niphon/iStock via Getty Images

niphon/iStock via Getty Images

Microsoft (NASDAQ:MSFT) unveiled the bedrock of its metaverse strategy at its recent Ignite conference. MSFT’s strategy revolves around transforming the workplace at the core of its strategy. Notably, it includes enhancements to its Cloud and Microsoft 365 offerings. Given that these two product segments are the company’s key growth drivers, we are not surprised.

Omniverse underpins Nvidia’s (NASDAQ:NVDA) strategy. It “is an end-to-end collaboration and simulation platform.” It’s also easily extensible and “enables universal interoperability across different applications and 3D ecosystem vendors.” Notably, it’s created around universal scene description (USD). Therefore, the platform is designed to facilitate interoperability and compatibility and is not dependent on the hardware or software used. Nvidia aims to develop an operating system that enterprises can use to build their metaverse ambitions.

We discuss which of these stocks is our preferred pick to conquer the metaverse.

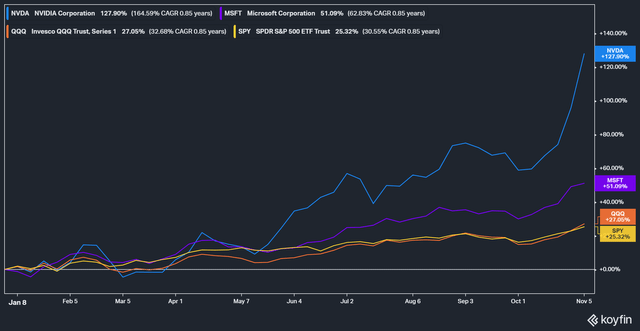

NVDA Vs. MSFT stock YTD performance (as of 5 November 21).

Both stocks have had a fantastic year so far as they easily outperformed the broad market. NVDA stock is having an even better year with a YTD gain of 127.9%. Its momentum has been gangbusters all year as it outperformed its semiconductor peers. MSFT stock is no slouch either, as it outperformed the market with a YTD return of 51.1%. Investors in both stocks have been rewarded by being patient and sitting on their fantastic upward momentum all year.

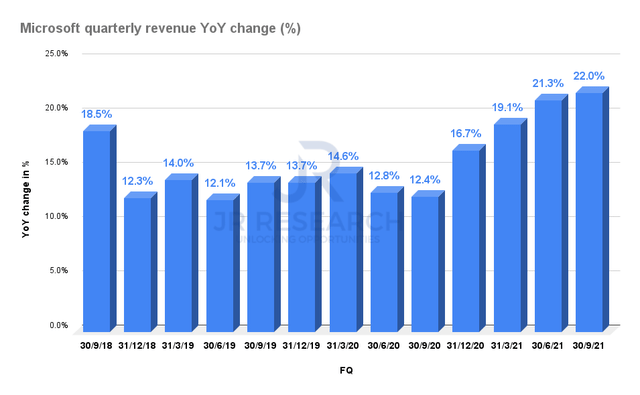

Microsoft quarterly revenue YoY change. Data source: S&P Capital IQ

Microsoft had another banner quarter in FQ1’22 as revenue rose 22% YoY, following FQ4’s remarkable 21.3% YoY growth. While the growth was broad-based, it was driven mainly by its cloud products. Revenue for Azure and other cloud services rose 50% YoY, following FQ4’s remarkable 51% rise. Moreover, the revenue of Office 365 also increased by 23% YoY.

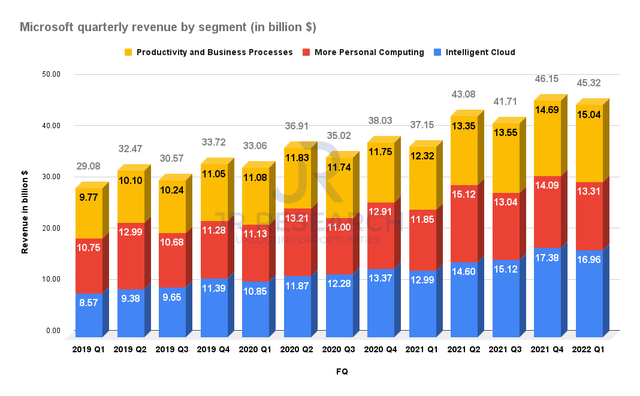

Microsoft quarterly revenue by segment. Data source: Company filings

Readers can quickly glean the broad-based nature of Microsoft’s recent solid performances. In particular, the company’s cloud segment has been experiencing robust momentum. The Information shared that MSFT represents a formidable threat to AWS (AMZN) in cloud applications even though AWS remains strong in IaaS and PaaS. It added:

