A couple of days ago I read an article that suggested that investors should move to cash for the next seven years, as equity market valuations are purportedly too high. I agree that valuations are indeed quite stretched in some pockets of the market, but not everything is expensive. Moving one’s wealth to cash, which basically generates no returns at all in today’s environment, is a move that many would regret, I believe. In this article, I’ll try to show some alternatives. Source: imgflip.com

Source: imgflip.com

KCI Research wrote an article a couple of days ago that suggested to “move to cash for the next seven years”. The main thesis for moving to cash is that US equity markets are historically expensive. The same holds true for US bond markets. This, in turn, means that forward expected returns are weak, potentially weaker than they were before the Great Recession. I think that this is, in general, a good point, but I don’t think the conclusion should be to move to cash for many years.

It is true that equity markets, overall, are expensive right now. That is, I think, even more the case for bond markets:

The S&P 500 forward earnings yield is ~4%, which corresponds to a ~25 times earnings multiple. Ten years ago, the S&P 500 earnings yield was ~6% (which equates to an earnings multiple of ~17), so the index has gotten around 50% more expensive.

US 10-year bonds, meanwhile, have seen their yield sink from around 3.5% a decade ago to about 1.1% right now. 10 years ago, one would have had to pay around $30 to get $1 a year in income, while today, one has to pay around $90 to get the same income. In other words, bonds have gotten ~3 times more expensive when one looks at the income yield. This makes me believe that bond markets are overvalued relative to equity markets.

Factoring in that equity markets have a tendency of delivering higher total returns in the long run, while also accounting for the S&P 500 dividend yield of 1.5%, which is more than the yield on Treasuries, I think that equities are a better investment compared to bonds at current prices.

When we also look at the fact that inflation expectations are a little above 2% going forward, bonds surely seem like a bad, long-term investment at current levels, as net losses on an inflation-adjusted basis are basically guaranteed. I thus fully agree with KCI Research that bonds are too expensive and that investing in them at current levels is not a good move for most investors.

On the other hand, I am not sure that equity markets will necessarily deliver negative returns over the next seven years. Paying ~25 times earnings for the S&P 500 index surely is not great, but I don’t think that this is extraordinarily expensive, either. When we account for the fact that interest rates are at ~1%, getting a 4% earnings yield is not too bad.

Looking at the earnings yield of the broad market and the Treasury yield gets us to the following picture:

We see that, relative to bonds, equity markets are actually rather inexpensive. In the 90s and the 2000s, the yield spread of equities over Treasuries was way lower than it is right now. This does not mean that equities are a great buy today, but I think that equities are less overvalued than bonds for sure. I thus wouldn’t put the two in the same pocket. After all, paying 25 times earnings for equities when interest rates are at 1% is a completely different thing than paying 25 times earnings for equities while interest rates are at 3%, 5%, or even 10%, where they were at different times in the past.

I also do not agree that moving to cash entirely, for seven years, is a good idea. With inflation expectations at 2%+, it is basically guaranteed that investors who do this will lose a meaningful amount of wealth in real terms. Factoring in the massive, unprecedented stimulus and money-printing during the current crisis, it also seems possible that inflation will actually be higher than the current consensus estimate of 2.1% going forward.

Looking at the prices of many commodities, inflationary pressures seem to be significant. Copper, gold, natural gas, lumber, and so on are way more expensive right now than they were one year ago before the pandemic emerged. It seems, to me, very much possible that these commodity price increases will result in inflation rates rising above 2% a couple of years from now. It thus is possible that going to cash for seven years will result in 15%, 20%, or even higher losses in real terms. I thus do not see moving to cash as a viable, long-term strategy.

There are a couple of other strategies investors can utilize, however, as investing in bonds, the S&P 500, and going to cash are not the only possibilities. Let’s look at a couple of things that may be of value.

1. Real Estate

In times of ultra-low interest rates, owning real estate could be a viable approach. That is true when one uses that property oneself, but also when one rents the property out. In many markets, rent returns will be higher than the interest one pays, and real estate owners will (likely) get some price appreciation on top of that. For those that do not want to invest in a property directly, real estate investment trusts (VNQ) can be a good alternative, I think.

Many REITs are attractively priced. This includes resilient retail REITs such as W.P. Carey (WPC) and Realty Income (O), but also some housing REITs such as Equity Residential (EQR) or medical REITs such as Medical Properties Trust (MPW).

These REITs trade with yields of 4%-6% and are not expensive based on a price to book or NAV basis. I think it is not likely that one will lose 15% of one’s wealth over the next seven years when investing in a basket of REITs like these.

2. International Stocks

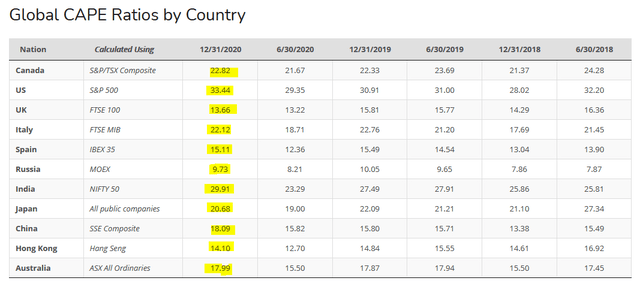

Stocks in other countries can be significantly less expensive than US stocks. Looking at CAPE ratios, we see the following valuations for some international markets: Source: siblisresearch.com

Source: siblisresearch.com

Sure, some of these countries may have governance or macro issues, but nevertheless, it can make sense to take a look at non-US markets. Canadian equities, at a 30% discount versus US equities, or UK equities, at a 50%+ discount spring out. The MSCI World Index (URTH), for example, offers exposure to a very diversified selection of international stock. The index has generated highly attractive returns in the past, and I believe it is unlikely that it will only move downwards over the coming seven years.

