In a recent update on our US stock portfolio, I detailed how slight outperformance of the benchmark was achieved by letting the winners run.

Please have a read of Buying Dividend Stocks Without Looking; 5 Years Later.

And here’s the background on those holdings.

I like to write that I bought ’em without looking. Now, I did not look, but the index certainly did. I did no further evaluation. I trusted the index criteria, and the larger-cap bias.

The 15 companies that I bought are 3M (NYSE:MMM), Pepsi (NASDAQ:PEP), CVS Health Corporation (NYSE:CVS), Walmart (NYSE:WMT), Johnson & Johnson (NYSE:JNJ), Qualcomm (NASDAQ:QCOM), United Technologies (NYSE:UTX), Lowe’s (NYSE:LOW), Walgreens Boots Alliance (NASDAQ:WBA), Medtronic (NYSE:MDT), Nike (NYSE:NKE), Abbott Labs (NYSE:ABT), Colgate-Palmolive (NYSE:CL), Texas Instruments (NASDAQ:TXN) and Microsoft (NASDAQ:MSFT).

I have bought and held and added. In fact, I’ve mostly added to companies that were out of favor. I’ve also done the same with my Canadian stocks.

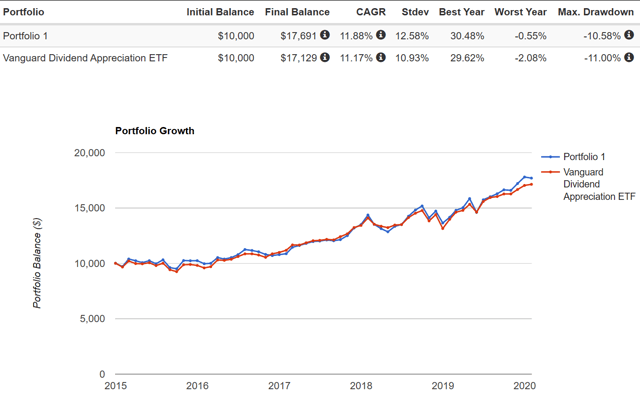

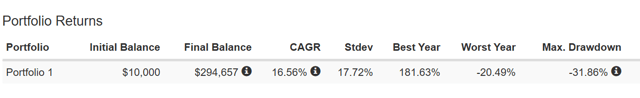

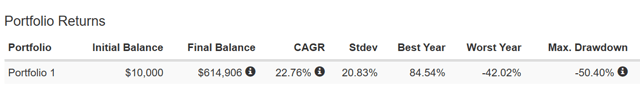

Here’s the chart of the 15 holdings as Portfolio 1 vs. the total index.

If I rebalance the portfolio annually, it’s a draw. That perhaps should not be surprising as we are in a mostly roaring bull market, well save for a couple of bumps. And that includes the recent coronavirus tragedy and scare.

That said, my recent article shows that the past global viral outbreaks and scares have had little effect on the stock markets.

In a roaring bull market, the winners keep on winning. Momentum rules. For value investing to work, we need a rotation away from momentum. We see the market makers give their head a shake and look for more current earnings yield. In a reversal or correction of market fortunes, they will start to weigh the stocks again instead of simply going along for the stock market ride. They will also place a premium on quality.

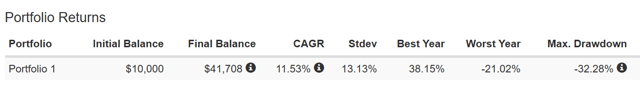

We’ll take those same 15 companies back to 2007 and let them run through the various market corrections. The period is January of 2007 through to end of 2019.

And now we will rebalance on an annual schedule.

We created some additional total return by rebalancing. The market saw more value in the underperforming stocks during periods of market volatility.

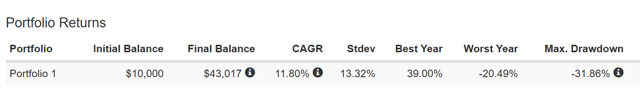

And if we go back to 1998. Letting the winners run.

Rebalancing on an annual schedule.

We now see a drastic level of outperformance. We also see a much lesser drawdown and level of volatility.

