Starbucks is a dominating force in the coffee industry. The power of the “Starbucks Experience” cannot be denied, and the ubiquity of their stores has cemented their dominance. However, the company has cannibalized themselves in U.S. markets, and they face headwinds from their attempt to expand into China, especially with the recent Luckin IPO.

I wrote about Starbucks back in August of 2018. At that time, Howard Schultz had just officially exited the company, with plans to run for president, that have since pretty much dissolved due to back surgeries. Scott Maw retired, replaced by Patrick Grismer to positive reception.

I still believe that the company will face growth headwinds in the coming years, especially as they break into the Chinese market and re-adjust their U.S. operations. Also, the overall uncertainty of a trade war could create problems, especially if it intensifies. Dunkin is a better coffee company buy in the current environment.

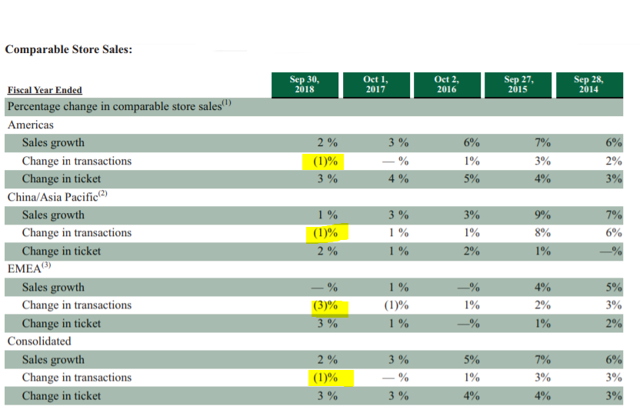

Starbucks relies on growth through opening new stores, rather than comparable store sales growth. Q2 2019 revenues increased 6% due to the opening of 916 new Starbucks, as compared to a 3% increase in comparable store sales. The results were also bolstered by a 3% increase in the average store ticket.

For FY 2018, there was an overall decline in transactions, with a 1% decline in the Americas and CAP, and a 3% decline in EMEA. They also have $208.5M in lease exit costs for the closure of Teavana stores and 150 Starbucks company-operated stores.  Source: SBUX FY 2018 Annual Report

Source: SBUX FY 2018 Annual Report

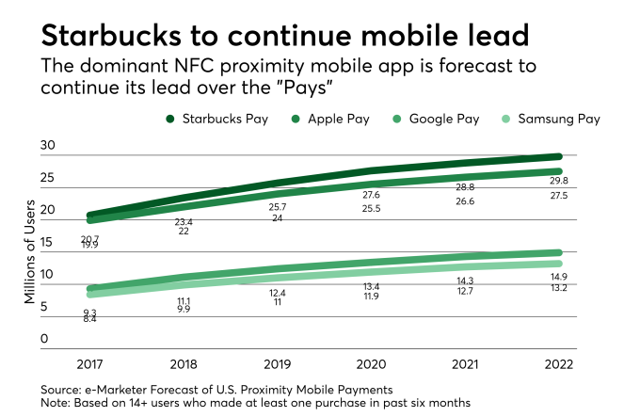

The company has three strategic priorities moving forward, focusing on accelerating growth in China and the U.S., expanding their global reach, and increasing shareholder returns. Starbucks is embracing partnerships and strategic alliances, and have an extremely strong mobile presence with over 16M Starbucks Reward Members as of FY19 Q1. Source: Payments Source

Source: Payments Source

They also have opportunity with Valor Siren Ventures, a private-equity firm that focuses on food technology. This gives Starbucks direct exposure to up-and-coming food start-ups, which could be beneficial moving forward.

Their Global Coffee Alliance partnership with Nestle has enabled them to break into 6 new consumer packaged goods markets, as well as continue to build out their single-serve options. They recently entered into a joint venture with Coffee Concepts in Thailand, which will work to boost their presence in Southeast Asia.

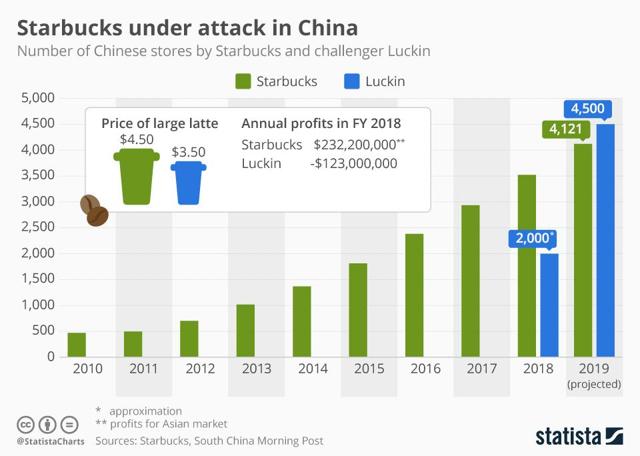

Their China bet has been a growth driver, with 3% comparable sales growth. They’ve opened up more than 550 new stores, at a 17% annual growth rate. The company plans to build out Starbucks Delivers as well as their Starbucks Rewards program there. However, Luckin provides some fierce competition. Source: Statista

Source: Statista

In my previous article, I wrote that “SBUX knows that China is going to be the tipping point. It has to be.” China is still a very important growth factor for the company, and one that they need to pay close attention to moving forward. The market is going to get saturated there, with competition from Luckin and other brands.

