Sean Gallup/Getty Images News

Sean Gallup/Getty Images News

Microsoft (NASDAQ:MSFT) is the rare tech stock that can deliver robust growth while generating huge profit margins and rewarding shareholders. While the dividend yield might not look that enticing at less than 1%, the stock may nonetheless reward dividend investors through aggressive growth rates over the coming years. Further, with the stock trading at an earnings yield just over 3%, shareholders are also being rewarded through ample share repurchases. This is a case where it can pay off to pay up for quality.

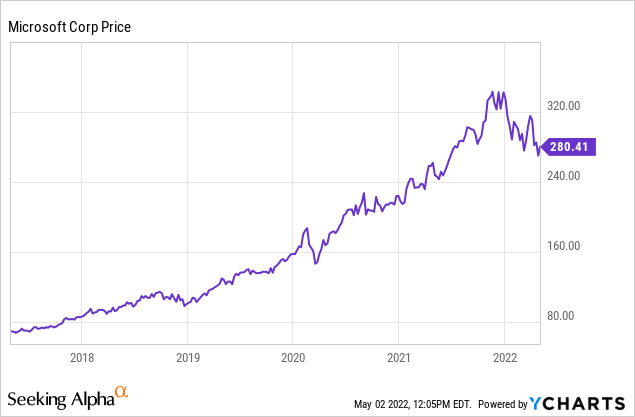

Even amidst a crash in the broader tech sector, MSFT is still trading not far from all-time highs.

Now trading at just around $280 per share, the stock is still offering plenty of potential forward returns for long-term investors.

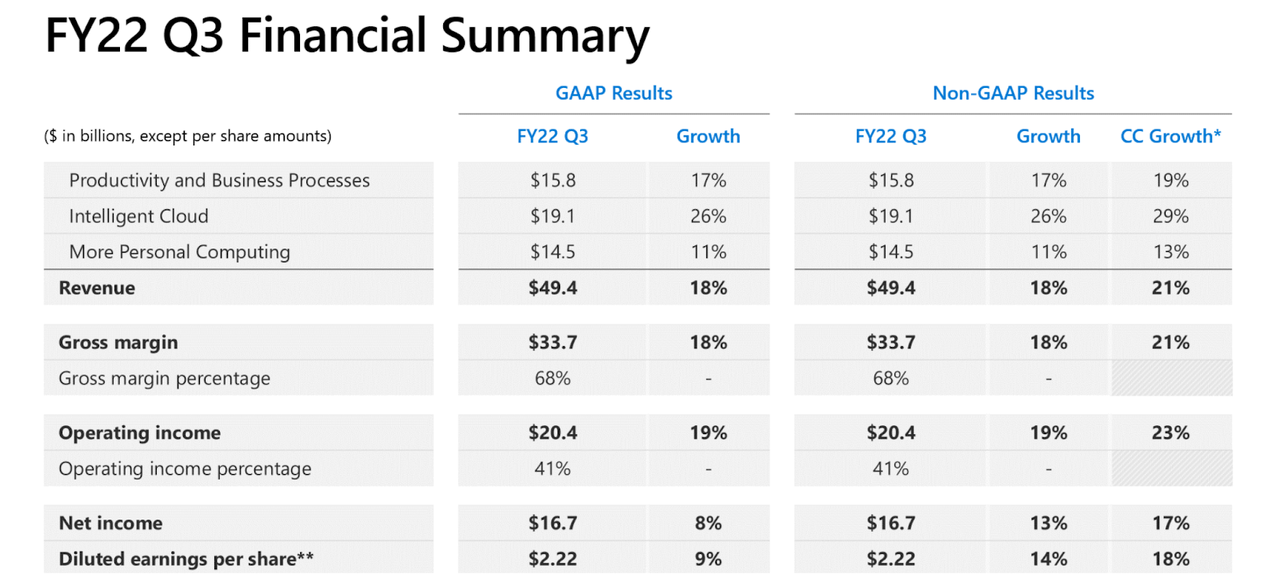

In the latest quarter, MSFT delivered typically strong growth, with overall revenue growing 18% (21% adjusted for constant currency) and operating income growing a bit faster at 19% (23% adjusted for constant currency). Net income grew slower at 8% because the prior year’s quarter benefitted from a $620 million tax benefit. Earnings per share grew slightly faster due to ongoing share repurchases.

