Adrian Vidal/iStock via Getty Images

Adrian Vidal/iStock via Getty Images

2022 has presented investors with nothing but volatility, inflation, rising commodity prices, geopolitical tensions, and declining major idiocies. Gold of all things has appreciated by 10.10% YTD, and many of the high-flying growth stocks which were loved in 2020 have lost 50%, 60%, 70%, or more from their highs. Investors look for strong income-producing vehicles to drive yield to their portfolios when it comes to income investing. Regardless of whether you’re utilizing the income to live off of or diversify your investment mix, reliable dividends are important.

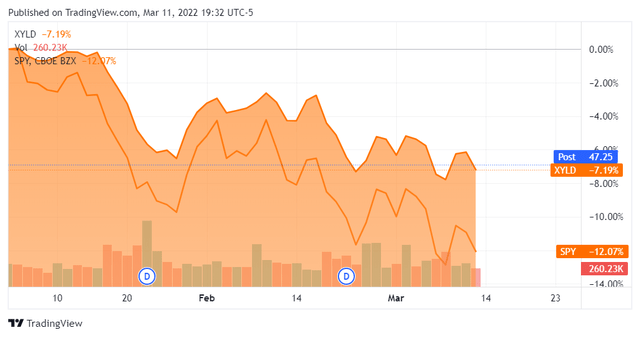

I am a fan of the Global X Covered Call ETFs and have been writing about them for some time. Many investors seemed interested but were reluctant because they were never tested throughout a correction, while other skeptics called them gimmick funds that wouldn’t hold up through a hard market environment. If the first three two and a half months of 2022 aren’t classified as a hard market, I don’t know what is. YTD, the SPDR S&P 500 Trust (SPY), has declined by -12.07% compared to the Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) declining by -7.19%. The chart below is certainly interesting as at no point in 2022 has XYLD declined further than SPY. YTD, XYLD has declined by 4.88% less than SPY, which clearly indicates that this fund can hold up just fine in a declining market vs. the index.

Seeking Alpha

Seeking Alpha

As options become more mainstream, I hope that more people understand there are ways to utilize options as income vehicles and not just as an instrument to control blocks of shares for a fraction of the cost. Some types of options can be extremely volatile, and even if you understand how to utilize options, they can be risky, so please do your homework when it comes to the options market.

Covered Calls are much different than buying options contracts. All options contracts are based on 100 shares. Once you own 100 shares of an equity, you can sell a contract against your shares which is referred to as writing a Covered Call. This is a financial transaction where the person selling call options owns an equivalent amount of the underlying security. The seller needs to hold a long position in the underlying equity to write a covered call because the shares owned in the equity are the covered part of the call option. This means the seller can deliver the shares if the call option buyer chooses to exercise.

Hypothetically let’s say company XYZ trades at $10 per share and pays a dividend of $0.50 for a 5% yield, and the investor owns 100 shares. The investor sells a covered call at a $12 strike for .08 with an expiration date of 9/1/21. The investor just sold the right to purchase their 100 shares of company XYZ on or before 9/2/21 for $12 regardless of what the share price appreciates to for $8. If XYZ goes to $15 and the option is exercised, the investor who wrote the covered call would only get $1,200 for their shares because they sold the right to buy their shares at $12 on or before 9/1/21.

The downside to selling a covered call is that you’re capping your upside potential. The upside to a covered call is you generating additional income simply by selling the right to someone else to purchase your shares at a specific price on or before a specific date. I like selling covered calls on stocks I want to own long-term, and that trade sideways. I generate additional income from dividend stocks by selling covered calls. Since I own the shares, I don’t see this as being risky because the contract is covered by my shares. XYLD does this for you and pays a much larger yield than you will find from many individual equities in the market.

