The Goldman Sachs Hedge Industry VIP ETF (NYSEARCA:GVIP) is a simple fund. GVIP invests in the 50 most common stocks held by hedge funds. These are all high conviction picks which industry professionals expect to outperform, which has been the case since the fund’s inception. GVIP’s strong performance and strategy make the fund a buy.

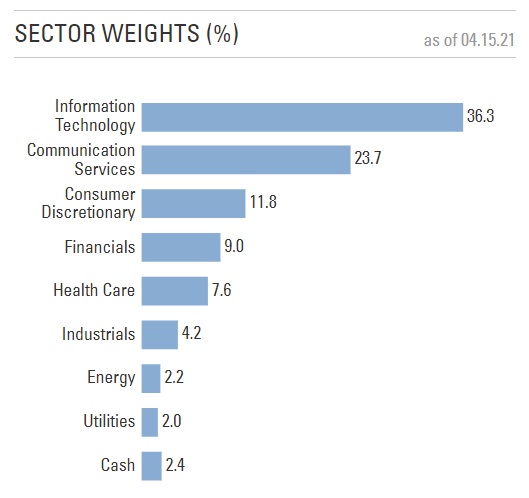

GVIP is an index fund, tracking the Goldman Sachs Hedge Fund VIP Index. Said index invests in the 50 most common stocks held by hedge funds. There are rules meant to exclude activist, quantitative, and small hedge funds, as these are not representative or fundamentals-based. Holdings are equal-weighted. There are technically no rules to ensure industry diversification, but the fund is still quite diversified:

(Source: GVIP Corporate Website)

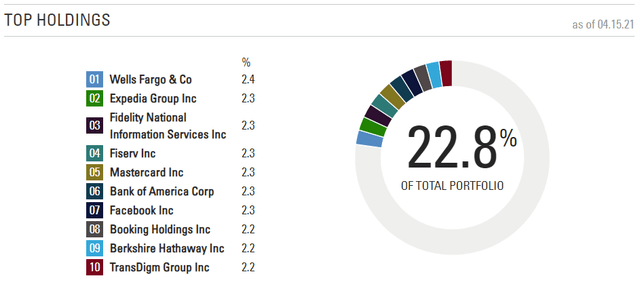

The fund’s largest holdings are as follows:

(Source: GVIP Corporate Website)

GVIP is a simple fund, with an even simpler investment thesis.

Hedge funds generally invest in stocks their managers believe will outperform.

If many hedge funds invest in the same stock, that is because many in the industry believe it will outperform.

If the industry is right, these stocks, and GVIP itself, should outperform.

So, investors who trust the hedge fund industry, who think hedge fund managers pick the right stocks, should consider an investment in GVIP. Those who don’t, shouldn’t.

The obvious question is should investors trust the hedge fund industry? Let’s try to answer that question.

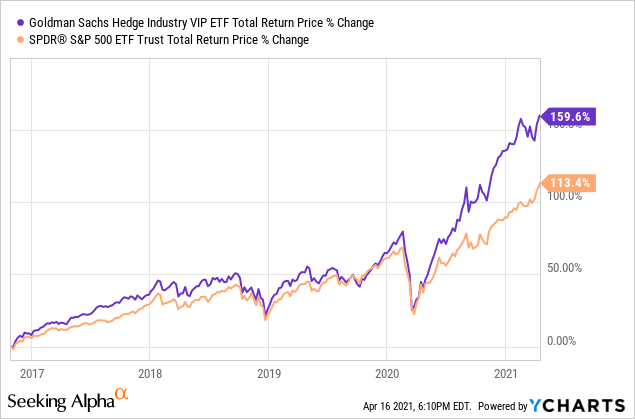

The easiest way to know if the hedge fund industry knows how to pick stocks is to see if they have picked the right stocks in the past. From what I’ve seen, that seems to be the case. GVIP itself has consistently outperformed the S&P 500 since inception, and for most relevant time periods, meaning that popular hedge fund stocks have done so as well:

