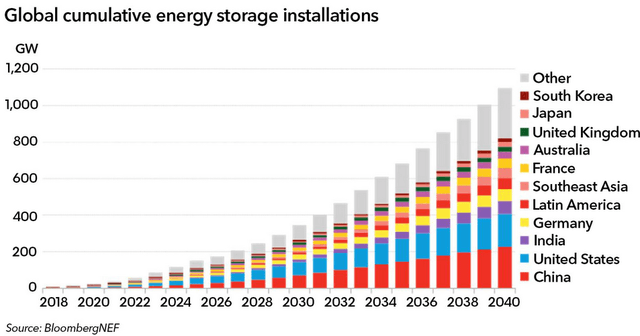

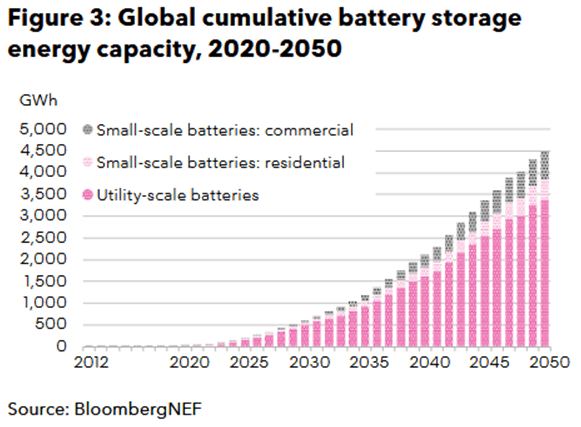

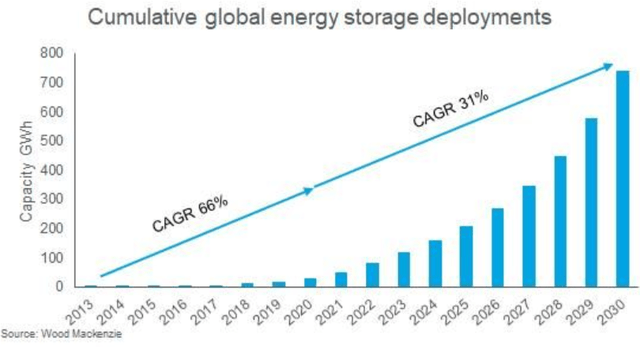

Energy storage adoption is already rapidly accelerating in the USA, up 182% QoQ in Q4 2020. Looking out further, BloombergNEF (BNEF) forecasts a 122x increase in global energy storage from 2018 to 2040. BNEF forecasts that utility scale energy storage will be the dominant sector, meaning the utility companies that supply grid scale electricity, rather than behind-the-meter residential energy storage. If correct, this means utility energy storage is the area of greatest growth potential.

For a background, you can read my past articles:

Wikipedia states:

“Energy storage is the capture of energy produced at one time for use at a later time to reduce imbalances between energy demand and energy production… Bulk energy storage is currently dominated by hydroelectric dams.”

Apart from dams, the most common form of energy storage is using batteries. The most common form of battery by far, for now, is lithium-ion; however, other types such as vanadium redox flow [VRFB], zinc flow and other methods (compressed air, flywheel, thermal, gravitational) also have potential.

Demand for USA energy storage increased nearly 182% QoQ in Q4 2020, boosted by demand from utility scale installations.

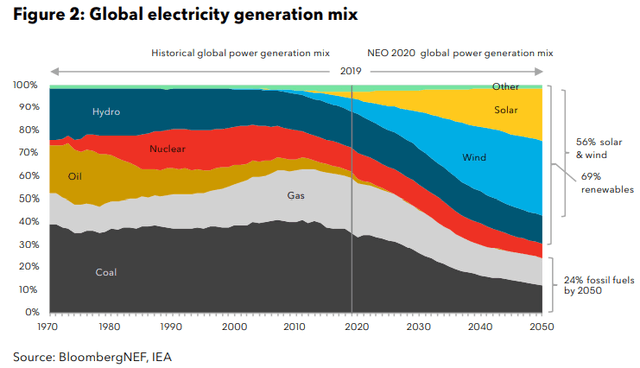

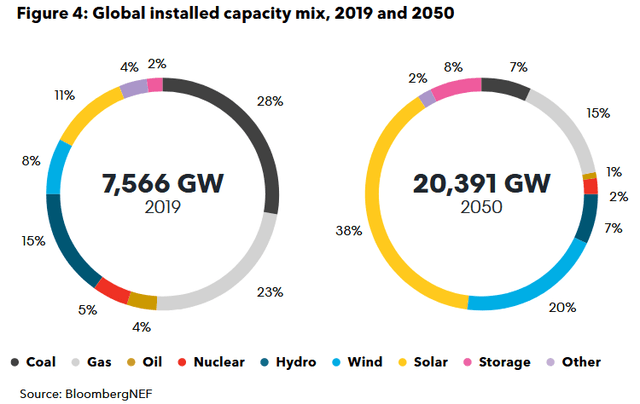

Energy storage is set to benefit from the accelerated move towards renewable energy. The chart below shows BNEF’s 2020 global electricity generation mix forecast. We can see the two major areas of growth will be solar and wind. Both of these are intermittent energy, so they need energy storage back up to perform at their best.

