In this article, I argue that the market is too optimistic about Luckin Coffee’s (LK) future, with its current valuation of 20x P/S and 2.9% quarter-over-quarter (QoQ) sales growth. I argue that:

The number of Luckin’s stores grew from nine stores in 2017 Q4 to 2,400 stores in 2019 Q1. It currently has ~3,000 stores in China, and it is still planning to have 4,500 stores by the end of 2019.

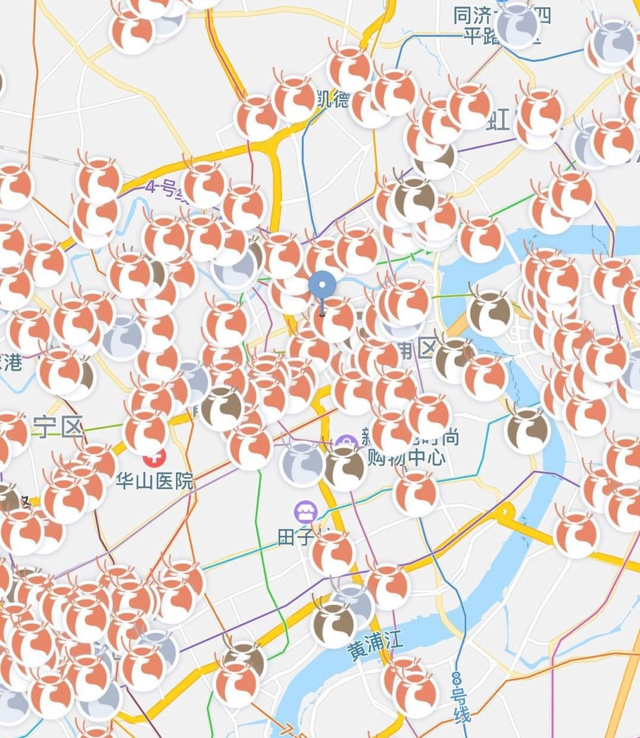

However, there might not be enough room for so many stores in China, given that Starbucks has ~3,900 stores in China, and coffee shops are everywhere in China. Moreover, Luckin’s presence is already very dense in Tier-1 cities. Figure 1 shows Luckin’s density in Shanghai. Figure 1. The density of Luckin Stores in Shanghai. Grey icons indicate closed stores. Source: Luckin’s app.

Figure 1. The density of Luckin Stores in Shanghai. Grey icons indicate closed stores. Source: Luckin’s app.

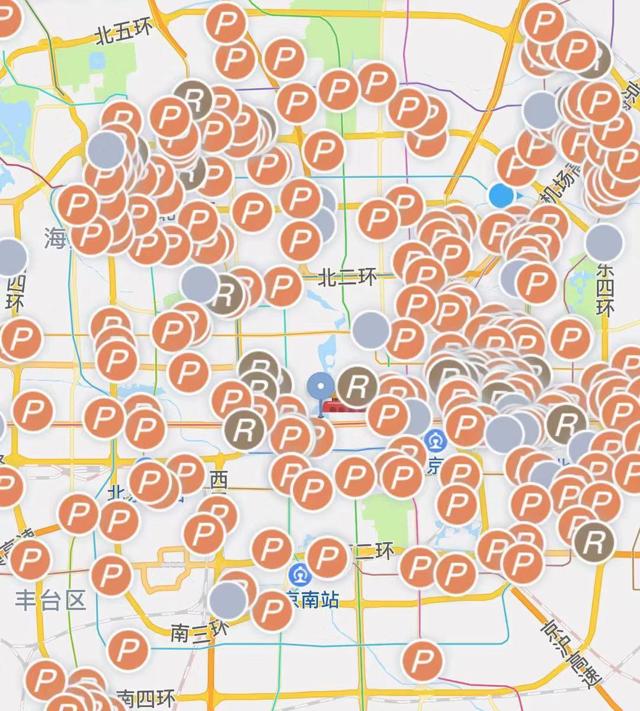

In some places, Luckin stores are very close to each other (see Figure 2). In major business districts, you can easily access 5-18 Luckin stores within a 1 km radius – that is a 12-minute walk. Luckin stores do not need to be so close together.

Figure 2. The density of Luckin Stores in Beijing. Source: Luckin’s app.

According to Aurora Mobile’s data, 85% of Luckin’s customers are in Tier-1 cities, and the remaining 15% in Tier-2 or Tier-3 cities. With current allocations in China, Luckin can hardly reach 4,500 stores in China, and it simply cannot reach that number in 2019, as there is not much space for more openings in Tier-1 cities. In Tier-2 cities, customers are more sensitive to prices, and most of them drink tea, so Luckin is not likely to capture a significant market there. If Luckin cannot increase its store count, its sales growth will be equivalent to GDP growth.

