DKosig/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on December 12th, 2021.

The Vanguard Total International Stock ETF (NASDAQ:VXUS) offers investors a simple, easy, cheap way to invest in undervalued international equities. VXUS’s diversified holdings, cheap price and valuation, and strong growth prospects make the fund a buy. VXUS only yields 2.5%, and has about average dividend growth, and so is not an effective income vehicle.

VXUS is an international equity index ETF. VXUS’s investment thesis rests on the fund’s:

The above combine to create a strong fund and investment opportunity. Let’s have a look at each of the points above.

VXUS is an index ETF investing in international equities. It is administered by Vanguard, the second-largest investment managers in the world, and the largest index providers in the same. Vanguard is generally my top choice for index ETFs, and VXUS is no exception.

VXUS tracks the FTSE Global All Cap ex US Index, an index of global all-cap equities, explicitly excluding U.S. stocks. It is a relatively simple, broad-based index, which includes all relevant countries subject to a basic set of institutional, regulatory, and shareholder rights criteria. The index then includes all relevant international equities subject to a basic set of liquidity, trading, size, voting and shareholder rights, criteria. Inclusion and exclusion criteria are both quite lax.

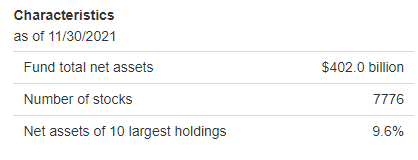

VXUS’s underlying index is quite broad, which results in an incredibly well-diversified fund. VXUS invests in over 7760 securities, from dozens of countries, and from all relevant industries

(Source: VXUS Corporate Website)

Of special importance is VXUS’s international tech holdings. The fund invests quite heavily in high-growth, comparatively cheap stocks like Taiwan Semiconductor (TSM), Tencent (OTCPK:TCEHY), and Alibaba (BABA). These stocks have the potential for outsized returns, but are not included in most U.S. equity indexes, like the S&P 500, or the Nasdaq-100. Their inclusion would help to diversify an investor’s portfolio, and could boost returns too. VXUS provides investors with exposure to these and other strong international equities.

Diversification serves to reduce portfolio risk and volatility, and is a significant benefit for the fund and its shareholders. VXUS’s holdings are diversified enough that the fund could function as a core portfolio holding, and as the only international holding in an investor’s portfolio.

VXUS’s international equity holdings are currently very cheap, with low prices and competitive valuations. The fund’s underlying holdings have an average PE ratio of 15.2x, PB ratio of 1.9x, both relatively low figures, and significantly lower than that of most broad-based U.S. equity index funds.

(Source: Vanguard Corporate Website – Chart by Author)

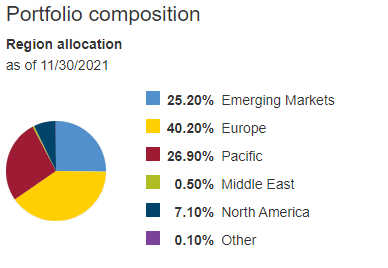

International equities generally sport cheaper valuations than comparable U.S. equities, but the gap has widened these past few years, and is currently at the widest levels seen in decades. International equities are cheap, and uncharacteristically so.

(Source: J.P. Morgan Guide to the Markets)

VXUS’s cheap valuation increases (potential) shareholder returns in two key ways.

First, a cheap valuation means a low share price, which almost always means a high dividend yield. That is the case for VXUS, with the fund sporting a 2.5% dividend yield. Although this is not a particularly strong yield on an absolute basis, it is more than twice as high as those offered by most broad-based U.S. equity funds, and moderately higher than global equity index funds too. Higher dividend yields are almost always a benefit for a fund and its shareholders, and that is the case for VXUS too.

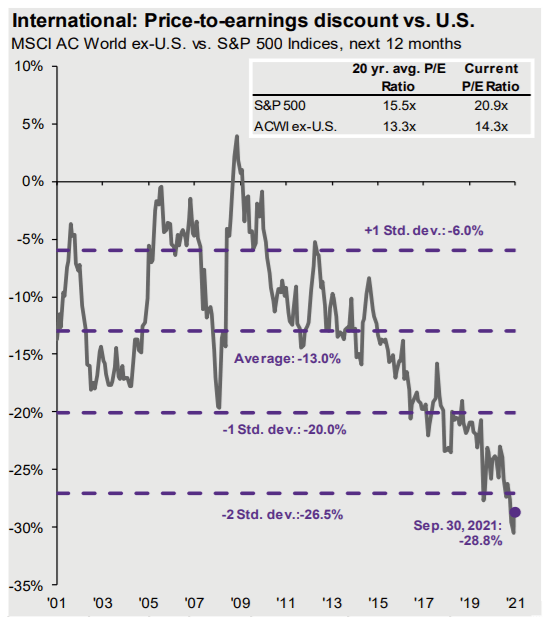

As per J.P. Morgan, the gap between international and U.S. equity dividend yields is also comparatively high, although less so than valuations themselves.

