P_Wei/iStock via Getty Images

P_Wei/iStock via Getty Images

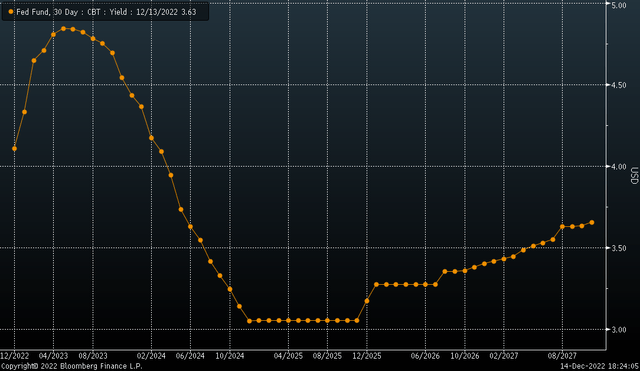

Well, the Fed handed the market a big surprise on Wednesday afternoon by increasing their 2023 terminal rate forecast by 50 bps to 5.1% for all of 2023. On top of that, they raised their unemployment and inflation forecast while lowering their GDP growth forecast. The message is as clear as can be, not only will they not be cutting rates in 2023, but they are willing to accept an even bigger economic slowdown and higher unemployment rate than projected in September.

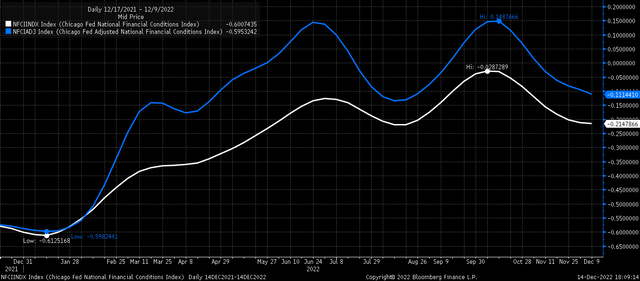

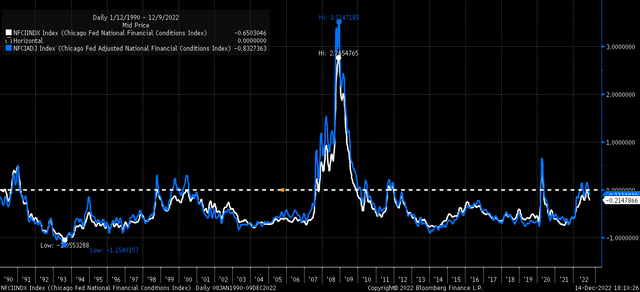

Additionally, the Fed still needs financial conditions to tighten further. Based on the current level of those conditions, there is still much work to be done. Financial conditions had eased considerably since the middle of October following that September CPI report and are currently at levels seen in August before the Fed hiked rates by 200 bps.

Bloomberg

Bloomberg

At this point, financial conditions aren’t even close to restrictive; they still need to get back to the zero bound, a level they have backed off from. When the Chicago Fed National Financial Conditions index is below 0, it suggests that conditions are accommodative to the economy, and when they are above zero, they are restrictive.

Powell made it clear in the press conference, on the first question, noting the Fed’s feeling today is that they are not at a restrictive policy stance. The Fed transmits its monetary policy by the easing and tightening financial conditions.

Bloomberg

Bloomberg

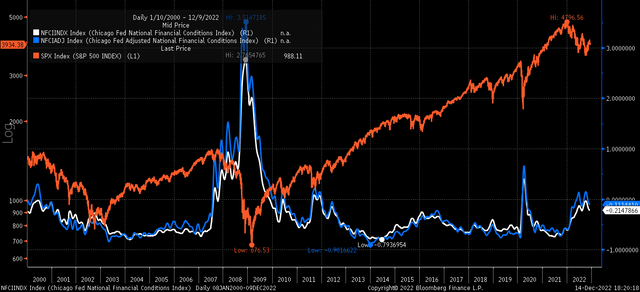

In translation, the Fed will raise rates until financial conditions tighten enough to slow the economy and the labor market. The longer the markets fight against the Fed and conditions do not tighten, the more the Fed is likely to continue its hawkish rhetoric and probably the rate hikes.

Tightening financial conditions occur when rates increase, the dollar strengthens, spreads widen, implied volatility rises, and stock prices fall. Saying they want financial conditions to tighten and that they aren’t restrictive enough signals that asset prices need to drop.

Bloomberg

Bloomberg

More importantly, from a market standpoint, the market read the Fed completely wrong. Thinking that slower rate hikes meant the Fed was closer to being finished. The Fed came out pushing back hard, saying not only would they raise rates, but they would raise them above current market pricing.