Luckin’s growth of net revenues mainly comes from the expansion of its stores rather than the average sales/store. Table 1 shows Luckin’s revenue growth compared to its growth in stores. Note that the average sales/store have been constant since 2018 Q2 and have decreased from 2018 Q4 to 2019 Q1. The decrease is mainly due to a significant reduction in marketing expenses, which reduces the total sales (see the bold numbers).

Table 1. Luckin’s average sales per store, shown in thousand RMB.

2018Q1

2018Q2

2018Q3

2018Q4

2019Q1

Total Net Revenue

12,954

121,509

240,799

465,433

478,510

Total No. of Stores (Ending)

290

624

1,189

2,073

2,370

Total No. of Stores (Average)

150

457

907

1,631

2,222

Average Sales/Store

87

266

266

285

215

Marketing Expenses

-54,412

-178,061

-225,255

-288,290

-168,103

As of July 2019, Luckin had 3,000 stores in China, and growth of future stores will slow down due to the limited market space. The long-term sales growth would then depend on the increase of single-store sales. Luckin can also increase single-store sales by increasing the unit price. However, the price per unit has been roughly stable since 2018 Q2.

The average price per unit of Luckin was 9.8 RMB in 2019 Q1 (see Table 2), while the price of coffee shown on the Luckin app was ~24 RMB, and Starbucks’ standard coffee price is 25 RMB. Therefore, it offers a 60% discount to its customers through coupons on average.

Table 2. Luckin’s price per unit, shown in RMB. Source: Prospectus.

2018Q1

2018Q2

2018Q3

2018Q4

2019Q1

Total Net Revenues

12,954

121,509

240,799

465,433

478,510

Unit Sales (monthly)

488

4,001

7,760

17,645

16,276

Price per Unit

9

10

10

9

10

Table 3 shows the standard coffee price of Luckin compared with its competitors in China. KFC and McDonald’s (MCD) both price their coffee low. With competitors’ distribution, it is almost impossible for Luckin to raise the coffee price to 20 RMB/cup, its estimated breakeven price.

Table 3. Luckin’s Standard Americano Coffee price vs. its competitors. Prices in RMB.

Standard Coffee Price (Per Cup)

Starbucks

25

Luckin (pre-discount)

21

KFC

14

McDonald’s

13

7-Eleven

6

Luckin (Post-discount)

10

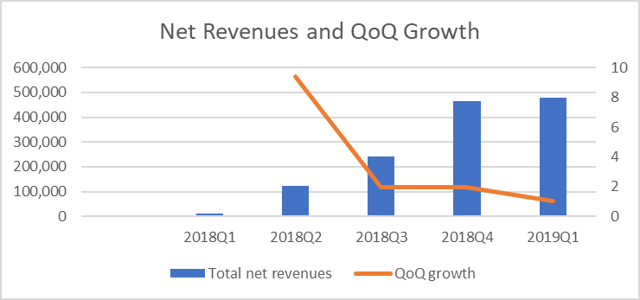

Recently, Luckin’s revenue growth has slowed as it cut its marketing expenditures (see Figure 3). Revenue in 2019 Q1 grew only 2.8%, compared to 2018 Q4. This quarter-over-quarter (QoQ) growth does not justify a 20x P/S valuation.

Figure 3. Luckin’s quarter-over-quarter growth. Source: Prospectus.

Luckin’s costs suggest it provides substantial compensation to customers. This is unsustainable over the long term. According to the most recent financial statement in 2019 Q1 (shown in Table 4), a cup of coffee is sold for ~10 RMB, while it required materials of 60% or 6 RMB, rent and operating costs counted 60% or 6 RMB, depreciation counted 2 RMB, sales and marketing was 3.5 RMB, and general and administration expenses were 3.6 RMB. This suggests that Luckin lost about 11 RMB per cup of coffee (110% of revenue).

Even if Luckin cuts its selling, general and administrative expenses (SG&A), it is still far from profitable, as the rent, store operation, and the costs of raw materials are 120% of the price of a cup of coffee (shown in Table 4).

Table 4. Luckin’s revenue and operating expenses, in thousand RMB. Source: Prospectus.