Microsoft FY22 Q3 Presentation

Microsoft FY22 Q3 Presentation

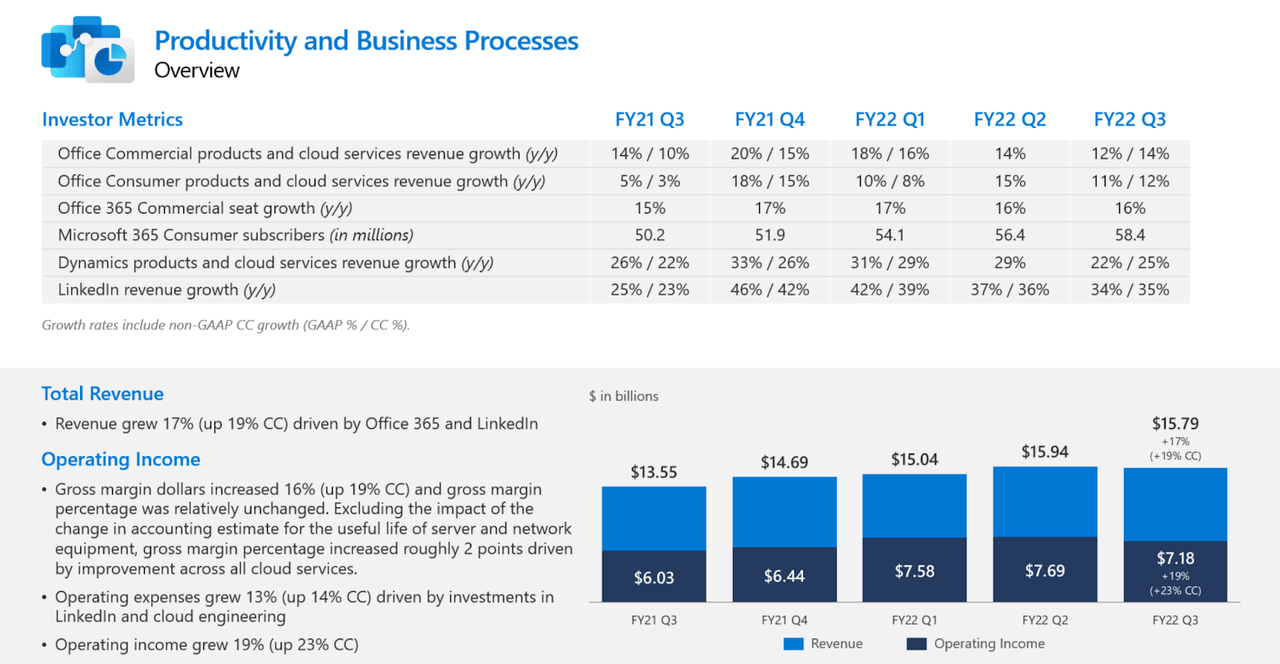

MSFT’s core productivity and business processes segment delivered solid growth and continues to be a cash cow with 45.5% operating margins.