3. Inexpensive Stocks

The third suggestion, and maybe the most important one, is to look for inexpensive US stocks. Sure, pockets of the market are looking expensive or even bubble-like, such as Tesla (TSLA), trading at 20+ times sales estimates. I would also count Apple (AAPL) among the overvalued mega-caps, as it trades at more than twice the historic valuation:

Other expensive stocks include much of the rest of the EV industry, some renewable energy stocks, stocks with crypto exposure, some “trendy” consumer stocks, and some software names:

Paying 600 times net earnings for vegan burgers, or 400 times net earnings for high-quality training equipment does not sound like a great value proposition to me. Even NIKE (NKE), at close to 50 times net profits, seems like a quite expensive stock, considering that the same company could be bought for 20 times profits a couple of years ago. Non-profitable companies that nevertheless trade at high market capitalizations, such as Snowflake (SNOW) or Nikola (NKLA) also belong to the stocks I personally would avoid.

But that’s not everything in the market. In fact, there are also bargains to be bought, e.g. in biotech:

AbbVie (ABBV), Bristol-Myers Squibb (BMY), Merck (MRK), and Pfizer (PFE) are trading for 9-13 times net profits and offer sizeable dividend yields on top of that. Even a stock such as Johnson & Johnson (JNJ), at 18 times profits, is not outrageously expensive when we consider that it’s holding a better credit rating than the US. I believe that it is unlikely that a basket of stocks like these will not deliver positive returns over the next seven years, especially when dividends are included.

There are other inexpensive industries on top of that. One industry we like at Cash Flow Kingdom is (natural gas) midstream:

Enterprise Products (EPD), Williams (WMB), and Archrock (AROC) are offering yields of 6%-8%, and their payouts are well-covered. These companies are recession-resilient, and their infrastructure will remain in place for decades, as the world is moving away from coal and replacing it with natural gas.

There are also stocks from the financial industry, consumer goods industry, etc. that do not seem overvalued:

With a high-performing growth stock such as BlackRock (BLK) trading at 18 times 2022’s net profits, or a resilient consumer goods stock such as Becton Dickinson (BDX) trading at 19 times net profits, I think the risk of losing money in the long term is not overly high. This also holds true for lower-growth value picks such as Goldman Sachs (GS) and Prudential (PRU), trading for less than 10 times net profits respectively. Even a railroad such as Union Pacific (UNP), at 19 times net profits, can be a very solid investment:

If you bought the stock at 19 times net profits seven years ago, you would have doubled your money in the meantime. The same may not happen over the next seven years, but I would be surprised if the total return, including dividends, would not be positive seven years from now.

Even some large-cap stocks that may look expensive when only looking at the earnings multiple could be solid investments over a long period of time:

Paying 25 times to 27 times net profits for a wide-moat giant such as Facebook (FB) or Alibaba (BABA) that grow their EPS at a ~20% clip will likely not result in an extremely bad outcome. I personally assume that their share prices will be higher seven years from now, although they may not necessarily belong to the best investments that can be made right now. Still, I think going into a basket of stocks like these will beat going to cash.

4. Stocks That Benefit From Inflationary Pressures

As suggested earlier, inflationary pressures could rise going forward, due to the massive money-printing seen all around the world. With commodity prices jumping upwards, some stocks with commodity-price exposure could benefit quite meaningfully. A couple of months ago Cash Flow Kingdom decided to play this via BHP Group (BHP), but even though shares have risen by more than 40% since then, there could be more upside over the next year – and especially over the next seven years:

Mining stocks such as BHP, Rio Tinto (RIO), and Vale (VALE), as well as some other commodity-exposed stocks, are still trading at quite inexpensive valuations while also offering above-average dividend yields. It could make sense to look in this space for someone looking for investment ideas with some built-in inflation protection.

Yes, bond markets are very expensive, and I don’t think it is a good idea to have a lot of bond exposure right now. Equity markets, on average, are also on the expensive side, but avoiding equities altogether doesn’t seem like the best idea to us.

Instead, one can avoid overvalued pockets of the market and find reasonably-valued, or even undervalued, stocks both in the US and internationally. There is, we believe, no good reason to move to cash completely (owning a cash portion that can pay for near-term expenditures is a good idea). Overall, when it comes to a long-term portfolio, we believe that “cash is trash“. There are ways to invest money today that will likely result in positive returns, whereas going to cash for a long period of time will result in a basically-guaranteed loss in real terms.

If you found this article interesting or helpful, it would be greatly appreciated if you “Follow” me by clicking the button at the top, or if you “Like this article” below, as this will help me in building an audience and continuing to write on SA. If you want to share your opinion or perspective, you are also very welcome to comment below. Happy investing!

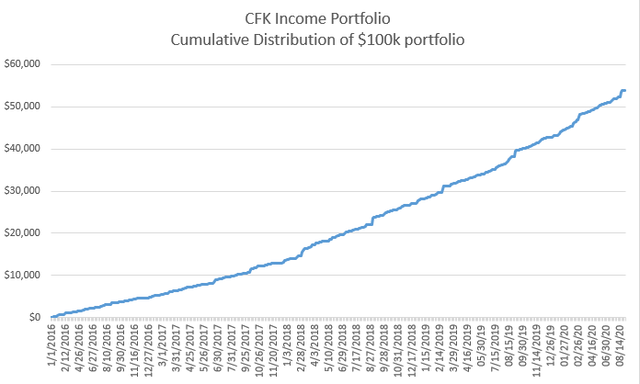

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, the income stream not so much. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Kingdown.

Disclosure: I am/we are long ABBV, JNJ, BMY, O, WPC, MPW, BBL, BABA, FB, EPD, AROC, MRK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.