Global X

Global X

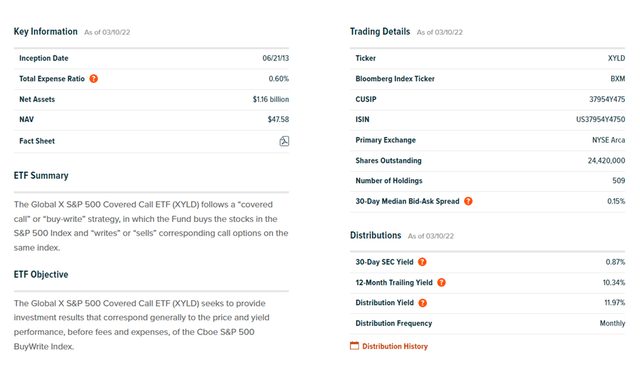

XYLD follows a covered call strategy as it invests in companies throughout the S&P 500 index then writes corresponding call options on the S&P 500. This is an efficient way for investors to gain exposure to income generated from the options market without worrying about doing something incorrectly or spending time learning what to do. XLYD does all of the work as it writes call options on the S&P 500 index saving investors time and the broker fees of doing this independently. XYLD also invests in the S&P 500 index, a market-capitalization-weighted index of the 500 largest companies in the United States. XYLD invests at least 80% of its total assets in the securities of the S&P 500 and writes call options on the S&P 500 index. Each time the fund writes a covered call option, the fund receives a payment of money from the investor who buys the option from the fund. The premium paid by the buyer of the option provides income in addition to the security’s dividends or other distributions. XYLD uses an at-the-money call option strategy, and the options are written systematically on the monthly writing option date of the S&P 500. For all of this work, XYLD only charges 0.60% in management fees.

Back on 11/24/21, XYLD had $761.45 million in net assets. In less than 4 months, XYLD’s net assets have grown by $398.55 million (52.34%) to $1.16 billion. Clearly, more and more people keep plowing capital into XYLD as they seek sustainable ways to generate income in a yield-starved environment. XYLD has an 11.97% distribution yield and a 12-month trailing yield of 10.34%. XYLD has never missed a distribution since its inception and continues to be a distribution paying machine.

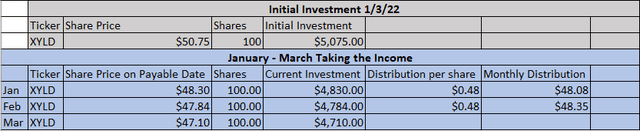

If you had purchased SPY on 1/4/21, shares would have declined from $477.55 to $420.07 for a loss of $57.48 or -12.36%. Shares of XYLD have declined from $50.75 to $47.10 for a loss of $3.65 or -7.19%. XYLD is certainly faring better in a down market and is generating large amounts of income. If you had purchased 100 shares of XYLD on 1/4/21 for $5,075, you would have generated a $48.08 distribution in January and another $48.35 in February. With just 2 months of distributions, your losses would have been offset by 26.42% from the $96.43 you collected in income. Not only is a covered call ETF doing better in a down market than a traditional ETF focused on the underlying index, but it’s generating double-digit yields.

