jbk_photography/iStock Editorial via Getty Images

Considering its historic outperformance, Mastercard Inc (NYSE:MA) (also, “the Company” hereafter) has been uncharacteristically flat over the past 12 months. It may be a case of “too far, too fast” over the prior several years. This has not been for lack of swings. Market sentiment is a bit shaky with inflation fears, supply chain problems, and lingering job openings. While some may run for the hills, for many long-term investors this means it is a great time to accumulate shares in this stalwart. The flat year has allowed the valuation to recouple with results and shares should be near a consolidation.

To discuss the Company’s valuation first it helps to get a handle on the excellent margins and cash flows produced. After all, what are we investing for if not to take part in the company’s cash? Mastercard, and its competitor Visa (V), have some of the best margins on the market. Mastercard has an EBITDA margin over 58%, operating margin over 53%, and a tremendously impressive net margin over 43%. These margins dwarf most stocks on Wall Street. This includes some of the most successful companies on Earth, as shown below.

Author’s Note: Data presented on a trailing twelve month basis (TTM) throughout article unless specified otherwise.

Even looking at standouts like Microsoft (MSFT), Apple (AAPL), and Alphabet (GOOG), there isn’t one profitability metric that exceeds Mastercard.

Looking at the relative newcomers in payment processing, Square (SQ) and PayPal (PYPL) each have a long way to go to compete on these metrics.

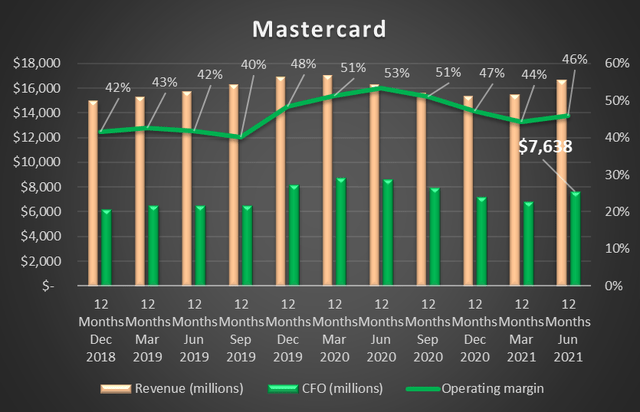

This leads to operating cash flow (CFO) where Mastercard is again one of the leading companies in the world. Mastercard keeps on average more than 45 cents for every dollar in revenue produced when considering just operating activities. Chart created by author with data from Seeking Alpha.

Chart created by author with data from Seeking Alpha.

Over the last 12 months, Mastercard has generated $7.6B in operating cash flows. This translates to over $7.00 in free cash flow per share. While MA stock has a small dividend yield, much of this cash is still returned to shareholders through stock buybacks. More on this later.

Against this backdrop MA stock nearly always trades at what would be called a premium valuation. Currently, the PE ratio is just under 49x, the forward PE is 43x. Price to CFO per share is just over 45x, as shown below.

While these are high, the last year’s worth of flat trading has brought them back in line with historical metrics. Just prior to the pandemic Mastercard traded at a PE and Price to CFO per share just under 43x, similar to where the stock trades today. This may be largely due to the modest pullback in CFO in recent quarters, however, this is expected to reverse shortly. According to Seeking Alpha’s analyst consensus growth metrics, the forward CFO growth is over 11%. For long-term investors, perhaps the best case for purchasing now is shown below:

The PE ratio based on forward 1 year (December 2022) estimates is a modest 32.77. The last time MA stock traded at a PE in this range, pandemic crash excluded, was 2017.

Mastercard’s dividend is extremely safe, however, the yield is a paltry 0.50%. If an investor is looking strictly for dividend yield, then this is quite likely not the stock for them. However, for those looking at the total amount of cash returned to shareholders, then Mastercard is very attractive indeed.

There are a couple key differences between the return of capital through dividends vs. through buybacks. First, dividends are taxed in the year they are received, provided of course it is a taxable account. The dividend is also more predictable than a stock buyback as they typically do not go down without some type of hardship on the company. For its part, Mastercard has increased the dividend each year since 2011.