On their own, applications are a big source of profits for the 46-year-old Microsoft. But they have also given Microsoft deep connections inside the IT departments of large companies, which have in turn made it easier to sell its Azure cloud services. “Microsoft’s salespeople carry bigger bags filled with more to sell, so they can compete for a larger share of a customer’s wallet,” said Charles Fitzgerald, a Seattle-based angel investor who previously worked for Microsoft and VMware. “This has been a material sales advantage from the primordial days of enterprise IT.” (from The Information article)

Therefore, readers must appreciate the prowess of Microsoft’s enterprise applications. As a result, it makes a lot of sense for MSFT to predicate the foundations of its metaverse strategy around its enterprise capability. Cloud led all segments with a 30.6% YoY growth in FQ1’22. Therefore, we believe that Satya Nadella & Co. are playing to its strengths here. Even though they also have a pretty successful Xbox vertical, its size and growth have not come anywhere near Cloud’s success.

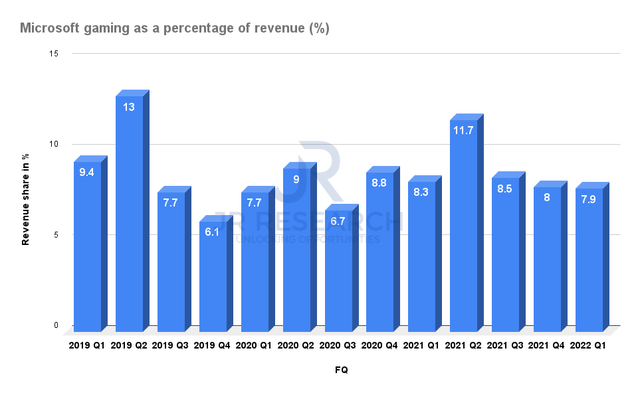

Microsoft Gaming as a percentage of total revenue. Data source: Company filings

Gaming performed well in FQ1, up 16% YoY. It was even better than FQ4’21 when it grew by 10.6% YoY. Moreover, the company’s Xbox vertical has also been hampered by the recent supply-chain challenges which affected its chip supply. Nevertheless, it has been a remarkable performance. However, Gaming only accounted for 7.9% of FQ1’22 revenue. Its share of total revenue has also been declining lately. Microsoft considers Xbox as an important player in its overall metaverse strategy. However, the company is staking its claim through its enterprise products first.

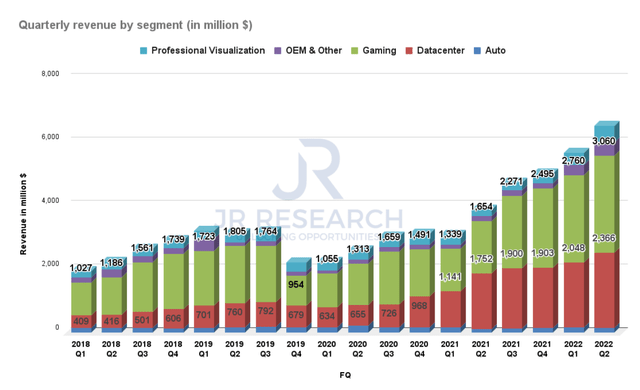

Nvidia quarterly revenue by segments. Data source: Company filings

The company’s revenue is still mainly driven by its hardware segments. Notably, it’s the leading GPU player in both the consumer gaming segment and the enterprise data center segment. In addition, it’s building up its revenue in the other segments where its AI expertise is also focused. However, they are still less significant than its hardware revenues. Therefore, NVDA’s strategy towards the metaverse is founded on the strength of its hardware infrastructure.

The Information estimates that the metaverse could be worth about $82B by 2025. It includes revenue from gaming, business communication, and advertising. Matthew Ball, the famed venture capitalist who launched the Roundhill Ball Metaverse ETF (META), recently added that in the longer term, “the majority of metaverse revenues will eventually accrue to the tech companies supplying the infrastructure, not game developers or others making a virtual platform. [He also added] that much of the value in the current internet goes to semiconductor firms, wireless towers, and content delivery networks that supply the backbone for the internet.”

Notably, the META ETF owns both NVDA and MSFT stock as its #1 and #2 holdings, respectively. Moreover, readers should also observe that NVDA’s metaverse strategy goes beyond its hardware stack through its revenue segments. Nvidia already has a full hardware stack to underpin its hardware metaverse strategy. Its Grace data center CPU and Bluefield SoC have reinforced its full-stack strategy. Coupled with its dominant GPU market leadership, NVDA has a unique hardware strategy that we believe is second-to-none.

