countermeasures. Diversifying as much as possible and being intentional about the risks you take are the best routes to success. If nothing else, being aware of index construction issues will help make you a better investor.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.