sasirin pamai/iStock via Getty Images

sasirin pamai/iStock via Getty Images

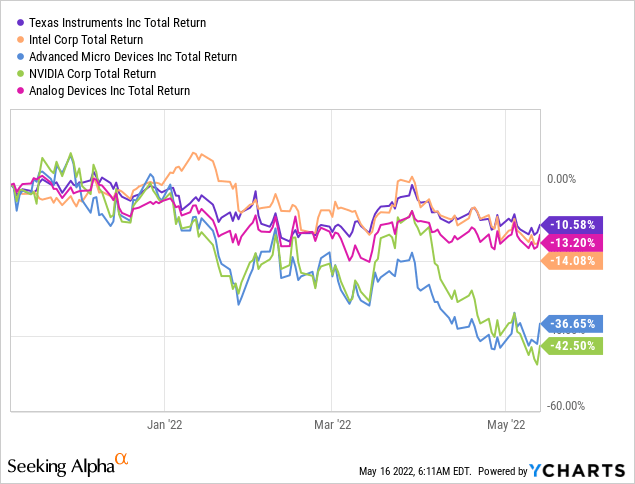

About half a year ago I argued that Texas Instruments (NASDAQ:TXN) is one of the highest quality long-term oriented companies in the semiconductors space. I showed why a long-term strategy could be a significant competitive advantage in a highly cyclical industry where meeting or beating quarterly sales numbers has become the only game in town.

Six months later, Texas Instruments has become the best performing company within its peer group at a time when some of the high-flyers in the space lost more than 40% of their value.

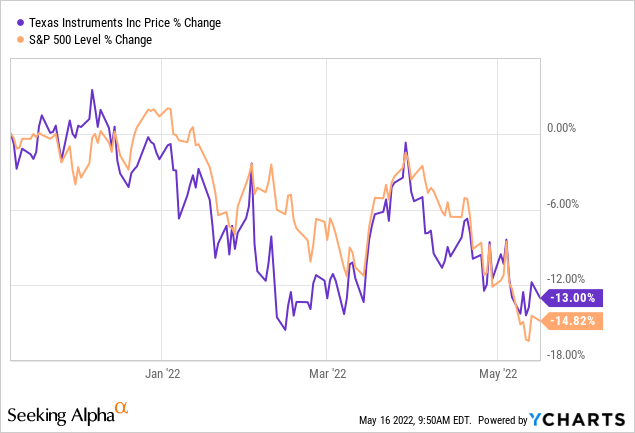

What is also worth mentioning is that TXN’s decline has been in line with the overall market, given the company’s beta of close to one.

As trivial as this might sound, the decline we saw above of the high-flyers – Advanced Micro Devices (AMD) and Nvidia (NVDA) has been far worse than what their historical betas would suggest.

This dynamic clearly illustrates the risks associated with unsustainable valuations and why steady value accumulation is often the preferred approach for long-term investors.

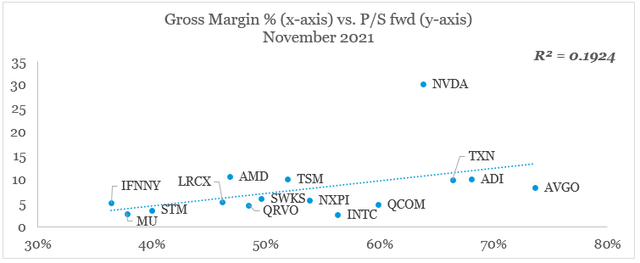

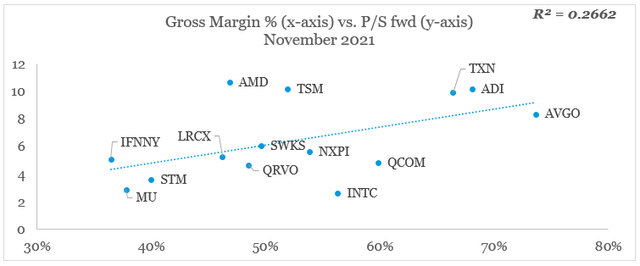

Back in November, I explained why forward revenue growth has become one of the key valuation drivers on a cross-sectional basis within the semiconductors industry. Also in November, gross margin was doing a poor job at explaining differences in valuations (see graph below).

prepared by the author, using data from Seeking Alpha

prepared by the author, using data from Seeking Alpha

Even if we exclude the outlier – NVDA, the R-Squared between gross margins and forward Price-to-Sales multiples was around 0.27.