Microsoft FY22 Q3 Presentation

Microsoft FY22 Q3 Presentation

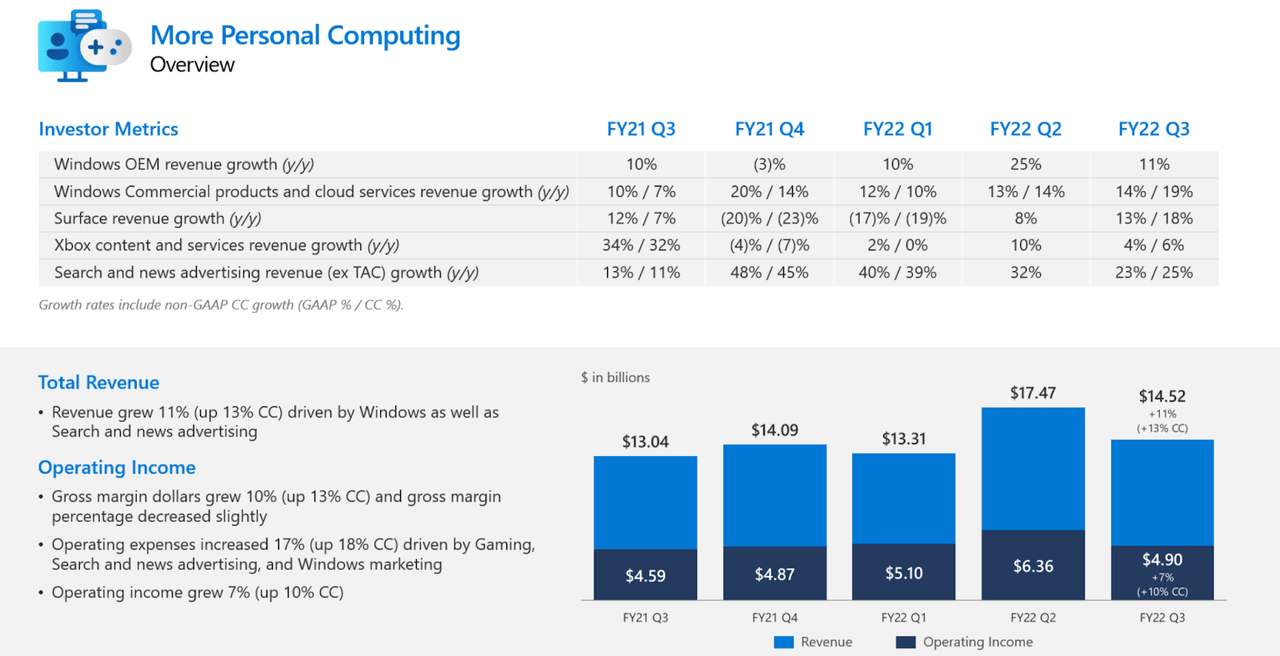

MSFT saw its weakest results in its gaming segment – largely due to tough pandemic comparables.