2018Q1

2018Q2

2018Q3

2018Q4

2019Q1

Net revenues

9,575

100,518

192,666

346,850

361,095

Freshly brewed drinks

1,403

8,449

34,397

91,393

83,980

Other products

1,976

12,542

13,736

27,190

33,435

Others

Total net revenues

12,954

121,509

240,799

465,433

478,510

Operating expenses:

% of Revenue

Cost of materials (1)

-9,419

-75,771

-151,648

-295,379

-275,812

-58%

Store rental and other operating costs (2)

-20,224

-99,939

-172,547

-283,534

-282,371

-59%

Depreciation expenses (3)

-3,965

-14,973

-28,873

-58,879

-83,979

-18%

Sales and marketing expenses (4)

-54,412

-178,061

-225,255

-288,290

-168,103

-35%

General and administrative expenses

-39,022

-74,916

-118,298

-147,502

-172,962

-36%

Store preopening and other expenses

-11,085

-21,296

-29,793

-35,620

-22,374

-5%

Total operating expenses

-138,127

-464,956

-726,414

-1,109,204

-1,005,601

210%

From Table 4 above, I estimate that Luckin’s breakeven price is 20 RMB/unit, because its cost of materials is 6 RMB/unit, store rental & other operating costs are 6 RMB/unit, depreciation expense is 2 RMB/unit, sales & marketing expense is 3 RMB/unit, and general and administrative (G&A) expense is 3 RMB/unit. These are necessary costs associated with coffee. Adding these up gives me 20 RMB/unit. The SG&A has taken in the scenario of future expense cut. If Luckin increases its price to 20 RMB/unit, it will lose a big portion of coffee sales due to the competitive pricing offered by competitors.

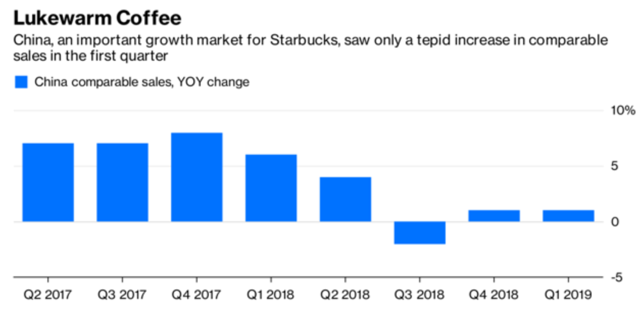

The coffee market is not a fast-growing industry in China. Luckin claimed in its prospectus that the coffee market would have a compound annual growth rate (CAGR) of 26% from 2018 to 2023. This number is misleading. Starbucks noted in its earnings release that its Chinese sales in 2019H1 grew from $1,308 million to $1,432 million, representing a 9.4% increase year over year (YoY). That increase was mainly due to an increase in the number of stores, which grew from 3,382 to 3,922 or 16%. The comparable sales (single-store sales) growth for Starbucks in the recent quarter was only 6% YoY, which is even lower than the 7% growth in the United States. Figure 4. Comparable sales for Starbucks in China. Source: Bloomberg.

Figure 4. Comparable sales for Starbucks in China. Source: Bloomberg.

Moreover, the failures of some of Luckin’s competitors also demonstrate that the market is very competitive. Coffee Box, a digitally-driven coffee brand in China, was founded in 2012 and received 400 million RMB in funding since its inception. Recently, Coffee Box cut 30% to 40% of its stores, as these stores had negative gross margins. U.B.C. came to China in 1997 and grew to have more than 3,000 outlets. Today, it has fewer than 200 outlets across China. Even though the Chinese market is big, there are many failed or closed coffee stores. Creating a consistently profitable coffee business is not easy.

Luckin tells the story about market potential of China, in which a Chinese person consumes 6.2 cups of coffee each year, much lower than 279 cups in Japan and 388 cups in the United States. However, it is a fallacy that Chinese per capita coffee consumption can ever converge with the rest of the world. China will remain China, because of consumers’ habits. There has not been much change from the past, and the recent thriving of fusion-style milk tea demonstrates that tea will be the predominant drink in China.

According to the data from Meituan, an online food delivery website, milk tea orders rose 24-fold from 2016 to 2018, higher than the 10-fold increase in coffee orders. Milk tea is taking over the freshly made drink market and eroding the coffee market in China (see Figure 5).

Figure 5. Number of freshly made drink stores, tea vs. others. Source: Financial Times.

Milk tea chains, such as Hey Tea and Nayuki, are growing very rapidly with strong backing by private equity (PE) investors. The biggest milk tea chain in China, Hey Tea, is said to have finished its Series B round of financing with a valuation of ~$1.3 billion this year. Hey Tea currently has ~300 stores in China, an increase from 100 stores in early 2018. More importantly, Hey Tea has said its total sales reached 1 billion RMB in 2018, and it was profitable in 2018. I estimate its sales at roughly 1.5 billion RMB in 2019, indicating a 6x P/S ratio.