Source: BNEF – New Energy Outlook 2020

The March 2, 2021, CLEAN Future Act (H.R. 1512) Bill authorizes US$565 billion in spending to cut greenhouse gas emissions to net zero by 2050, with an interim target of reducing carbon pollution by 50% from 2005 levels by the end of this decade. The bill requires utilities to sell increasing amounts of carbon-free electricity until the power sector is fossil-fuel free by 2035. The key winners will be solar, wind, nuclear, and energy storage.

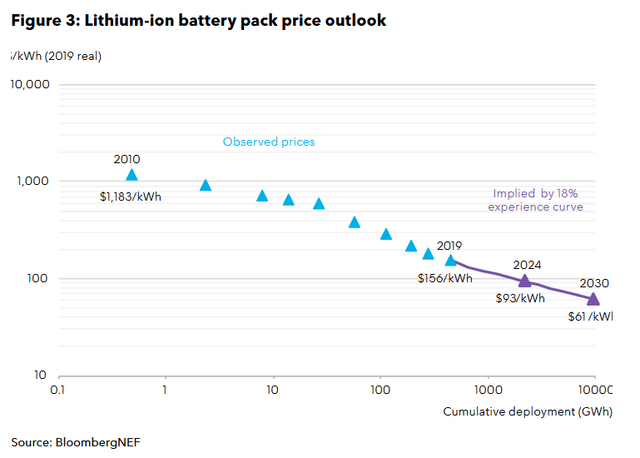

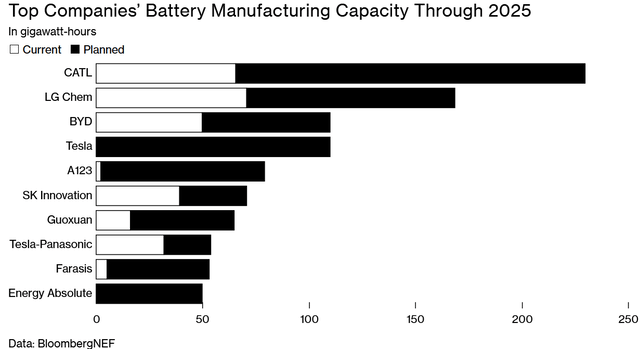

Lithium-ion battery costs are falling the fastest due to their need in electric vehicles. Rapid scaling of new gigafactories is leading to falling battery costs at about 18% pa. Lithium-ion batteries have a price advantage over most competitors due to current economies of scale from large scale global production.

BNEF states:

Storage batteries get cheaper over the outlook via synergies with growing battery demand for electric vehicles… Battery-pack prices have fallen 18% for every doubling of cumulative manufactured volume, and we expect this relationship to hold for at least the next 10 years. This will lead to battery-pack prices of $93/kWh by 2024 and $61/kWh by 2030.

Source: BNEF: New Energy Outlook 2020

As vanadium redox flow batteries [VRFB] scale, they should also drop in price. The key ingredient is vanadium pentoxide, so its price will be a key determinant of the battery price. VRFBs do have several advantages over lithium at utility scale, so this would suggest they can do very well, albeit starting from a low base today. China is a leader in the adoption of VRFBs.

Source

Source: BNEF: New Energy Outlook 2020

Source: Courtesy Wood Mackenzie

Neoen [FR:NEOEN] (OTC:NOSPF) – Neoen is a renewable energy company headquartered in France. Neoen owns and operates solar and wind farms in 13 countries on four continents. Neoen is the owner/operator of what was the world’s largest lithium-ion energy storage plant (129 MWh, expanding a further 64.5 MWh), the Hornsdale Power Reserve in Australia, which uses Tesla’s batteries. Neoen’s 2021 PE is 89.0, and 2022 PE is 63.3.

Vistra’s 5 energy storage projects in California and Texas:

For a list of 50 energy storage companies, you can view here.

Neoen’s Hornsdale Power Reserve (129MWh + 64.5MWh = 193.5MWh) is located in South Australia with batteries from Tesla.