(Source: J.P. Morgan Guide to the Markets)

Second, a cheap valuation could lead to significant capital gains and returns if valuations were to normalize. This is a relatively common occurrence, as valuation gaps as large as the one existing today are rare, and generally short-lived. VXUS’s cheap valuation could plausibly lead to strong, market-beating returns for the fund and its shareholders in the coming months, a significant benefit for the fund. Valuations are unlikely to close without a catalyst, however, which brings me to my next point.

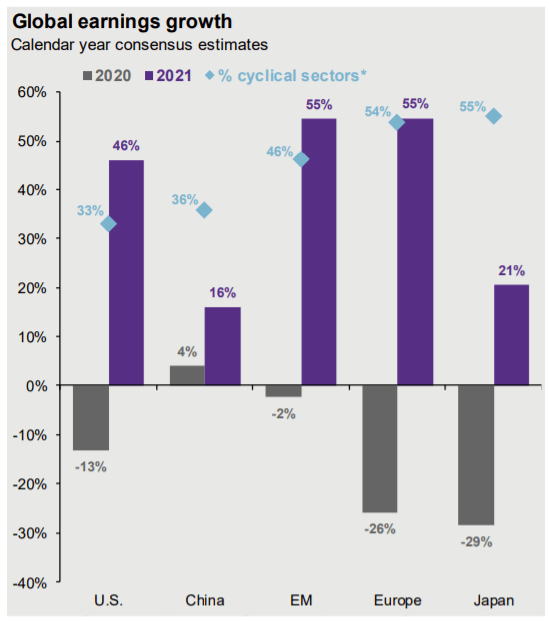

VXUS’s international equity holdings are likely to see strong revenue, earnings, and cash-flow growth in the coming years, due to a waning pandemic, and improved economic fundamentals. As per J.P. Morgan, corporate earnings growth will likely be about 10% higher in emerging and European markets, the two largest international markets, relative to U.S. corporate earnings.

(Source: J.P. Morgan Guide to the Markets)

Importantly, international markets are, in fact, performing as expected. As per FactSet, European corporations have seen revenue / earnings growth of 29% / 248% in the past quarter, compared to 24.7% / 89% for U.S. corporations. Emerging market equities have also seen outstanding financial and economic growth.

Strong revenue and earnings growth should lead to strong capital gains and returns. Growth could also be the catalyst for the closing / narrowing of the valuation gap between international and U.S. equities. Investors are paying a premium for U.S. equities, in part, due to their relatively high levels of financial growth. No growth premium could plausibly lead to no valuation premium, in my opinion at least.

In any case, the strong growth prospects of VXUS’s underlying holdings could lead to market-beating returns in the coming months, and are a significant benefit for the fund and its shareholders.

VXUS is a strong fund and investment opportunity, but it is not one without negatives. In my opinion, the fund’s most significant negative is the fact that its investment thesis is almost completely reliant on (fickle) market sentiment. There is no guarantee that strong growth will lead to capital gains or market-beating returns, even accounting for the fund’s comparatively cheap valuation. This has most definitely not been the case in the past, with VXUS underperforming most broad-based U.S. equity indexes since mid-2021, even as international equities saw skyrocketing growth as they recovered from the pandemic.

Market sentiment is less of a concern for high-yield funds and securities, as investors receive the income regardless, but VXUS’s 2.5% yield is simply not that large. VXUS’s returns will, and have, mostly consist of capital gains, and so investors depend on market sentiment to make a profit. Although this is the case for most investments, it is particularly important for VXUS, as international equities have been unloved by equity markets and investors for so long. VXUS’s investment thesis is dependent on markets changing their outlook on these securities, and this is far from certain.

As mentioned previously, I believe that the above is VXUS’s most significant negative.

VXUS’s diversified holdings, cheap price and valuation, and strong growth prospects make the fund a buy.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

—————————————————————————————————————

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.