Microsoft FY22 Q3 Presentation

Microsoft FY22 Q3 Presentation

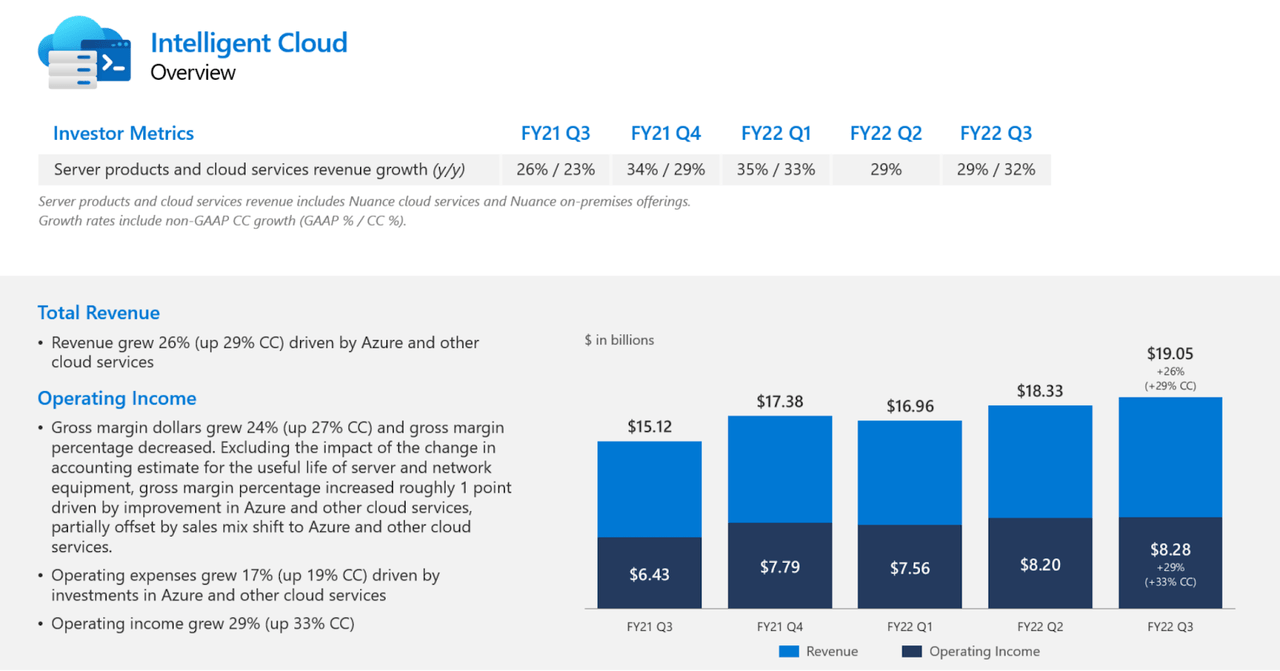

While the investors may typically know MSFT based on the above two segments, the cloud segment has quickly become the largest segment by revenue. Over time, I expect MSFT to be known primarily as a cloud company. Cloud revenues grew 26%, powered by 46% growth from Azure. Operating margins were also very strong at 43.5%.

Microsoft FY22 Q3 Presentation

Microsoft FY22 Q3 Presentation

The company generated $20 billion in free cash flow and returned $12.4 billion to shareholders through $7.8 billion in share repurchases and $4.6 billion in dividends. MSFT ended the quarter with $104.7 billion in cash versus $49.9 billion in debt for a $54.8 billion net cash position.

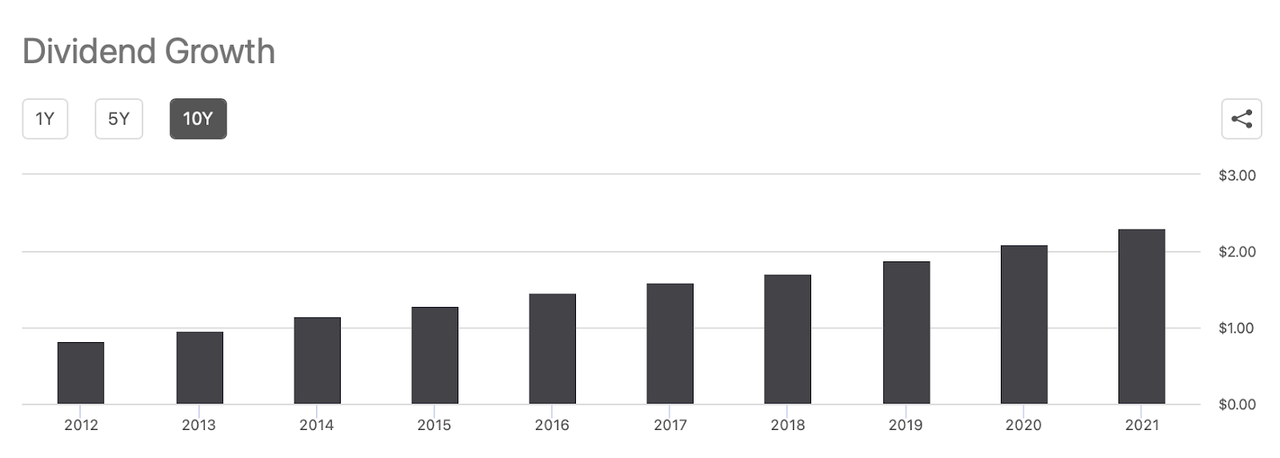

At first glance, MSFT might not look like an attractive dividend stock due to the low 0.9% yield.

Seeking Alpha

Seeking Alpha

Further, the dividend growth rate has hovered around 10% over the past 5 years – a solid rate, but not one that totally offsets the low yield.

Seeking Alpha

Seeking Alpha

What’s going on?