prepared by the author, using data from Seeking Alpha

prepared by the author, using data from Seeking Alpha

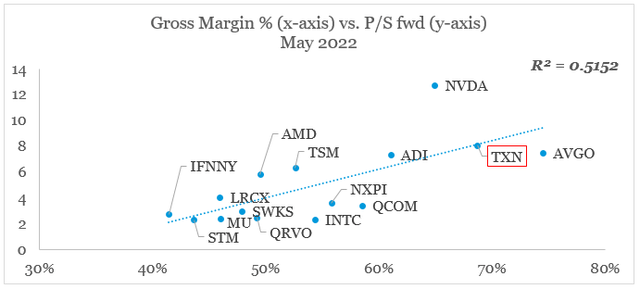

Following the recent rout in high growth and momentum names, however, has made profitability a far more important metric within the sector.

prepared by the author, using data from Seeking Alpha

prepared by the author, using data from Seeking Alpha

In that regard, Texas Instruments, alongside Nvidia and Broadcom (AVGO) are among the highest quality businesses within the extended peer set of 15 large enterprises.

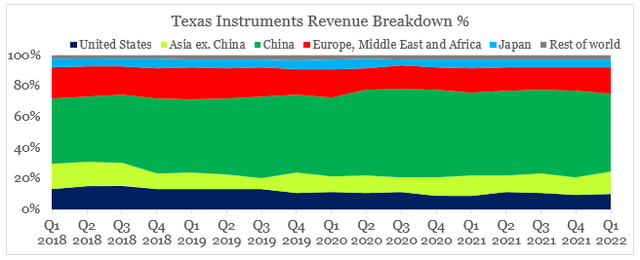

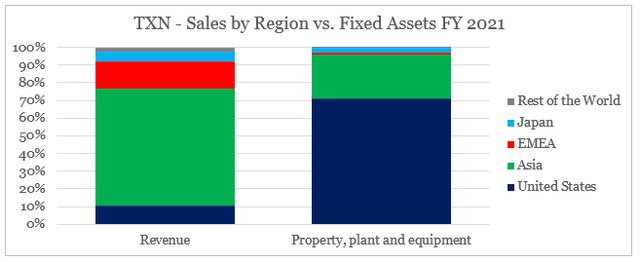

Having said all that, we should not forget one of the largest idiosyncratic risks for Texas Instruments – its large exposure to one market – China.

During the past few months, lockdowns in the country created significant uncertainty around TXN’s short-term performance as the country accounts for more than 50% of sales.

prepared by the author, using data from SEC Filings

prepared by the author, using data from SEC Filings

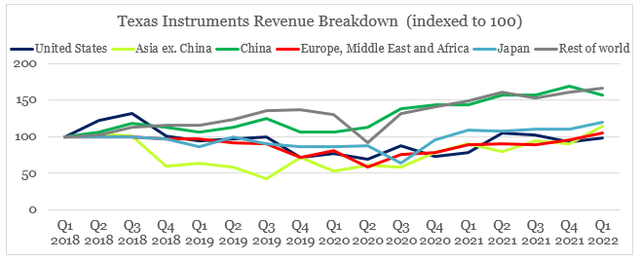

As a matter of fact, China has also been the main driver of sales growth for Texas Instruments since the United States, Japan, Asia excl. China and Europe, Middle East and Africa all grew at a significantly lower rate during the past few years.

prepared by the author, using data from SEC Filings

prepared by the author, using data from SEC Filings

While this might sound scary for anyone worried about the impact on lockdowns or any political tensions between China and the U.S., we should not forget that almost all of the installed base of TXN is located in the United States (see below).

prepared by the author, using data from 2021 10-K SEC Filing

prepared by the author, using data from 2021 10-K SEC Filing

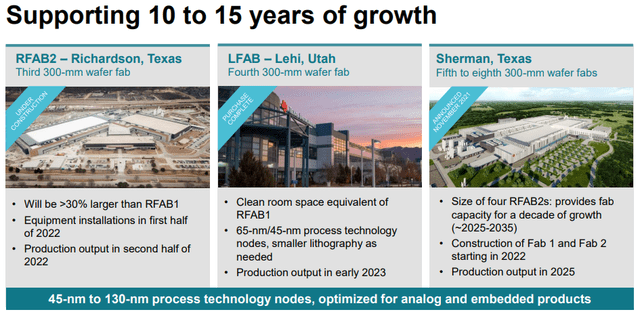

In the coming years, the U.S. will likely take an even larger share of the company’s property, plant & equipment assets as the ambitious Capex plan comes to fruition.