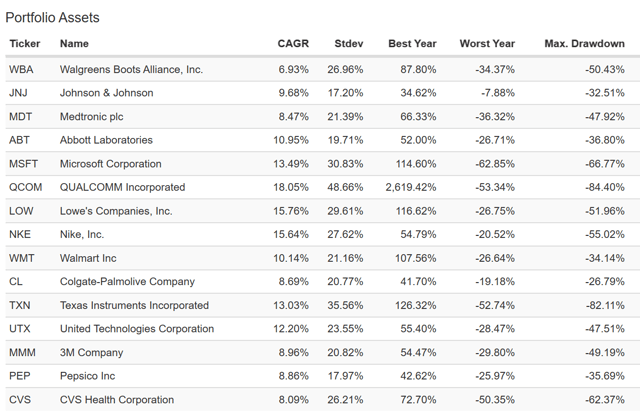

Here are the returns of each individual stock from 1998. Very few of these companies would be a Dividend Achiever in 1998. If you would have been able to pick this basket of stocks in 1998, well, we need to talk.

With that survivorship bias, it’s no surprise that all of the companies did very well. In fact, each and every one of ’em beat the S&P 500.

But each stock offered a great opportunity to rebalance. There was significant enough drawdown in each. Almost all of ’em went through their troubles.

A good example of that transfer of store of value to future growth is Texas Instruments. It was beat up terribly heading into and through the financial crisis. It then went on to be the second best performer in the portfolio in the 10 year plus bull market run.

The value was stored in the Walmart’s and JNJ’s in the correction and then unleashed into the Texas Instruments’.

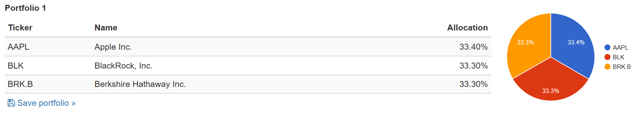

And now we’ll do an interesting look at my 3 stock picks. It’s an interesting combination of growth and value. And they’ve all been in and out of favor for different reasons, in different time periods. One you’ll recognize is a classic value stock. Almost like a value fund.

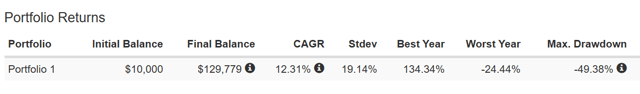

Here they are without rebalancing. We run the portfolio from January of 2000 to January of 2020.

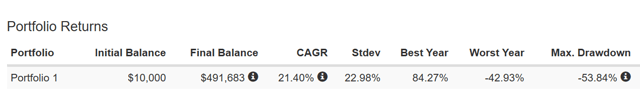

And now we’ll rebalance and I honestly have no idea how this will turn out. But I will guess that value will be created, but perhaps only in certain periods.

The outperformance for the total period is quite incredible. It created a portfolio value that is 25% greater. Once again, we see less volatility and a lesser drawdown.

That said, and my guess was correct, the value hunting worked through the first correction of early 2000s, not the financial crisis. Apple (AAPL) has simply been too strong a performer in the last decade. But again, that result may change in favor of rebalancing if we move through another correction. If Apple profits of today were moved to a Berkshire (BRK.A)(BRK.B) that is sitting on over $130 billion in cash in the hands of the world’s greatest investor, value may rule again.

We’ll get back to you on that in 2030. Perhaps we will have had another major market correction ‘by then’.

If you have a somewhat consistent group of holdings over the last market corrections or two, give them a run on portfoliovisualizer.com with and without rebalancing.

Let us know here in this post. Or send me a direct message. I do not have to publish your name or portfolio holdings.

It would be wonderful to create a scorecard of real life portfolios and the value of value hunting by way of rebalancing.

Perhaps we’ll find out that Mr. buyandhold2012 left a little on the table by not selling stocks?

Author’s note: Thanks for reading. Please always know and invest within your risk tolerance level. Always know all tax implications and consequences. If you liked this article, please hit that “Like” button. Hit “Follow” to receive notices of future articles.

Dale

This article was written by

Disclosure: I am/we are long BNS, TD, RY, AAPL, BCE, TU, ENB, TRP, CVS, WBA, MSFT, MMM, CL, JNJ, QCOM, MDT, BRK.B, WMT, TXN, PEP, LOW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Dale has been writing on Seeking Alpha since 2012. A former investment advisor, Dale is now the Chief Disruptor at the investment blog Cut The Crap Investing.