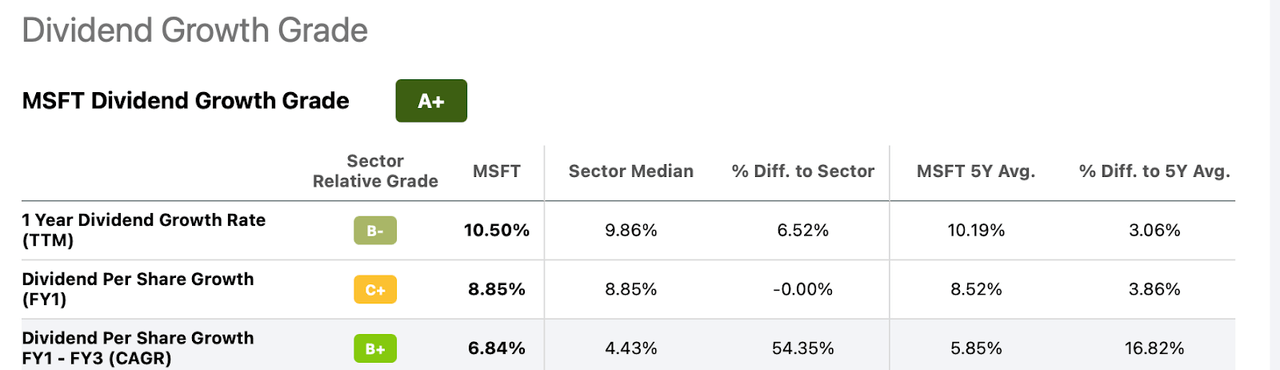

The key here is that the past dividend growth rate is likely understated in comparison with forward growth rates. MSFT has been growing earnings per share at a 30% clip over the last 5 years. Dividend investors should focus on underlying earnings for a better understanding of true dividend safety because dividends are paid out of earnings. We can see that Seeking Alpha rates MSFT’s dividend with a safety score of A+.

Seeking Alpha

Seeking Alpha

That grade makes sense in light of the strong underlying earnings as well as the $54.8 billion net cash balance sheet position. While the low 26% dividend payout ratio is worth mentioning, that metric is less important than balance sheet strength and forward growth outlook of the business – both of which, as mentioned, are very bright for this company.

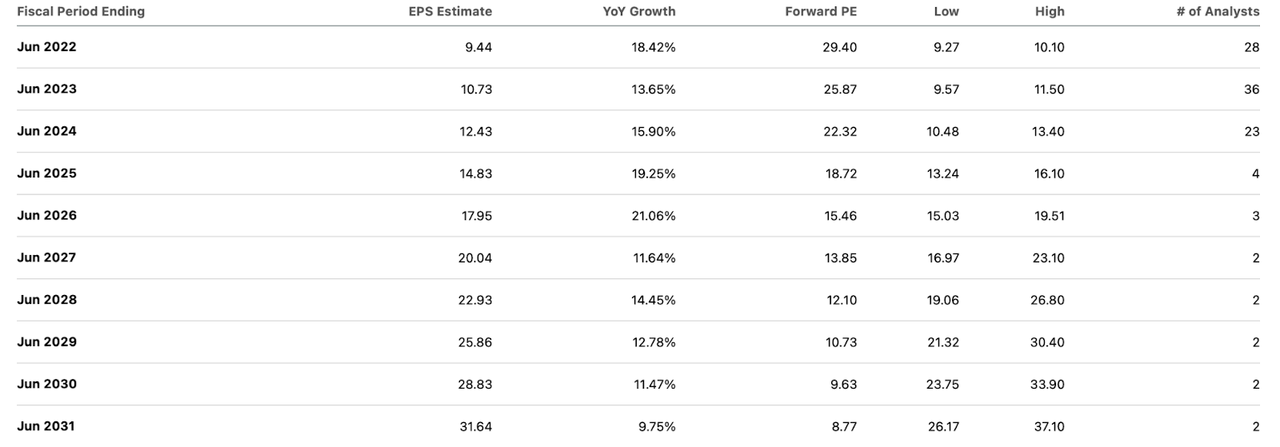

While MSFT is not an obviously cheap stock, the company is expected to sustain robust growth over the next decade.