I still think that the company is going to have an 1-2 year adjustment period as the explore different options for their U.S. business, such as their CPG arm with Nestle, the growth of their mobile app, and drive-thru options. They also need time to adjust to their China business as well.

The company has strong financials, with top operational, solvency, and liquidity metrics. They do have a current and quick ratio below one, which could be troublesome for some of their short-term obligations. They substantially increased their long term debt into 2018, primarily to finance their $25B share repurchase program.

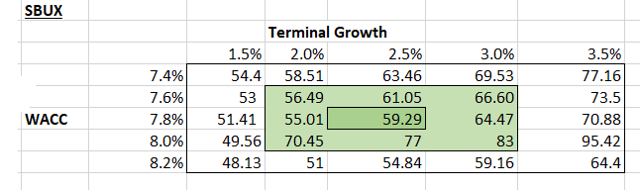

Based on my discounted cash flow valuation, Starbucks is currently overvalued. The stock is trading around ~$83 currently, which leaves it poised for a potential 38.3% drop. This is in line with what other analysts have calculated. Source: Author

Source: Author

Their PE ratio is currently sitting at 36.48x which is pretty high for them. I believe that after their adjustment period, the company will be a better buy, but right now, they are too expensive. Luckily, there are other coffee options to invest in.

Dunkin is an internationally recognized chain of quick service coffee houses and a coffee distributor. They have strong brand recognition, even outside of traditional coffee drinkers. Their revenue grew 3.4% domestically and 13% internationally from 2017 into 2018. The company benefited from the growth of “special distribution opportunities” which are small full-service restaurants and self-service kiosks that exist in frequently visited areas, such as hospitals, colleges, airports, and offices.

However, Dunkin is weighed down by Baskin-Robbins. Baskin-Robbins’ domestic profits declined 3.8% in 2018, and international profits declined 8.4%. Dunkin is also strapped with a significant amount of debt, with $3M in long-term debt and more than $7M in capital lease obligations. They also are franchise operated, so that loss of operational control can weigh heavily on their profits in the long run.

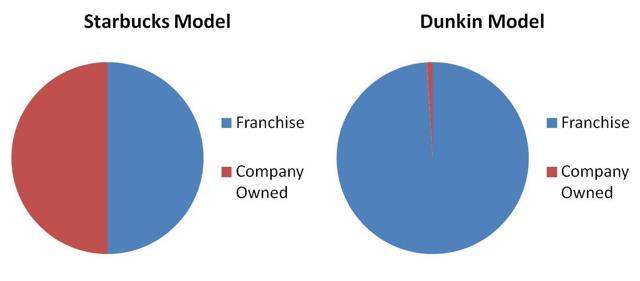

Franchising results in a stronger operating margin, as well as an asset-light business, but it’s much harder to manage the day-to-day of the stores. Starbucks is known for quickly changing store operations, like closing 8,000+ stores for racial bias training last May. Dunkin can make recommendations but stores are up to their own prerogative with most of the decisions. Source: Seeking Alpha

Source: Seeking Alpha

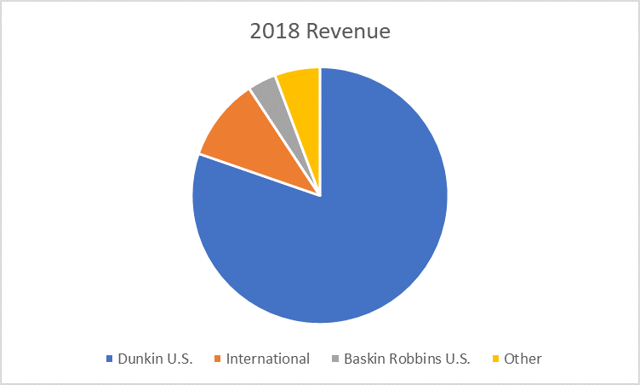

The U.S. is still an extremely large part of their revenue, representing 77% of their inflows for 2018. Baskin Robbins represented 6% of their domestic revenue, with international revenues representing 17% of the company’s total revenue stream. Source: Capital IQ

Source: Capital IQ

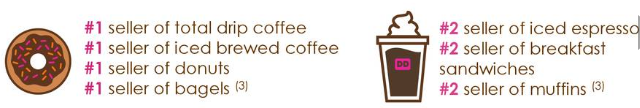

As a a benefit to their domestic concentration, the company was able to post $8.8B in U.S. systemwide sales in 2018, along with several other accolades. In their most recent earnings report, they state that their focus is to be “beverage-led, on-the-go” appealing to the consumer that needs a quick caffeine pick-me-up throughout the day. Source: Q1 2019 Investor Presentation

