jetcityimage/iStock Editorial via Getty Images

jetcityimage/iStock Editorial via Getty Images

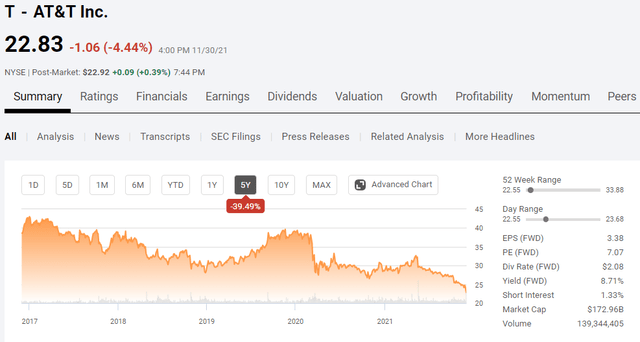

This couldn’t have been what Randall Stephenson envisioned when AT&T (NYSE:T) acquired Time Warner or what John Stankey thought the market’s reaction would be months after announcing the WarnerMedia spinoff. Like many, I am in the red on my investment, and not even the large dividend yield has been enough to keep me in the black. Today shares of T reached their lowest point since the Global Financial Crisis, which occurred more than a decade ago. Over the past five years, shares of T have declined by -39.49%. Five years ago, shares of A&T traded at $38.63 and on 1/3/17 reached $43.02. Throughout the end of 2019 and the beginning of 2020, shares flirted with breaking out past $40s again after reaching a low of around $28.08 on 12/26/18. The question becomes, are shares of T just dead money, a dog with fleas as Gordon Gecko would say, or a valuation paradox?

When someone asks how low can a stock go, the standard answer is zero because companies can go under. Let’s be very clear, T is not going bankrupt even though the chart indicates there is no end in sight with T’s decline. T isn’t an exciting growth company; management has said that T’s revenue growth will be in the low single digits after the spinoff. I never thought shares would breach $25, but at what point is it enough? In the trailing twelve months, T’s revenue now exceeds its market cap while generating over $25 billion in Free Cash Flow (FCF). Obviously, T can go lower, but is it realistic that T touches $20 per share or lower? T’s image is certainly a combination of dead money and a dog with fleas, but I see what may be an extreme valuation paradox if you have time on your side.

(Source: Seeking Alpha)

Embrace becoming the equivalent of a utility company. Unlike in 2011, smartphones and connected devices have become a necessity. This isn’t an exciting business, but it generates large amounts of revenue and cash from operations. Embrace being a low-growth business that prints money because everything T has tried has failed. At this point, T’s most important critical success factor is providing the best service possible. By providing a great network, customers will be retained, new customers will be added, and the cash from operations will slowly increase.

Outside of the business operations, there are only three things that T can do to benefit shareholders. The three main focuses need to be paying down debt, buying back shares, and paying dividends. Embrace being a utility and stop going off on tangents to try to create value for shareholders by acquiring businesses that don’t fit in the portfolio. In the original update on May 17th, management specifically stated that after the spinoff, legacy T will generate $20 billion-plus of FCF and expects to reset its annual dividend to reflect between 40-43% of its new FCF.

This isn’t a hard equation. If T generates $20 billion in FCF and 40% is allocated to the dividend ($8 billion), then there is $12 billion of FCF left over. I would love to see $7 billion a year earmarked for debt reduction, $4 billion allocated to buybacks, and $1 billion put in its war chest from the remaining FCF. T has $154.98 billion in long-term debt on its balance sheet, with an additional $15.68 billion of short-term borrowings under its current liabilities. When the spinoff closes, T will receive $43 billion in a combination of cash, debt securities, and WarnerMedia’s retention of certain debt.