Despite that, the company has also moved into becoming a comprehensive software powerhouse. One of our earlier NVDA articles highlighted that the company has already transformed itself into a full-stack technology company. Nvidia emphasized:

NVIDIA is a full stack computing company. Today, we are much more internally a software company than we are a hardware company. We have many more engineers working on software than on hardware. And the reason is because when you use artificial intelligence, you use it in a variety of different use cases, whether it’s video analysis or conversational AI or cybersecurity or robotics. (from Evercore ISI Inautural TMT Conference)

The brilliance of Nvidia’s metaverse strategy is that it transcends beyond its hardware capability. It recognizes the need to build a highly capable software SDK alongside its hardware leadership. Nvidia has astutely positioned itself as a leading enterprise AI player, along with its consumer gaming and data center ambitions. Its move into cloud gaming has secured its position alongside the pioneers of metaverse-like experiences. Such experiences have been championed by Roblox (RBLX) and Epic Games.

Matthew Ball also added that gaming is the foundation for building the metaverse. He added: “In the near term, the metaverse will mostly feel like immersive gaming platforms. They are farthest ahead in this ‘new internet’ and also fastest to change. Consumer hardware, for example, is typically replaced every 2.5 years, while game engines are constantly being upgraded and new content experiences are being created.”

Therefore, NVDA is exceptionally well-equipped to navigate this space as many avid gamers use discrete GPUs designed by NVDA. The company has an enviable lead in the d-GPU market for gamers. Moreover, it has also recently launched the fastest supercomputer ever built for gaming. Nvidia announced its next-gen cloud gaming platform, dubbed the GeForce RTX 3080, in October. CEO Jensen Huang added: “Gaming is enjoying a multi-decade expansion as technology continues to make new game experiences possible. There are more genres than ever. The lines between gaming, sport, art and social are increasingly blurred in video games.”

Global gaming leader Tencent (OTCPK:TCEHY) also quipped in recently on their interpretation of the metaverse. The company also believes that gaming is fundamental to a successful metaverse strategy. Chief Strategy Officer James Mitchell emphasized:

And we believe there’s a number of potential pathways to the Metaverse, including very popular existing games that are highly social in nature, new games that are yet to be created as well as existing social networks that can become more Metaverse-like progressively over time. We also think that there’s certain skill sets or attributes that will be highly beneficial to companies seeking to provide a Metaverse environment, including experience of handling huge numbers of users interacting with each other, with which is akin to communications and social networking, including managing digital economies between users, which is akin to online games. (from Tencent FQ2 earnings call)

Nvidia’s continued momentum into cloud gaming is fundamental to helping it build its social network, and also manage the digital economies. The company highlighted in April that it had surpassed 10M subscribers. It’s still an opportunity in the early innings, which we believe NVDA is exceptionally well-positioned to undertake.

Notably, the software platform that underpins its metaverse strategy is the Omniverse Enterprise. The company emphasized that it’s “the world’s first technology platform that enables global 3D design teams working across multiple software suites to collaborate in real-time in a shared virtual space.” In addition, the company shared that over 400 companies have been evaluating the power of the Omniverse over the past two years. Therefore, NVDA is already many steps ahead of MSFT in this aspect. Notably, it’s designed to be interoperable across multiple platforms and software suites.

Therefore, the scope and depth of its applications are so varied that Nvidia estimates that millions of designers would benefit from using the Omniverse. NVDA added in a recent conference:

Our math, basically, when we look at the target audience for Omniverse and the work that we’ve done, we think there is about 20 million designers and engineers out there for whom Omniverse will be a great platform for them to do their day-to-day work. And if you just do some simple math of a subscription-based model that we’ve already put out and that fixed the norms and standards of the industry, if you will, this is, again, definitely a multibillion-dollar net incremental market opportunity from the use of Omniverse, right? (from Piper Sandler 2021 Virtual Global Technology Conference)

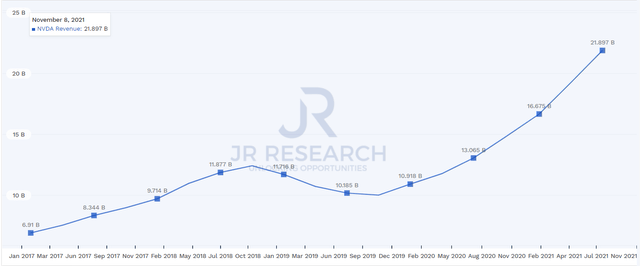

NVDA LTM revenue. Data source: S&P Capital IQ

Recently, Wells Fargo (WFC) analysts added that the incremental market opportunity is worth about $10B over the next five years. In addition, they emphasized that: “The company is an “enabler/platform for the development of the Metaverse across a wide range of vertical apps.” Considering that the company’s last-twelve-months (LTM) revenue was $21.9B based on FQ2’s earnings, therefore it’s a big deal.