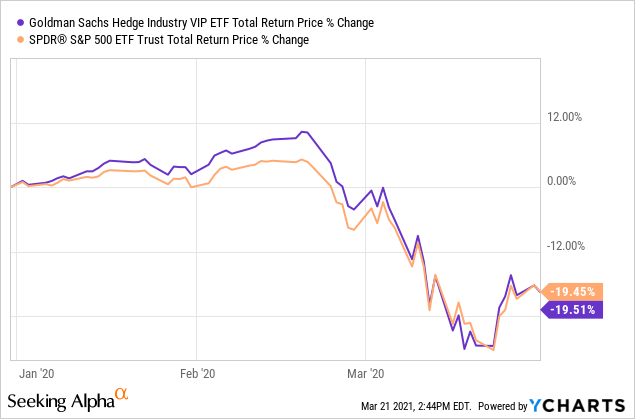

GVIP is also not particularly riskier than average, with the fund performing in line with the market during early 2020, the last downturn:

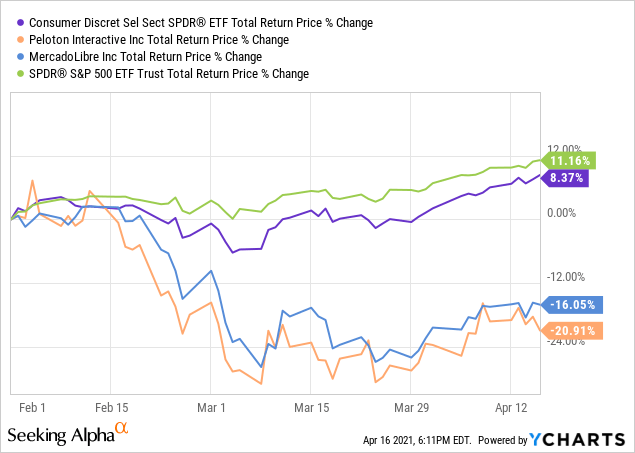

GVIP’s strategy seems to be working. From what I’ve seen, the fund, and the hedge fund industry more broadly do seem to be investing in appropriate stocks and industries. Selected stocks tend to outperform, and the fund also divests itself from industries and stocks before these suffer losses.

As an example, sometime after late January the fund shifted away from the consumer discretionary industry, and sold a couple of pandemic best-performers, including Peloton (PTON) and MercadoLibre (MELI). Said industry and both stocks have underperformed since, so selling was the right, profitable choice.

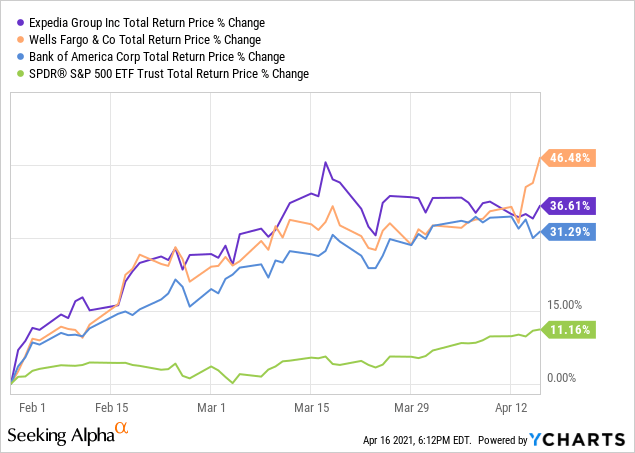

After selling these names, the fund seems to have pivoted towards banks and other reopening plays. Stocks include Expedia (EXPE), Wells Fargo (WFC), and Bank of America (BAC). These stocks have all outperformed these past few months, so the switch was definitely a good idea.

Now, as we don’t have exact dates for GVIP’s trades, it is possible that some of the examples above were not as profitable as shown. Perhaps GVIP sold after the stocks had already gone down somewhat, and bought after they started to go up. Still, the fund has outperformed since inception, so it makes sense for its trades and investments to be quite profitable, which is what I’m seeing.