Use the $43 billion to eliminate the $15.68 billion in short-term borrowings and bring the long-term debt on the balance sheet down to $127.66 billion. Then by allocating $7 billion per year from FCF to reducing long-term debt, over the next 8 years, T could bring its long-term debt down to $71.66 billion by 2030. Over this period, T could also utilize $32 billion to buy back shares. As of the last report they had 7.14 billion shares outstanding. T’s share price is going to be reduced when WarnerMedia is spun off, so hypothetically, I am going to use $25 as an average share price. If T were to repurchase $4 billion worth of shares from 2022 through 2029, they would be able to buy back 1.28 billion shares which would work out to 17.92% of the shares outstanding.

This is T’s best move to generate value for shareholders, in my opinion. Income investors may complain because this plan doesn’t earmark any capital for dividend increases but think about it. 40% of T’s FCF would go to the dividend, which is $8 billion, and based on the shares outstanding of 7.14 billion, this would be $1.12 per share in dividend income. Based on today’s share price, that would be a 4.9% yield. As T buys back $4 billion of shares each year, the $8 billion earmarked for the dividend wouldn’t change, so each year, you would get a dividend increase because the dividend allocation of $8 billion would be spread across fewer shares.

Shares of T have dropped so low that its market cap is now $158.74 billion. I am going to compare T’s valuation to Verizon (VZ), Shopify (SHOP), PayPal (PYPL), and Netflix (NFLX). You may be wondering why I am throwing SHOP and PYPL in there and it’s because they are now larger companies that T. T is now a valuation paradox, and in the end, I believe we will see increased volume as others realize T is far from being on life support.

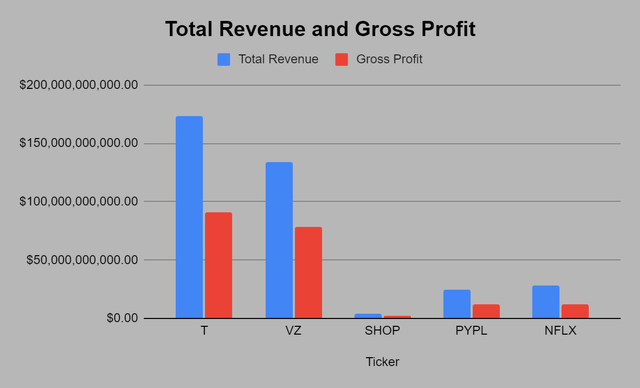

To start out, T generates $173.6 billion in revenue and $90.68 billion in gross profit. T generates the most revenue and gross profit from this group, yet it has the lowest market cap. VZ generated $134.24 billion in revenue and $78.11 billion in gross profit over the TTM, placing them as the 2nd largest company by these metrics. SHOP, which has been a market darling, doesn’t even generate $5 billion in revenue or $2.5 billion in gross profit, yet its larger than T. PYPL and NFLX both generate under $30 billion in revenue and $15 billion in gross profit, and they are also larger than T. Anyone who wants to use the growth argument needs to take a step back and look at the numbers. How much growth do these companies need to generate to produce the amount of revenue and gross profit that T does, and is it even realistic? SHOP’s revenue would need to grow by just over 41x to reach T’s revenue.

(Source: Steven Fiorillo) (Data Source: Seeking Alpha)