Seeking Alpha

Seeking Alpha

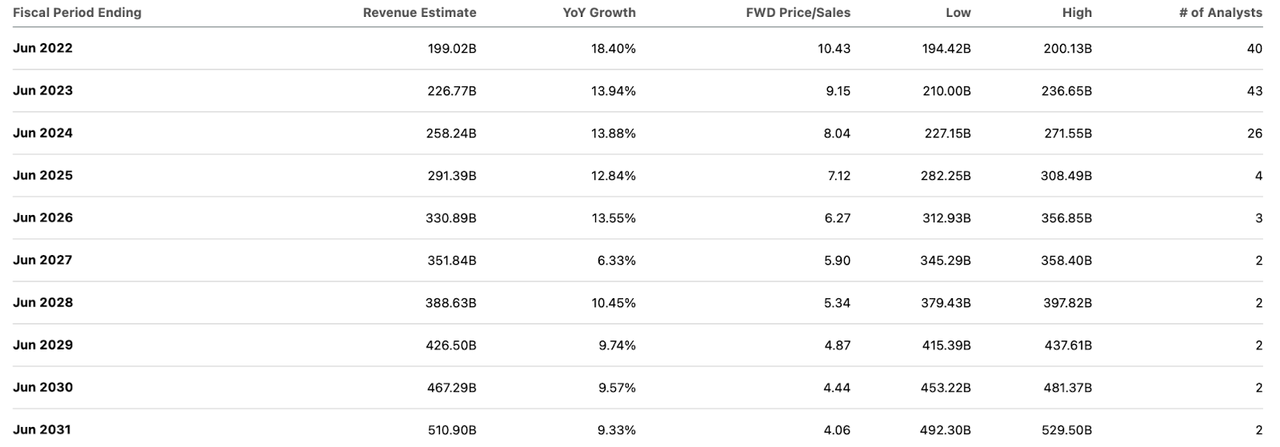

Those earnings growth projections look reasonable when compared against consensus revenue estimates.

Seeking Alpha

Seeking Alpha

Consensus estimates call for the company to achieve 46.3% net margins by 2031. For reference, MSFT has achieved a 38.3% net margin through the first 9 months of its 2022 fiscal year. That 800 basis points of projected margin expansion looks very achievable considering the high scalability of MSFT’s software products. MSFT hasn’t shown materially greater operating income growth (relative to revenue growth) in this past quarter, but that is likely due to aggressive investment in growth, as evidenced by the 21% growth in R&D spending. I expect MSFT to soon start showing large levels of operating leverage as top-line growth begins to flow directly to the bottom line.

While there are cheaper alternatives in the tech sector, MSFT remains a buyable stock. It is currently trading at 8.9x 2031 consensus estimates. Due to the strong balance sheet, persistent growth, and high levels of shareholder returns, I could see the stock trading at a 2.5x price to earnings growth ratio (‘PEG ratio’). That would place the stock at 25x earnings, or a price of $791 per share by 2031. That represents potential returns of over 11% annualized from capital appreciation alone. Throw in the roughly 1% dividend yield, and that edges up higher to around 12%. I note that MSFT may be able to beat consensus EPS estimates due to ongoing share repurchases. I expect a 12% annualized return to beat the overall market from here though potentially fall short of keeping up with more beaten down tech names. There are two key risks to consider here. First, the projected returns are highly predicated on both the company’s ability to sustain solid growth rates and a premium multiple. Due to the company’s growing investment in R&D, annual double-digit growth looks reasonable from here – not to mention that the company may be able to accelerate EPS growth by taking more leverage later. It is possible that MSFT trades at a lower earnings multiple as growth slows, but I still expect it to sustain a premium multiple in light of the high free cash flow generation and willingness to return capital to shareholders through dividends and share repurchases. The other risk is that of regulatory intervention – MSFT has been able to sustain premium multiples relative to the likes of Alphabet (GOOGL) and Meta Platforms (FB) largely due to investor perception that MSFT is not as targeted by regulators. Should that change, which shouldn’t be ruled out considering the company’s size, the premium multiple may also go away. I rate MSFT a buy in light of its robust fundamentals, though note the high likelihood of better opportunities elsewhere in the tech sector.

Growth stocks have crashed. Buy the big winners of tomorrow at stupid cheap prices today. Big profits are available for the taking, but you must act now.

My portfolio includes my highest conviction ideas that I think will absolutely crush the market over the next decade.

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Disclosure: I/we have a beneficial long position in the shares of FB, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all holdings of the Best of Breed portfolio