CVS Health (NYSE:NYSE:CVS) has once again caught our attention as a possible rebound play after reporting its earnings Feb 20th. Since then, the stock has been in free fall. Rumors of Medicare for All, and changes to pharmacy/drug reimbursements have fueled the fire. The company has lost 25% of its value in two weeks. It is over done. It is in our opinion disgusting. We are holding our noses and buying. Let us discuss.

Ok, so aside from the “what-ifs” of legislative changes, the company is strong. The earnings report was quite interesting relative to our expectations, for the second time within a year. This name had been stuck in neutral for months, essentially range bound. Remember last year the last opportunities stemmed from until news that it was interested in purchasing Aetna (AET) which sent the stock below $70, and then earnings would send it toward the $60 mark.

The $60 mark has been the level of interest for our firm for some time. We stated plainly in our BAD BEAT Investing service that under $60 was the level we loved. Here we are under $55 now. We feel very compelled to get behind the name here.

We think CVS is a great long-term play, but now also offers a short-term trade opportunity once again. We have said this time and again but CVS has really grown to be more than a pharmacy. From a trading perspective $60 was reliable, buy, ride it up, sell, let it fall, buy…rinse and repeat. With shares breaking under $60 and now $55, they are ripe for a bounce:

Source: BAD BEAT Investing

The decline was big and shares surpassed the 3-day selloff expectation many of us had, but it gave us opportunity to take a shot. We think the action is opportunity. We think short-term, this retakes the $60 line, and climbs toward the mid $60 level again. However, we are recommending this for both a long-term value play and a trade.

Let us now turn to performance to ensure that this multiple compression and narrowing valuation metrics are not being driven by incredible declines in critical performance metrics.

One of the reasons we like the company long-term is that CVS is becoming a one-stop-shop powerhouse health sector play. It now has well over 1,000 walk-in medical clinics offering check-ups, screenings and immunizations, among other services. CVS Health is also a leading pharmacy benefits manager and now has over 70 million members in its pharmacy benefit plan. With the addition of Aetna, which should substantially increase pharmacy volume, CVS looks very compelling once again as it seeks to implement this unprecedented vertical integration of a major insurer.

Source: Earnings presentation

We like the move and believe it is a significant step toward the future of health care, although it may have slightly overpaid. We are awaiting on the deal to be 100% approved by the government, so CVS can get the integration complete. But for all intents and purposes, its complete. Aetna brings a lot to the table.

With the completion of the $70 billion Aetna acquisition, CVS Health will excel in a market that is rapidly transforming. We strongly believe in the long-term value being created here. The new combination will drive above market growth going forward across much of the business lines. Let us turn to performance and discuss our expectations moving forward.

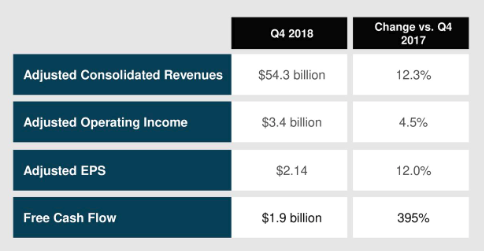

Source: Earnings presentation

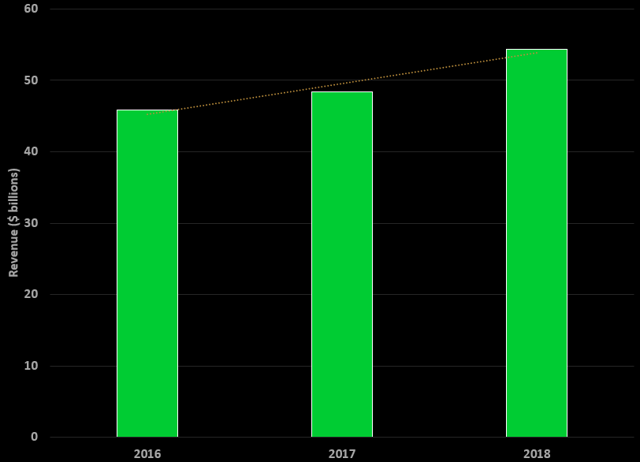

The earnings show an interesting trend in sales over the last few 4th quarters, and reflects Aetna’s contributions. The name is performing rather close to in line with our expectations for overall sales, though the pace of growth was slowing prior to the acquisition:

Source: SEC Filings

Revenues this quarter came in at $54.4 billion, essentially in line (but slightly below) what we were expecting at $48.4 billion. This figure is good enough for 13% growth year-over-year. We predicted 54.5 billion in revenue so this was about in line. There is a growing dichotomy between Pharmacy Services, and retail. Let us discuss these revenues in more context, and understand the contribution of Aetna.

As a result of the acquisition of Aetna in November CVS established a new Health Care Benefits segment, which is the equivalent of the former Aetna Health Care segment. Certain aspects of Aetna’s operations, including products for which the Company no longer solicits or accepts new customers, such as large case pensions and long-term care products, are included in the Company’s Corporate/Other segment. Then there is pharmacy services and the retail side of things. Let’s start with pharmacy services.

Well, we actually saw some strength in same-store sales, which improved to be up 2.2% year-over-year, while pharmacy same-store sales increased 7.4%. While the reimbursement and generics issue weighs on CVS Health and the competition, there are other issues to consider here. Prescription volume was up nicely. However, thanks to an early cold and flu season, and a much harsher winter in the United States this far, on a 30-day basis, pharmacy claims volume was up 5.6%. This is a big strength.

Over on the retail side of things, we were pleased to see growth. Revenues increased 5.4% compared to the prior year. The increase in revenues was primarily driven by increased prescription volume and branded drug price inflation, though there continues to be reimbursement pressure and the negative impacts of recent generic introductions.