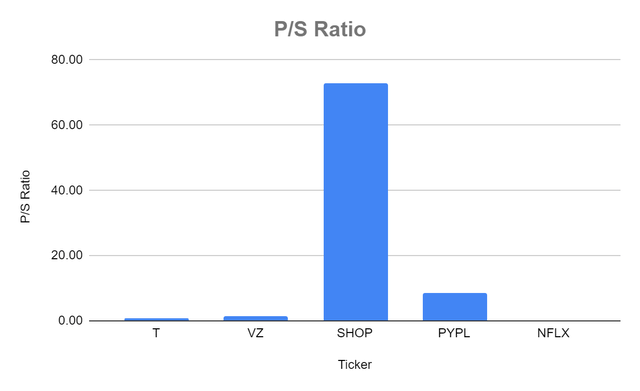

T is selling at less than a 1 to 1 ratio on sales. T generates more revenue annually than what its market cap is worth. Today T has a P/S ratio of 0.92. VZ has a P/S of 1.54 while SHOP’s is 72.99, PYPL is 8.57, and NFLX’s P/S is 9.55. It’s perplexing that the market has crushed T’s value by so much that they now trade at less than a 1 to 1 ratio to its revenue generated. I think it’s ridiculous that SHOP can have a 72.99 P/S while generating less than $5 billion in revenue, and T isn’t even trading at a 1 to 1 ratio.

Price to Sales

Ticker

Market Value Per Share

Revenue Per Share

P/S Ratio

T

$22.23

$24.24

0.92

VZ

$49.77

$32.41

1.54

SHOP

$1,459.71

$20.00

72.99

PYPL

$179.32

$20.93

8.57

NFLX

$617.77

64.66

9.55

(Source: Steven Fiorillo) (Data Source: Seeking Alpha)

Anyone who wants to bash T could certainly say their P/E is crazy high at 185.25. Sure 185.25 is not what you would expect T’s P/E to be, but there is certainly a reason. If you look at Q4 2020, T lost -$13.88 billion. This was explained in the notes for Q4:

We announced on January 27, 2021 that fourth-quarter 2020 net loss attributable to common stock totaled $(13.9) billion, or $(1.95) per diluted share. Fourth-quarter 2020 loss per diluted share includes amounts totaling to $(19.3) billion, or $(2.70) per share, resulting from the following significant items: $(2.02) per share from the impairment of assets, $(0.43) per share for noncash losses for the annual adjustment related to pension and postemployment benefit accounting, $(0.22) per share for the amortization of merger-related intangible assets, and a combined $(0.03) per share for tax-related items, employee separation charges and other items. The results compare with a reported net income attributable to common stock of $2.4 billion, or $0.3 3 per diluted share, in the fourth quarter of 2019. For the full year 2020, net income (loss) attributable to common stock was $(5.4) billion versus $13.9 billion in 2019; earnings (loss) per diluted share were $(0.75) compared with $1.89 for 2019.

Looking at the last 11 quarters, Q4 is the only time we see -$15.55 billion in EBT, EXCL, Unusual Items on its income statement under Earnings from Continuing Operations. If you look at T on just a 9-month period, for the first 3 quarters of 2021, their EPS is $2.07, and they generated $0.82 in Q3. While T has a sky-high P/E due to Q4 and its one-time charges being in the TTM, if we looked at their P/E just using nine months of earnings, it would be 10.74. If I was to speculate and use $0.69 in EPS for Q4 as that is their 3 months average, it would put their TTM P/E ratio at 8.05. T’s P/E ratio will be rightsized in less than three months and could be in the high single digits once their Q4 results are delivered.