Fed Fund futures saw a peak rate of 4.85% by May and then predicted that the Fed would start cutting rates in 2023 back down to 4.4% by December 2023. The market was wrong.

Bloomberg

Bloomberg

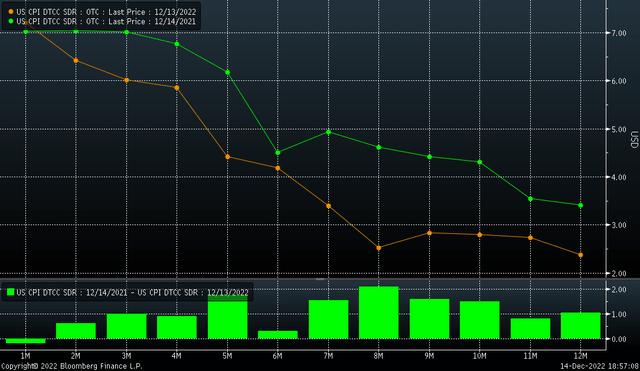

Inflation may be rolling over, but it is also impossible to know if inflation is not rolling over. It was 12 months ago that the CPI inflation swaps market was pricing in an inflation rate by the end of this year at 3.4%. Now, they are predicting 2.4% by the end of next year. If anything, I think it is clear there is no way of knowing.

Bloomberg

Bloomberg

The terminal rate of 5.1% is for the entire year of 2023, and there are no rate-cut prices in the Fed projections until 2024. It means that rates and the dollar have fallen too much, and stock prices have rallied too far.

Stocks did fall 1.4% from their intraday peak on December 14, but nothing horrible. It wasn’t worse because of the options expiration on Friday and the significant level of option gamma concentration in the S&P 500 at 4,000. So, market makers are continually hedging their books around that 4,000 level. So the 4,000 level may hold until Friday. But after that, a market rally now seems pretty far-fetched because the Fed is telling you that they want financial conditions to tighten.

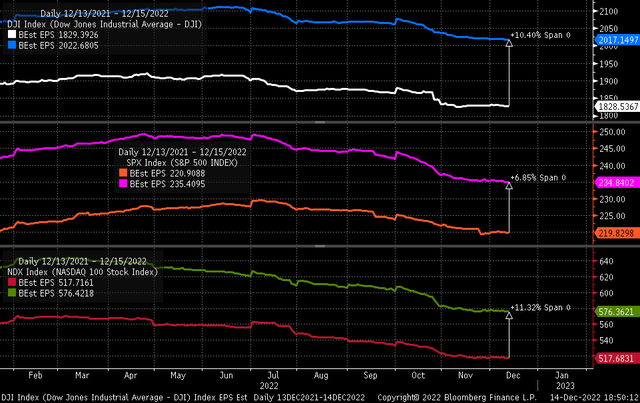

On top of that, the Fed is telling you they are knowingly inducing an economic slowdown that takes the economy to a status of no growth. It will only weigh more heavily on earnings estimates for 2023, which are already falling and probably too high because analysts are still pricing in almost 7% earnings growth for next year.

Bloomberg

Bloomberg

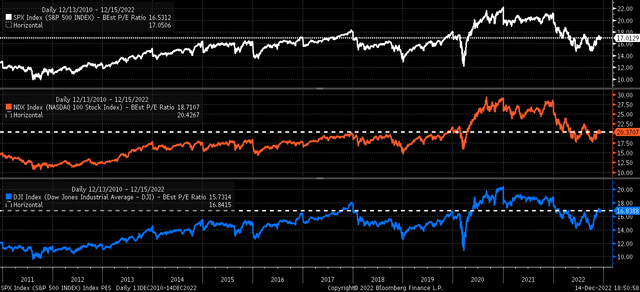

And the PE ratio today is at a level that is historically very high when compared to the past decade. No, they aren’t high compared to the past two years, but let’s face the facts, the prior two years were also a bubble induced by easing financial conditions and QE. But compared to 2018 and 2020 before the pandemic, a 17 PE for next year’s earnings on the S&P 500 is high.

Bloomberg

Bloomberg

The Fed is saying they want financial conditions to tighten. They are telling us they expect the economy to slow to stall speed, earnings estimates are probably too high, and investors should pay a historically high multiple to buy stocks.

It doesn’t seem like an ideal setup for stocks going forward.

(*The Free Trial offer is not available in the App store)

See why Reading The Markets has been one of the fastest-growing Seeking Alpha marketplace services in 2022.

Reading the Markets helps readers cut through all the noise by delivering stock ideas and market updates.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.