Source: CVS website

Front store revenues remain approximately 23% of total retail revenues. Front store revenues increased driven by increases in health product sales. Prescription volume is a strength. Total prescription volume grew 8.6% on a 30-day equivalent basis compared to the prior year. The growth was driven mainly by the continued adoption of patient care programs and collaborations with PBMs as well as preferred status in a number of Medicare Part D networks during 2018.

Where the big question mark for us was happened to be over in the new health care benefits segment. We knew it would be tough to pinpoint revenue here but given the timeline of integration we were ballparking $5.2-$5.6 billion in revenue. Revenues were not directly comparable to the former Aetna Health Care segment given the partial quarter contributions, but revenue seemed decent at $5.54 billion.

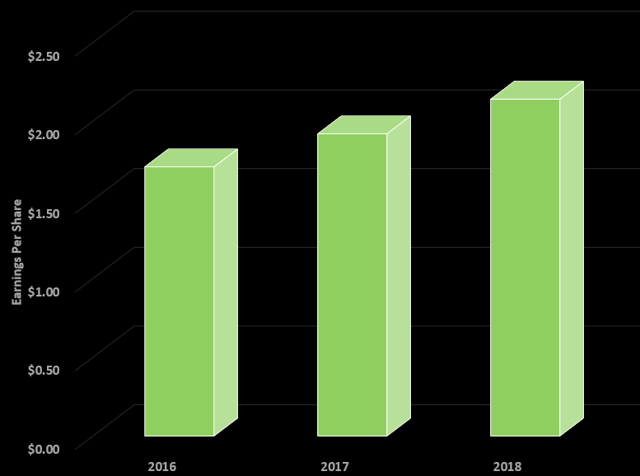

Taking into account the slight rise in sales to $54.5 billion, and the pressures associated with Medicare Part D timings and more generics, as well as cost savings initiatives, the integration, and other associated costs, operating profit rose 4.5% in the quarter to $3.35 billion. Factoring in all expenses, net income fell to a loss of $421 million. This translates to a loss of $0.37 in earnings per share, down from the $3.22 brought in last year. Factoring in adjustments to the GAAP net income, adjusted earnings were $2.14, up 8% year-over-year from the $1.92 in earnings last year:

Source: SEC Filings

The improvement in earnings is certainly welcome. These earnings beat our expectations by $0.04, mostly due to of course due to a lower tax rate, as well as the operating profit increase stemming from expense reductions that were better than we anticipated. Of course, with the acquisition and integration expenses GAAP was ugly, but expect this to improve as we move forward. With Aetna under the company’s belt, mostly, we turn to 2019.

Taking everything into consideration, there is continued fear in retail sales, and the reimbursement issue will continue to weigh on the pharmacy, but the new health care segment creates so much opportunity.

We are looking at the stock conservatively, but guess what? With our conservative expectations, the stock is trading at less than ten times forward earnings. That is very attractive, even if there are some growth concerns in the short-term.

Based on what we saw for the Q4 2018 impact of Aetna, and the trends in the front-end retail and pharmacy side of things, our expectations are for $4.95 to $5.10 for the year 2019 in GAAP earnings. That may look weak, but considers expenses. When we factoring in adjustments we anticipate will be made, we see adjusted earnings per share possibly hitting $7.00, with our range being $6.60 to $7.00. We arrive at this figure based on expectations for revenues growing to $246.5 to $258.0 billion with the projected impact of Aetna, with continued expense management, comparable tax rates, and taking into account management’s outlook for business lines.

Factoring in dividends and share repurchases, the company has returned significant value to shareholders in the last few years. As we consider where the earnings trend is heading to close the year, we have our expectations for 2018 laid out. Mind you, this excludes any possible mergers with Aetna.

At $55 a share, we are 8 times forward earnings. Levels unheard of. The stock is trading at 2013 levels again, despite immense growth of the business and reshaping the business to be a total health care shop.

We like the stock under $60, and love it under $55. If you can get shares here this is one hell of a bargain. We think a nice trade is setting up here, and factoring in a 3%+ dividend, shareholder friendly repurchases, and a growing health services business, we think you can step in here and do some buying. Ignore the noise of the ‘what-ifs.’ Unless earnings are decimated, the valuation is attractive.

This type of article is what we discuss at BAD BEAT.

This week we are offering an additional 20% off our 46% annual discount! Get our highest conviction rapid-return trade ideas for $1 a day.

What We Do:

Find beaten-down stocks and profit from their reversals.

Give you our best ideas to make money.

2-3 trades a week, market commentary

Guided entry and exits.

Open discussions of ideas with other day-traders and DEEP value investors.

Invest in your future today.

This article was written by

We have turned thousands of losing investors into WINNERS. We are the team behind the top performing trading service BAD BEAT Investing. Quad 7 Capital was founded in 2017 by a team that consists of a long time investor, health researcher, financial author, professor, professional cardplayer, and a politician.

The BAD BEAT Investing service launched in 2018 and is a top performing Marketplace service relative to market returns. It is focused on extreme value, and leveraging mispriced stocks and momentum driven events for rapid return swing trades, options education, and long-term investments. Further, it offers a direct access line to our traders all day during market hours.

Quad 7 Capital as a whole has expertise in business, policy, economics, mathematics, game theory and the sciences. The company has experience with government, academia, and private industry. We offer market opinion and analysis, and we cover a wide range of sectors and companies, with particular emphasis on news related items and analyses on growth companies, cryptocurrencies, REITS, biotechnology/ pharmaceuticals, precious metals, blue chips and small-cap companies.

If you want to win, follow us, and if you want to make money, sign up to BAD BEAT investing today.

Disclosure: I am/we are long CVS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.