Texas Instruments Investor Presentation

Texas Instruments Investor Presentation

This puts TXN in a favorable spot for the coming years as onshoring of many industries will likely accelerate, thus allowing the company to slowly increase its dependency on the U.S. and European markets.

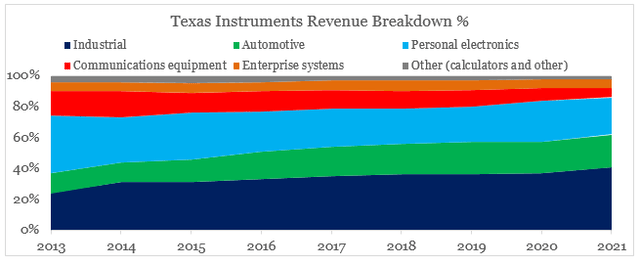

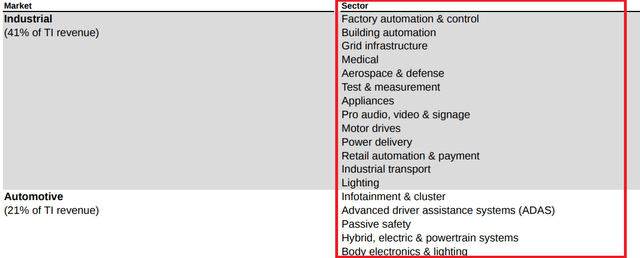

Industrial and automotive markets now make up 62% of the company’s total sales, up from 37% in 2013.

prepared by the author, using data from SEC Filings

prepared by the author, using data from SEC Filings

Many sectors within these two markets will likely benefit from the de-globalization and prioritization of supply chains resiliency over efficiency over the coming years.

Texas Instruments 2021 10-K SEC Filing

Texas Instruments 2021 10-K SEC Filing

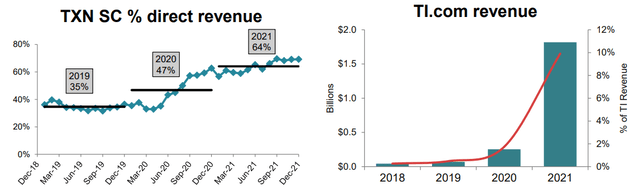

Additionally, TXN’s customer base is very diverse and fragmented which significantly improves the company’s negotiating power with customers.

Texas Instruments 2021 10-K SEC Filing

Texas Instruments 2021 10-K SEC Filing

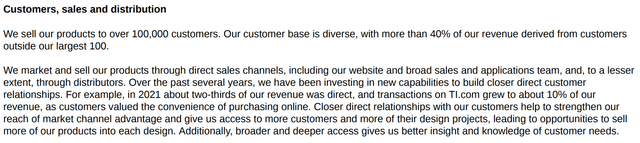

TXN management has further strengthened this competitive advantage by reducing its reliance on third parties and drastically increasing the share of direct sales in just a few years.

Texas Instruments 2021 10-K SEC Filing

Texas Instruments 2021 10-K SEC Filing

The other thing I would add is, as we have seen in other cases during the entire pandemic, but being able to ship direct and have the direct relationship with customers, it’s just a huge advantage, especially when you face these type of challenges just not having an intermediary that, kind of, frankly, most of the time gets in the way, and it’s not optimal for your relationship with the customer, but also there’s the tactical operational delivery of products. So whether it’s ti.com or non-ti.com legacy shipments are going direct, it’s a huge benefit, being able to do that, now close to 70% of our revenues directly.

Rafael Lizardi – Chief Financial Officer

Texas Instruments is among the highest quality semiconductor businesses, where management is strictly following a long-term oriented strategy as opposed to managing the business on a quarter-by-quarter basis. This is evident during market downturns, when quality of business models and achieved profitability become far more important than expected sales growth.

A potential slowdown of the Chinese economy and the risk of political tensions are the two major risks in front of Texas Instruments as the company has become a highly dependent on sales within the country. However, considering the company’s installed base in its home market and the high bargaining power with customers, the regional sales exposure appears far less concerning for long-term shareholders.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir’s content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.