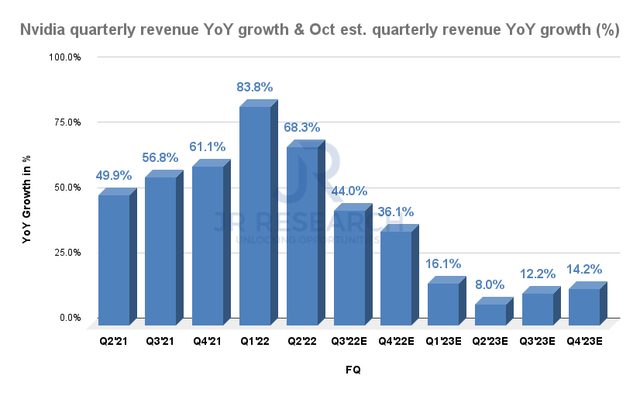

Nvidia quarterly revenue YoY growth & October estimates. Data source: S&P Capital IQ

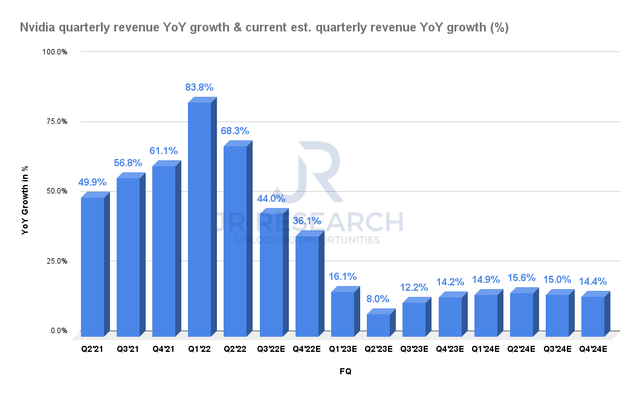

Nvidia quarterly revenue YoY growth & current estimates. Data source: S&P Capital IQ

We compared the consensus estimates from October against the ones that included the recent AI Omniverse opportunity. We believe that it will be a multi-billion opportunity for NVDA, as they have telegraphed clearly. Nevertheless, the revenue opportunity is unlikely to be in the near term. Considering that, its revenue growth moving ahead is still expected to decelerate even when we added the new estimates. Hence, we continue to think that NVDA’s current valuation may have baked in a huge premium for what it’s worth. We don’t think the current price surge is sustainable. Despite that, we remain confident about NVDA’s full-stack approach for its metaverse strategy.

The metaverse opportunity is expected to be massive. Even The Information acknowledged that its estimates are likely understating the TAM. Moreover, digital advertising is expected to be worth $645B by 2024. If the metaverse integration is successful, we would not be surprised to see ad budgets subsequently moved into the metaverse. We also believe that only a handful of companies will have the capability and resources to build a successful metaverse strategy. We consider both MSFT and NVDA as extremely well-primed to benefit.

Notwithstanding, if we were asked to choose just one player, we would undoubtedly prefer Nvidia. Therefore, we think NVDA will reign supreme in building the metaverse.

Given our analysis of both companies’ valuations in our recent articles here and here, we continue to reiterate our Neutral ratings for both stocks for now. But we encourage readers to add both stocks at potential deep retracements moving ahead.

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

I’m JR, the lead writer and founder of JR Research and Ultimate Growth Investing Marketplace service. Our team is committed to bringing more clarity to investors in their investment decisions.

Our marketplace service focuses on a price-action-based approach to growth and technology stocks, supported by fundamental analysis. In addition, our general SA site discusses stocks from various sectors and industries.

Our discussion mainly focuses on a short- to medium-term thesis. While we hold stocks for the long-term, we also use appropriate opportunities to benefit from short- to medium-term swings, leveraging long (directionally bullish) or short (directionally bearish) set-ups.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have a beneficial long position in the shares of NVDA, MSFT, AMZN, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.