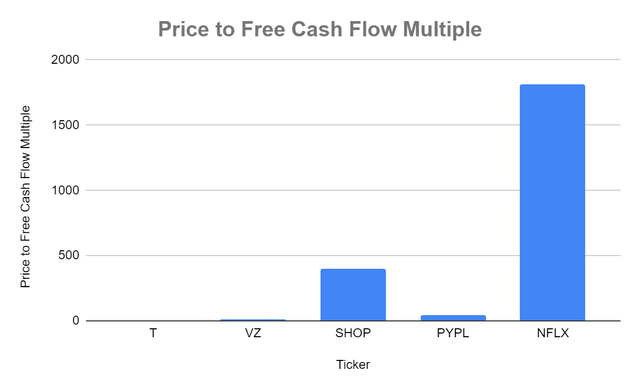

Sometimes P/E isn’t the best way to look at a valuation due to how companies report earnings and charges in one-time fees. This is why I like to look at price to FCF and Price to equity. FCF is one of the most important metrics for valuating a company, and looking at these valuations seems like a huge joke. T has generated $25.7 billion in FCF in the TTM and trades at a 6.18x multiple. VZ trades at a 9.13x multiple on $22.57 billion in FCF, which is at least in the same ballpark. Where things get crazy is with SHOP, PYPL, and NFLX. SHOP generated $458 million in FCF in the TTM and trades at a 400x multiple to FCF. PYPL has generated $5 billion in FCF and trades at a 42x multiple to FCF. NFLX has only generated $151.2 million in FCF in the TTM and trades at a 1,809x multiple. I am not sure why NFLX has only generated $658.2 million in cash from operations in the TTM, so I am going to look at 2020 as well. In 2020 NFLX generated $2.43 billion in cash from operations and had $1.93 billion in FCF. If I use 2020’s FCF, NFLX would trade at 141.84x FCF. The whole idea of operating a business is to generate a profit and generate FCF. T generates FCF in spades and trades at a severely discounted multiple.

Price to Free Cash Flow

Ticker

Market Cap

Total Free Cash Flow

Price to Free Cash Flow Multiple

T

$158,744,382,271.00

$25,697,000,000.00

6.177545327

VZ

$206,055,914,405.00

$22,573,000,000.00

9.128423976

SHOP

$183,303,224,315.00

$458,100,000.00

400.1380142

PYPL

$210,688,276,885.00

$5,003,000,000.00

42.11238794

NFLX

$273,642,527,468.00

$151,200,000.00

1809.805076

(Source: Steven Fiorillo) (Data Source: Seeking Alpha)

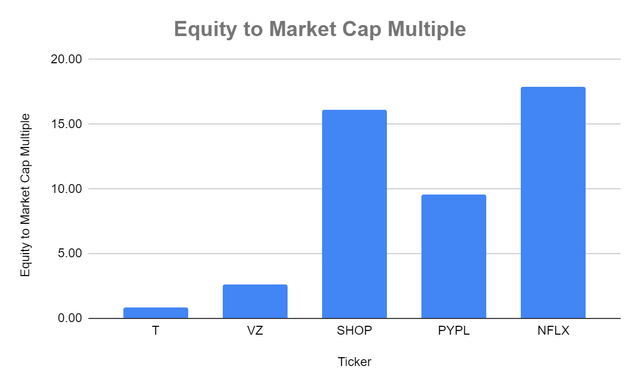

The last valuation metric I am going to look at is equity to market cap. Once again, the market is showing T no respect. T is now trading at a 0.88x multiple, so it’s not even being valued to the equity they have on the books. VZ trades at a 2.63x multiple, while SHOP trades at 16.12x, PYPL at 9.54x, and NFLX at 17.87x. How much more does the market, need to push the share price of T down before people are willing to say shares are too low and start buying? This isn’t a value trap when you’re generating $25 billion in FCF, and after the WarnerMedia spinoff, T will still generate $20 billion in FCF. There is more than enough cash coming in to meet its obligations and pay down debt.

Equity to Market Cap Multiple

Ticker

Total Equity

Market Cap

Equity to Market Cap Multiple

T

$181,303,000,000.00

$158,744,382,271.00

0.88

VZ

$78,489,000,000.00

$206,055,914,405.00

2.63

SHOP

$11,370,300,000.00

$183,303,224,315.00

16.12

PYPL

$22,090,000,000.00

$210,688,276,885.00

9.54

NFLX

$15,314,600,000.00

$273,642,527,468.00

17.87

(Source: Steven Fiorillo) (Data Source: Seeking Alpha)