Stock buybacks are tax-deferred returns of capital to shareholders. The buyback itself is not taxed, however, the buybacks will typically increase capital gains as the stock will likely rise more than it would otherwise. Once sold, assuming the gains are long-term, the investor is taxed at their respective capital gains tax bracket. In this way, the gains are not tax-free, just tax-deferred. However, deferring taxes can be very positive depending on the taxpayer’s situation. For instance, in one’s prime earning years, his or her long-term capital gain rate maybe 15-20%. Once retired, this may drop to 0% allowing for an entirely tax-free return of capital when the shares are sold.

Mastercard’s buyback program is ongoing. The most recent $6B program was authorized in December 2020 and commenced when the previous $8B authorization was completed. It is highly likely this cycle will continue. In total Mastercard has repurchased $6.3B in share over the last four quarters, as shown below. This is a little under 2% of the market cap in one year.

Recently, Mastercard has been trading in a choppy pattern – headed steadily downward.

There are several risks to MA stock’s future success that investors may be considering. One that is mentioned frequently, and recently, is the evolution of “buy now, pay later” (BNPL). Sounds like modern-day layaway doesn’t it? The biggest difference is that you receive the items right away with modern BNPL. Disadvantages include typically smaller limits than credit cards and that using BNPL does not build credit. Some have speculated that BNPL will take a significant debt out of credit card usage. However, according to a TransUnion study, this is not the case. In fact, according to the study, those who use BNPL also use credit cards more than the general population. Also, Mastercard has introduced its own BNPL program to compete with this new trend.

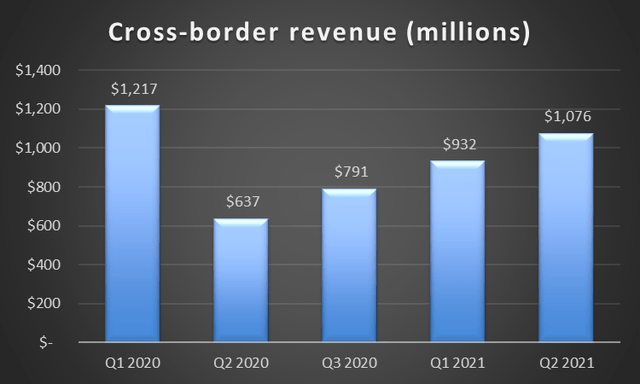

Inflation and rising interest rates should not hurt Mastercard relative to many other businesses. One major revenue stream is based on gross dollar volume of activity, so for this, higher prices will bring in more revenue. Other revenue streams are transaction and fee-based services. A major contributor is the highly profitable cross-border fees. These were hurt significantly during the pandemic as international travel slowed. These fees are just now beginning to approach recovery fully, as shown below. Chart created by author with data from company earnings presentations.

Chart created by author with data from company earnings presentations.

Obviously, any further travel restrictions would be detrimental to short-term results.

The state of the overall economy is always a concern for shareholders of Mastercard. Less consumer spending generally equals less revenues for Mastercard. As shown below, consumer disposable income has reverted to the mean, however, it’s still on a steady upward track. Consumer confidence, however, is seriously lagging. Consumer confidence is generally seen as the best indicator of overall consumer spending. Interestingly, consumer spending has increased significantly while sentiment remains depressed – no doubt induced by stimulus and low interest rates along with rising wages. This may be an indicator that consumer spending will increase even further if we can begin to make headway against our macro issues, such as the labor market and supply chain bottlenecks, in the coming quarters. It is easy to be drawn into pessimistic thinking on these issues and they will no doubt slow the economic recovery. However, the demand side of the market remains strong and the supply side will find a way to meet it – for a price. Prices may continue to rise, but Mastercard would be in a better place than most.

Analysts are bullish on Mastercard. According to Seeking Alpha’s Wall St. Analysts Rating Summary there are 21 very bullish ratings, 9 bullish, and 7 neutral ratings. The are no bearish ratings listed.

The average analyst price target is $435.28. This implies a 25% upside from the October 11, 2021 closing price.

Historically, Mastercard has crushed the overall market at every turn. The share buyback program will cushion the downside and create value for investors. The recent weakness is an opportunity for investors with long-term vision.

The stock is still trending downward. This may continue for the short term. I do not try to predict bottoms in stocks. Instead, I recommend that interested investors accumulate or add to existing holdings incrementally over a period of a few months. This allows the long-term investor to take advantage of short-term weakness without attempting to find the absolute bottom. In my view, Mastercard is a long-term staple holding and a buy at these levels.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MA, V, AAPL, AMZN, MSFT, GOOG, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.