Global X & Steven Fiorillo

Global X & Steven Fiorillo

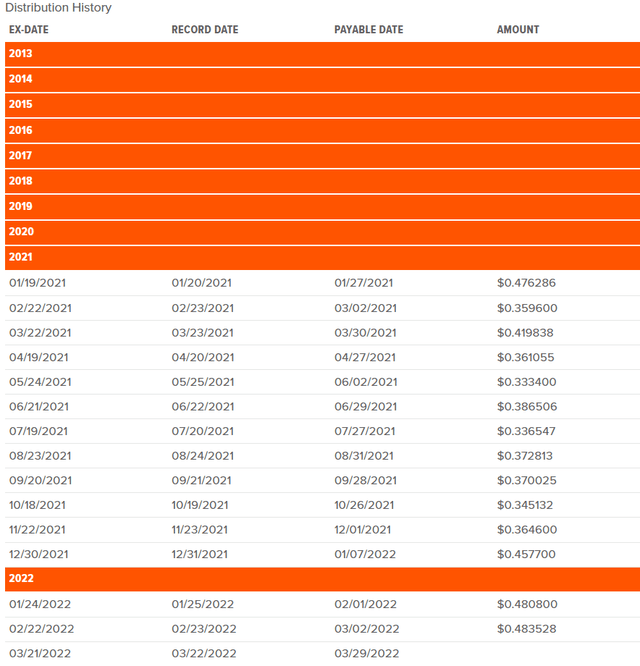

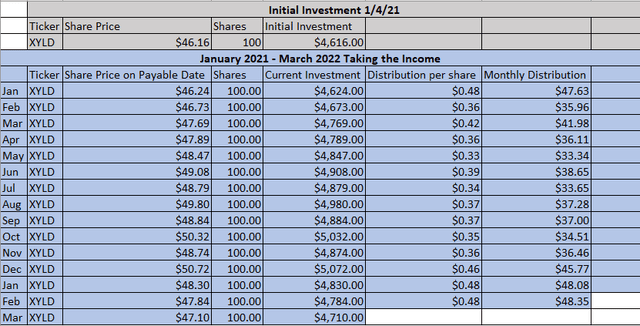

If we extrapolate this out to 1/4/21, you may be surprised with XYLD’s income generation. Hypothetically if you had purchased 100 shares of XYLD on 1/3/21, it would have cost $4,616. Today, you would still be in the black by $94, indicating that XYLD may not be as volatile as some thought. Over the past 14 months, XYLD would have generated $554.78 in distributions, a 12.02% yield on the original investment. In all fairness, SPY shares were $368.79 on 1/4/21, so today, you would have a gain of $51.28 or 13.91%. When you think about how volatile the markets have been and what the environment for yield has looked like, XYLD certainly stands out as an excellent option.

Global X & Steven Fiorillo

Global X & Steven Fiorillo

Suppose you’re wondering how much XYLD you would need to accumulate to offset the loss of income in retirement or have it be a component of an overall retirement portfolio. In that case, it’s all relative to what your nest egg is and how much money you’re looking to generate in retirement. Here are some figures for you. Based on the 1/4/21 prices, if you were to have purchased 5,000 shares, it would have cost you $230,800. Over the past 14 months, XYLD would have generated $27,739.15 in income, which breaks down to $1,981.37 per month. If you had purchased 10,000 shares for $461,600, you would have generated $55,478.30 in income or $3,962.74 per month.

If you were waiting to collect more data on XYLD to see how it held up in the face of adversity, the answer is in the statistics. XYLD has declined less than SPY while generating double-digit yields. It doesn’t matter if the markets are appreciating, declining, or just trading sideways; XYLD continues to generate large amounts of yield without skipping a payment. The beauty is that the distributions aren’t predicated on dividend harvesting, and XYLD generates new income every month by selling covered calls against the S&P 500. If your goals are capital appreciation, then XYLD probably isn’t going to be high on your list of possible investments as the gains are sacrificed for income generation. If your goal is to allocate capital to an investment that will generate a continuous income stream without getting obliterated in hard markets, then XYLD should be at the top of the list.

Global X

Global X

Barbell Capital provides investors with a comprehensive approach that utilizes growth, value, dividends, and options for income, to generate alpha in your portfolio while mitigating downside risk. Within Barbell Capital you will find exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. There is also a live portfolio dedicated to generating capital from trading, selling puts, and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep. Join today with a two week free trial!

This article was written by

I am focused on growth and dividend income. My personal strategy revolves around setting myself up for an easy retirement by creating a portfolio which focuses on compounding dividend income and growth. Dividends are an intricate part of my strategy as I have structured my portfolio to have monthly dividend income which grows through dividend reinvestment and yearly increases. Feel free to reach out to me on Seeking Alpha or https://dividendincomestreams.substack.com/

Disclosure: I/we have a beneficial long position in the shares of XYLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.