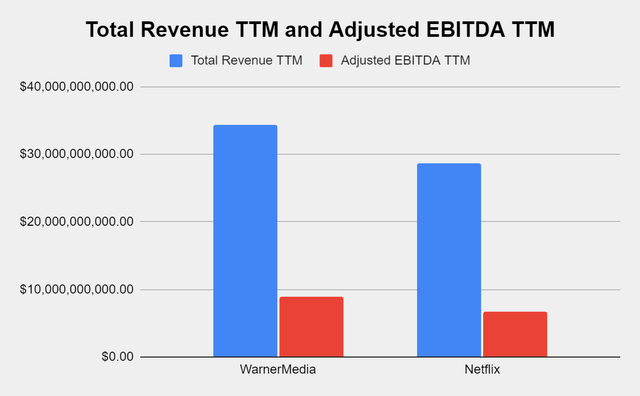

T is spinning off WarnerMedia and combining it with Discovery (DISCA) in 2023. If you want to read the details, you can go to my previous article on T. WarnerMedia current makes up roughly 1/5th of T’s revenue. How is it that on its own without DISCA, WarnerMedia generates more revenue and EBITDA than NFLX, yet NFLX’s market cap is almost double T’s entire company? It doesn’t make sense.

I have been comparing T to NFLX because T has a larger media conglomerate inside its company than NFLX, which is getting spun off. Reading through financial statements is just math, and the numbers aren’t adding up. Regardless of whose content you believe is better, NFLX or WarnerMedia, it’s safe to say they are both media icons. Both outfits are dominant forces in the marketplace, and both entities have desirable content. Which has better content is a matter of opinion, and I am not dealing in opinions. The facts are that WarnerMedia is larger than NFLX by revenue and EBITDA.

The blind hatred for T is astonishing as the market does not even give them a 1 to 1 valuation on its equity or revenue, but WarnerMedia is larger than NFLX, and NFLX has almost double the market cap than T’s entire company. So by this logic, you’re getting a communications business in Legacy T that generated $114 billion in the TTM and is expected to generated $20 billion in FCF on its own for free. I don’t believe shares of T are a value trap, I believe the blind hatred has overpowered logic.

Total Revenue TTM

Adjusted EBITDA TTM

WarnerMedia

$34,313,000,000.00

$8,870,000,000.00

Netflix

$28,633,000,000.00

$6,690,000,000.00

(Source: Steven Fiorillo) (Data Source: Seeking Alpha)

By the time this article is published, I will have purchased more shares of T. The market’s blind hatred for T has caused a valuation paradox, and eventually, I believe the fundamentals and financials will validate what many contributors on Seeking Alpha have been saying. The valuation isn’t justified by the financials, and T could be on its way to being the ultimate value play. Shareholders are going to keep legacy T shares that by today’s price would yield 5% on the dividend while owning 71% of the new entity when WarnerMedia is spun off and combined with DISCA. I really hope management doesn’t screw this up. I have years to wait, so I am not worried. This is crazy to say, but management doesn’t need to do a thing. All they need to do is use T’s FCF to pay down debt, strengthen its balance sheet, and buy back shares to make each shareholder’s equity more valuable. As shares are retired, the $8 billion allocated for the dividend will be more than enough for shareholders to recognize incremental increases as their shares will represent a larger piece of the EPS and revenue generated. If management just sits on their hands and doesn’t get in their own way, T’s FCF is more than enough to turn this story around as the year’s progress.

On Tuesday, December 7th, I will be launching a subscription service called Barbell Capital on the Seeking Alpha Marketplace. The first wave of users will receive a 20% lifetime discount on annual subscriptions, so sign up early if interested. Barbell Capital will provide exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features. There will also be a live portfolio dedicated to generating capital appreciation and passive income from dividend investments.

This article was written by

I am focused on growth and dividend income. My personal strategy revolves around setting myself up for an easy retirement by creating a portfolio which focuses on compounding dividend income and growth. Dividends are an intricate part of my strategy as I have structured my portfolio to have monthly dividend income which grows through dividend reinvestment and yearly increases. Feel free to reach out to me on Seeking Alpha or https://dividendincomestreams.substack.com/

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.