GVIP strategy seems to work, but I’ve identified some negative issues. Let’s have a look.

I think there are three key negatives with fund.

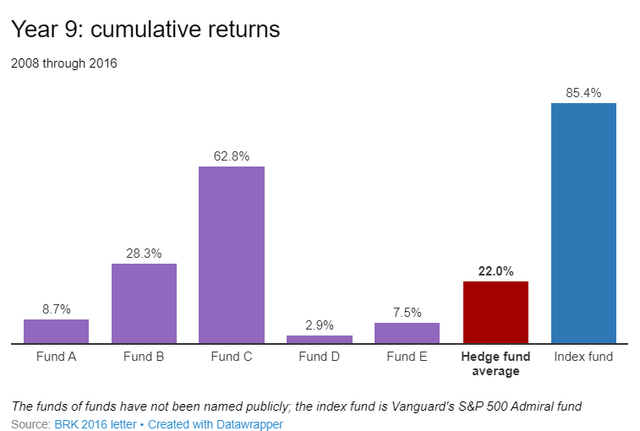

First, is the fact that hedge funds generally underperform the market. Lots of evidence and data for this, but I think Warren Buffett’s famous bet explains the situation best. About a decade ago, Buffett bet a hedge fund manager that an S&P 500 index fund would outperform hedge funds. Buffett thought that hedge fund managers were incapable of generating alpha, and that excessive hedge fund fees would lead to underperformance. Buffett was right, and the S&P 500 significantly outperformed the average hedge fund.

(Source: Investopedia)

Taking into consideration the above, I think it is possible that GVIP has just been lucky these past few years. Seems a bit odd that even though hedge funds underperform, an ETF focusing on popular hedge fund holdings outperforms.

On the other hand, GVIP only invests in the most popular holdings in the entire hedge fund industry. Perhaps few individual hedge fund managers are able to outperform, but their most popular holdings themselves are better than average. A wisdom of the crowd phenomenon. This makes sense and is consistent with the evidence.

At the same time, I also think it is possible that GVIP’s comparatively low expense ratio of 0.45% helps explains the fund’s performance. Hedge funds are expensive, and fees are a key reason for their underperformance. Makes sense that a cheaper ETF, but with the same strategy and holdings, outperforms.

Nevertheless, I think that the fact that hedge funds tend to underperform is important, and a significant negative for GVIP and its shareholders. The entire investment thesis is somewhat suspect, although I think the fund’s actual performance outweighs these issues.

Second, and related to the above, is the simple fact that past performance is no guarantee of future results. GVIP’s strategy has worked reasonably well so far, but it could always underperform in the future. This is of particular importance considering the fact that hedge funds tend to underperform.

Third, and finally, is the fact that GVIP’s strategy is backwards-looking. The fund invests in the most common holdings reported by hedge funds in their most recent quarterly reports. Quarterly reports are filed with a delay of about one month and a half, so the fund is using outdated information when deciding where to invest.

Using outdated information is obviously not ideal and could lead to shareholder losses or lack of gains. This is easy to show with an example. Hedge fund managers decided to invest quite heavily in Expedia, Wells Fargo, and Bank of America in late 2020. GVIP invested in these same stocks as soon as the hedge funds filled their quarterly reports, which happened in early 2021. These same stocks outperformed during early 2021, so GVIP’s delay didn’t cause any issues, but the strategy could have failed if hedge fund managers had better timing.

In my opinion, the fact that GVIP has consistently outperformed since inception means that these three issues have not been all that important in the past, although obviously conditions could always change.

GVIP offers investors the possibility of investing in the most popular hedge fund stocks, a strategy which has outperformed in the past. I believe that the strategy should continue to be successful, and so rate the fund a buy.

Profitable CEF and ETF income and arbitrage ideas At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

—————————————————————————————————————

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published to members of the CEF/ETF Income Laboratory on March 23rd, 2021.