Source: Q1 2019 Investor Presentation

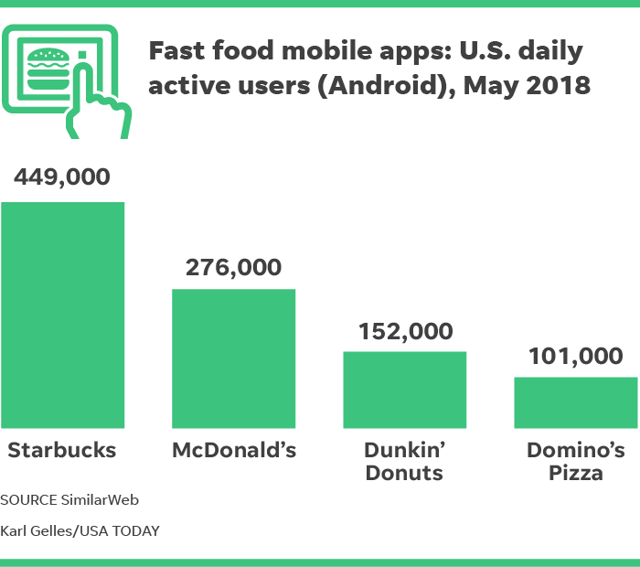

That stems into the idea of convenience, which the company is heavily emphasizing as they move forward. Right now, only 4% of their sales are through their on-the-go mobile ordering app. They are planning to build more into their app, as well as offer different delivery options through groups like Grubhub and DoorDash.  Source: USA Today

Source: USA Today

They are also expanding onto shelves through consumer packaged goods, with several at-home options for consumers to buy from grocers, as well as travel options, through Amtrak and JetBlue. Ready-to-drink coffee represented 17% of their total 2018 CPG retail sales. They are also doing nontraditional partnerships, such as creating a Dunkin beer with Harpoon brands.

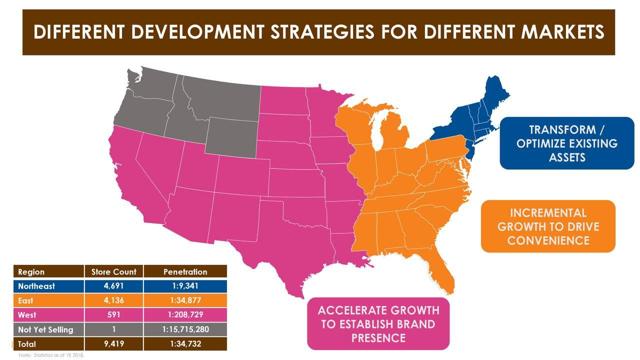

The company still has room to expand domestically, surprisingly. Right now, their penetration is primarily in the Northeast. They have huge opportunity in the Northwest, with one store throughout all of Washington, Oregon, Montana, Idaho, and Wyoming.  Source: Investor Presentation

Source: Investor Presentation

The company primarily uses cash for operational growth and product innovation. For 2018, operating cash flows declined by 5.08%, driven by cash expenditures on Dunkin’ US Blueprint for Growth. The Blueprint for Growth is driven by “menu innovation, restaurant excellence, brand relevance and unparalleled convenience”. 2018 was entirely a foundational year, according to the CEO, David Hoffman, which is why the overall performance was so low. 2019 is expected to see the fruition of these efforts.

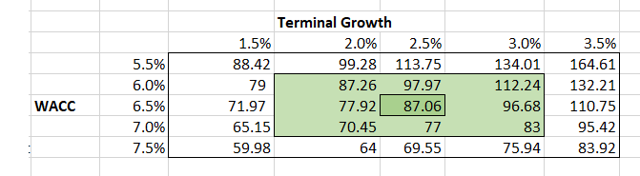

The share price has increased since the beginning of 2019, opening the year at $62.92 and is currently trading at $80. The company carries a dividend yield of 2.01%, which is right in-line with competitor’s Starbucks yield of 2.06%. According to my sensitivity analysis, the stock has some room to the upside, with a target price of $87.06. I calculated an expected weighted average cost of capital of 6.5%, with an expected growth rate of 2.5%.  Source: Author

Source: Author

Right now, SBUX is trading at a premium. They also have to adjust to the Chinese market, and balance the competition that comes from Luckin. They have a lot of available growth opportunities, but I see them trending downwards due to uncertainty and their current expensive share price.

Dunkin is one of Starbucks’ main competitors, and they also have a lot of available growth opportunities. I think that Dunkin has a lot of room to the upside, just based on the options that they still can explore, including mobile payments and the growth of daypart sales. Dunkin would be a good buy at the current share price too, with a potential upside of 8.75%.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.