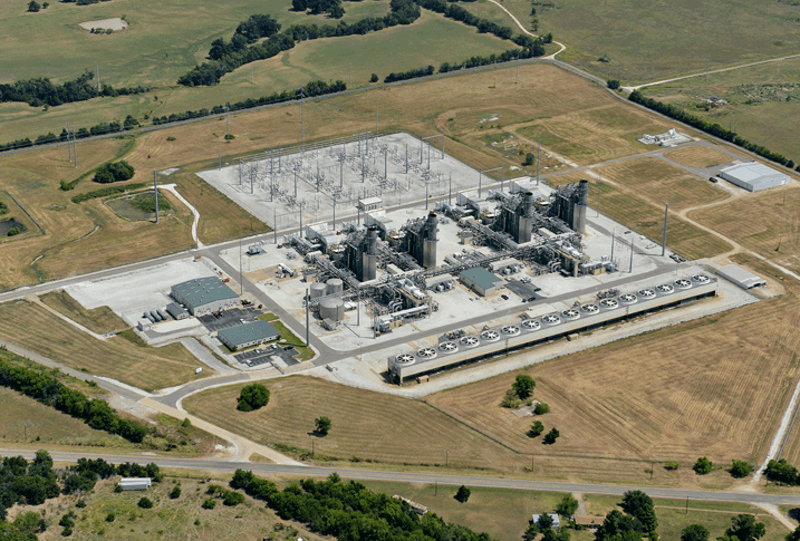

Completed by Fluence in Feb. 2021, the 400MWh Alamitos Energy Center [AEC] energy storage facility in Long Beach, California, is to supply electricity for Southern California Edison

Source: Vistra

Source: BNEF

The last article linked above quotes:

The CLEAN Future Act authorizes $565 billion in spending to cut greenhouse gas emissions to net zero by 2050, with an interim target of reducing carbon pollution by 50% from 2005 levels by the end of this decade. The bill, H.R. 1512, introduced March 2, requires utilities to sell increasing amounts of carbon-free electricity until the power sector is fossil-fuel free by 2035… Eligible power sources for the clean energy microgrids are solar, wind, geothermal, existing hydropower, micro-hydropower, hydrokinetic and hydrogen fuel cells.

Note: Energy storage of some type will be needed to optimize the above forms of renewable energy.

Source: Neoen

Energy storage is set to boom this decade, particularly as a way to support solar and wind energies intermittency. In fact, it is already booming (up 182% QoQ in Q4 2020 in the USA) with each new facility getting bigger and bigger. Lithium-ion battery storage is the current battery leader; but other areas of storage, such as VRFBs, also have great potential, particularly for utility scale and long duration projects that require energy to be held for greater than 4 hours, and that can charge and discharge at the same time. Costs and longevity are, of course, other key factors.

There is a large choice of energy storage companies to choose from. They are mostly either Li-ion battery producers or renewable energy utilities. Tesla, Fluence (Siemens AG and AES Corp.), Neoen, NextEra Energy, and Vistra Corp. are major players in the energy storage installation and/or ownership side. My top pick there right now would be NextEra Energy, as an accumulate. Top tier lithium-ion manufacturers (CATL, LG Chem, BYD Co., and SK Innovation) are also well positioned. Panasonic is also doing well boosted by their Tesla gigafactory JV and is currently well valued and a worthwhile accumulate. The VRFB producers can also do well over a longer time frame assuming VRFBs grow in popularity. My pick for an integrated vanadium miner and VRFB company is Largo Resources. For the ETFs consider BATT, LIT, ICLN, and GRID as the first two are an excellent way to gain broad exposure to the electric vehicle [EV] and energy storage themes at the same time.

Please read the risks section before investing.

As usual, all comments are welcome.

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", or sign up here.

Latest Trend Investing articles:

This article was written by

The Trend Investing group includes qualified financial personnel with a Graduate Diploma in Applied Finance and Investment (similar to CFA) and well over 20 years of professional experience in financial markets. Trend Investing searches the globe for great investments with a focus on “trend investing” themes. Some focus trends include electric vehicles and the lithium/cobalt/graphite/nickel/copper/vanadium miners, battery and plastics recycling, the online data boom, 5G, IoTs, AI, cloud computing, renewable energy, energy storage, space tourism, 3D printing, personal robots, and autonomous vehicles. Trend Investing also hosts a Marketplace Service called Trend Investing for professional and sophisticated investors. The service is information only and does not offer advise or recommendations. See Seeking Alphas Terms of use. https://seekingalpha.com/page/terms-of-use

Disclosure: I am/we are long TSLA, BYD CO [HK:1211], LARGO RESOURCES [TSX:LGO], GLOBAL X LITHIUM & BATTERY TECH ETF (LIT), AMPLIFY LITHIUM & BATTERY TECHNOLOGY ETF (BATT), ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN). I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.