RHJ/iStock via Getty Images

RHJ/iStock via Getty Images

God sleeps in the minerals, awakens in plants, walks in animals, and thinks in man. – Arthur Young

I had rated the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) as bullish in May 2021, when it was hovering around $83. The recommendation paid off and the ETF has jumped to $116 as of November 3, 2021, gaining a wholesome 40% in a space of 5 months.

The ETF invests in companies that are engaged in mining, refining, and recycling rare earth and strategic metals and minerals. It has a middling net expense ratio of 0.59% and a high portfolio turnover ratio of 70%.

I have been bullish on rare earth ETFs’ growth story for the long term and will remain so – however, as REMX has gained 40% since my last recommendation, I thought it was time to check if it still has some steam left to deliver price gains in the medium-long term.

Here is my review of REMX’s long- and medium-term prospects, once again:

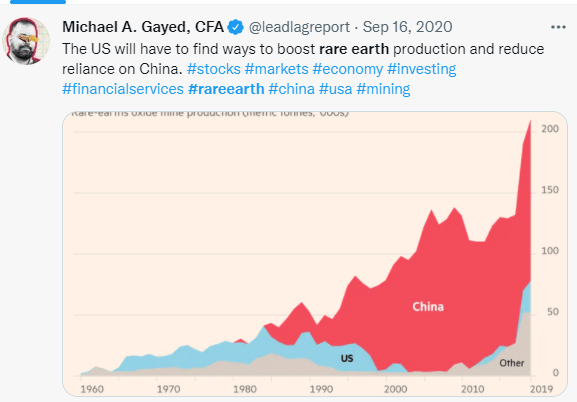

Image Source: My Tweet/The Lead-Lag Report

In 2019, the U.S. imported 80% of its rare earth requirements from China. The Biden administration has turned its focus on making the U.S. a self-reliant and a dominant player in the rare earth metals market. These metals are required in the manufacture of EVs, batteries, renewable energy equipment, and advanced technology. This is a significant move because a large part of our domestic reserves remains untapped.

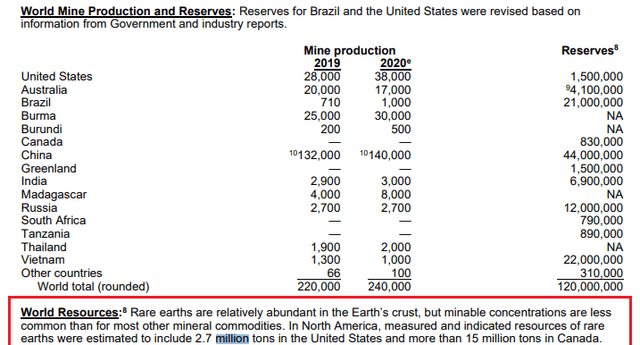

Image Source: Report from the U.S. Geological Survey

As per the data available, in North America, the measured resources of rare earth minerals are estimated to be 2.7 million tons. China’s resources are pegged at 44 million tons. Now – hold your breath – a veteran miner estimates that about 18 million tons of rare earth resources exist in Bear Lodge (Wyoming) alone. Add to that other potential undiscovered resources and you realize that the U.S. can dominate global rare earth mining and become a net exporter! Currently, the U.S. is mining just 38,000 tons per year – an insignificant number compared to what actually exists in the country.

Therefore, in the long term, the entire rare earth and strategic metals sector is poised for dramatic growth.

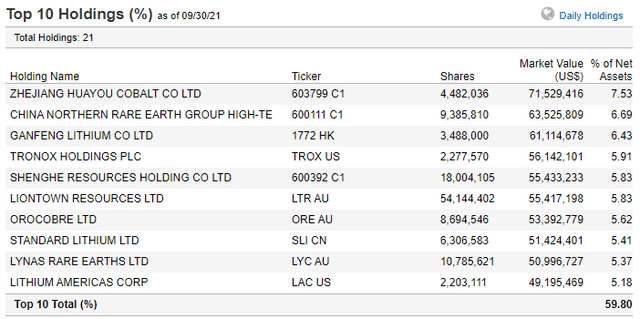

As of November 2, 2021, REMX has invested its total assets in 20 stocks. About 60% of the ETF’s total assets are locked up in its top 10 holdings.

Image Source: REMX’s Website

Investors should note that:

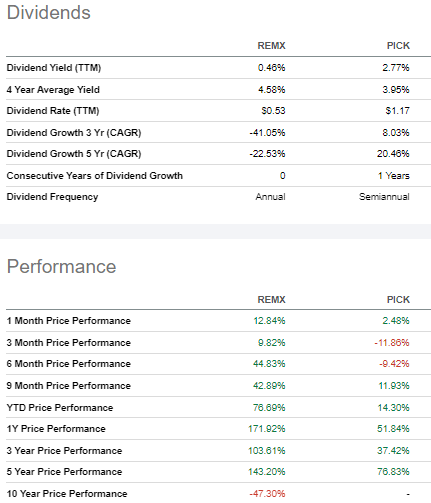

Image Source: Seeking Alpha

A comparison of REMX with its closest rival, the iShares MSCI Global Metals & Mining Producers ETF (PICK), reveals that:

The available data and conditions suggest that REMX makes for a solid long-term investment. I am, therefore, once again assigning a bullish rating on the ETF with the caveat that if near-term volatility roils the market, REMX too will take a hit.

This is an ETF for long-term growth investors – a hidden gem, just like rare earth metals.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.