Elen11/iStock via Getty Images

Elen11/iStock via Getty Images

The cooler-than-expected October CPI report sent markets soaring this past week and has driven expectations for an end-of-year rally into overdrive. However, an end-of-year rally is not a done deal, and some liquidity conditions may prevent that from happening and potentially send the S&P 500 (SP500, SPX) to new lows.

The US Treasury noted on October 31 that it plans to issue $550 billion worth of debt by the year’s end, pushing its end-of-year cash balance up to $700 billion. Should that happen, it will work to drain bank reserve balances at the Fed lower and potentially below $3 trillion.

As of November 9, the Treasury General Account held at the Fed stood at $527 billion. It means the TGA needs to climb by around $173 billion between now and the end of the year. That increase in the TGA will work to drain reserve balances and negatively impact the equity market and the S&P 500.

Bloomberg

Bloomberg

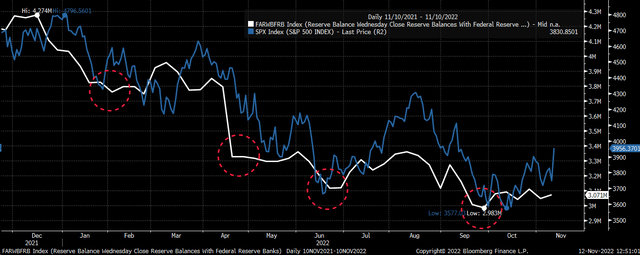

As noted previously, a rising TGA coupled with reverse repurchase agreements (repos) works to drain reserve balances. Falling reserve balances have worked to drain liquidity from markets and, as a result, push equity valuations lower. As of November, reserve balance stood at $3.07 trillion, the very low end of its range over the past year.

Bloomberg

Bloomberg

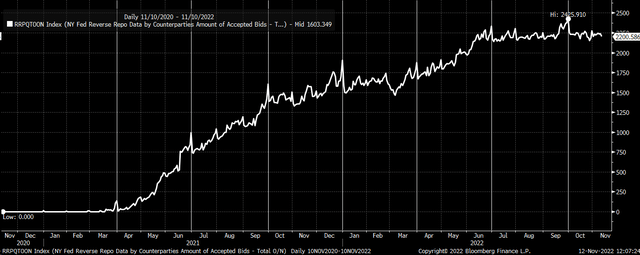

Should the TGA account increase by $173 billion, it would send total reserve balances to $2.898 trillion by the end of the year and a new low. However, reserves could fall even lower than that. December not only represents quarter-end but year-end. Typically, reverse repo activity picks up in the second half of every month as Government Sponsored Entities funnel money into reverse repos. It increases to even more significant amounts into quarter-end. December of 2021 saw reverse repos easily surpass their prior highs. Rising reverse repos also act to drain reserve balances.

BLOOMBERG

BLOOMBERG

At the end of September, reverse repo activity peaked at $2.425 trillion. That is $225 billion more than the $2.2 trillion seen on November 10. Suppose repo activity returns to September high heading into the end of the year. In that case, another $225 billion would come off the total reserve, sending reserve balances to $2.67 trillion by the end of December.

More importantly, even if reverse repo activity doesn’t increase but remains the same, it still suggests a new low for reserve balances. Over the past year, when reserve balances have made new lows, stocks have made new lows within several trading sessions, such as in February, April, June, and late September.

BLOOMBERG

BLOOMBERG

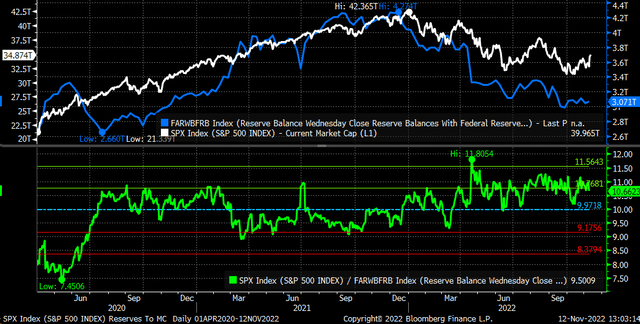

It is possible to estimate the potential market impact should reserve balances drop because the S&P 500 market cap has typically traded around ten times the size of reserve balances. Currently, the S&P 500 is trading around 10.66 times the size of reserve balances. Assuming the multiple stays the same, a decline in reserves to $2.898 trillion would value the S&P 500 around $30.9 trillion. A drop in reserves to $2.67 trillion would lower the market cap to around $28.46 trillion. That would equal a decline of approximately 11.3% to 18.4% from its current $34.8 trillion market cap. That would value the S&P 500 around 3,275 to 3,540.

BLOOMBERG

BLOOMBERG

While tracking reverse repo activity is easy because those numbers are published daily by the NY Fed. Tracking the TGA is more challenging because it is only updated on Thursday afternoon, when the Fed releases its updated balance sheet figures.

So not only may it be more challenging than it seems for the market to rally into the year-end, it may come as a surprise to many if the S&P 500 makes a new low.

(*The Free Trial offer is not available in the App store)

See why Reading The Markets has been one of the fastest-growing Seeking Alpha marketplace services in 2022.

Reading the Markets helps readers cut through all the noise by delivering stock ideas and market updates.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.