Another milk tea chain, Nayuki, finished its A+ round of financing in 2018 with a valuation of ~$870 million, and it currently has over 200 stores.

Figure 6. Nayuki’s and Hey Tea’s digital platforms. Source: WeChat mini-apps.

Almost all of Luckin’s competitors have adopted the WeChat mini-apps as their order and delivery platforms, including Nayuki and Hey Tea (shown above). The mini-app can be used for pickup or delivery service. It is said that the WeChat mini-apps can be set up with a very minimum cost, much lower than building an app.

Compared with Chipotle (CMG), Starbucks, Yum China, and Meituan-Dianping (MEIT), Luckin’s forward price-to-sales ratio is ~20, based on the price of $23/ADS, far above its competitors (see Table 5).

Table 5. Comparison of valuations.

P/S

P/E

P/OCF

Chipotle Mexican Grill

4

100

34

Starbucks

4

25

10

Yum China

2

24

15

Meituan

4

Negative

Negative

Luckin

20

Negative

Negative

Luckin’s profitability and earnings quality are lower than those of its competitors (see Table 6). Luckin’s annual SG&A exceeded its revenue, and its return on assets (ROA) is -46%.

Table 6. Comparison of Key Financial Metrics

SG&A/Revenue

Gross Margin

ROA

Chipotle

7%

33%

8%

Starbucks

7%

33%

19%

Yum China

10%

20%

16%

Meituan

33%

23%

-96%

Luckin

113%

37%

-46%

As is shown in Tables 5 and 6, Yum China is a better candidate to invest in, as its ROA and SG&A/Revenue are both optimal, and its price/operating cash flow (P/OCF) is only 15. Besides, the earnings quality of Yum China is better. Because of its well-known brands, including KFC, Pizza Hut, and Little Sheep, Yum China offers stable cash returns.

When comparing Luckin with the candidates in the primary market, I found that Hey Tea is clearly a better option, based on its current P/S ratio. Hey Tea has said that it had approximately 1 billion RMB to 2 billion RMB in sales in 2019. Assuming its current sales are 1.5 billion RMB (the numbers may not be accurate as Hey Tea is not a public company), Hey Tea’s P/S ratio is only 6 (based on its latest valuation of 9 billion RMB), which is much lower than Luckin’s P/S ratio of 20. Therefore, Luckin is significantly overvalued by the market.

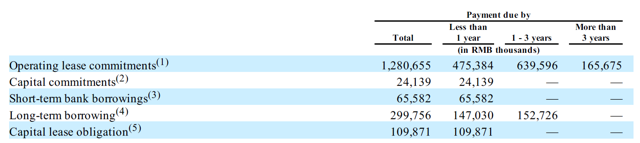

Luckin has raised capital of ~$650 million after the IPO, and it currently has $173 million cash. Table 7 suggests that Luckin would need to pay ~$74 million for non-operating contractual obligation, and it is going to spend ~$372 million (2019 Q1 operating cash flow -$93*4 = -$372 million) in operation for next four quarters. Consequently, the cash burn rate is approximately 1.8 years.

If Luckin chooses to pursue an M&A strategy, it could purchase another fast-growing milk tea chain and merge it into its sales platform. However, with the cash on hand, Luckin can only afford to merge with one potential milk tea company. The opportunity is limited.

Table 7. Luckin’s contractual obligations as of March 31, 2019. Source: prospectus.

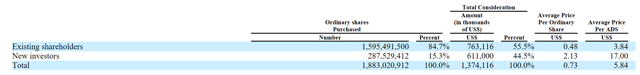

According to the prospectus, the existing shareholders of Luckin scored an average of 6x return from Luckin’s IPO. As is shown in Table 8, the average price per American Depository Share (ADS) for existing shareholders is $3.84, compared with the current price of $23/ADS. Considering that Luckin is only a two-year-old company, the return is incredible.

Table 8. Existing shareholders’ average price per ADS. Source: prospectus.

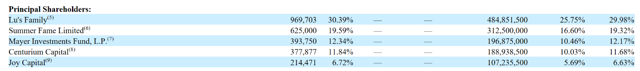

Moreover, two existing shareholders together hold ~18% of the company. The head of Centurium Capital used to serve in Warburg Pincus and invested in CAR, Inc., the Hong Kong-listed company, which the core management of Luckin founded before. Also, the head of Joy Capital used to serve in Legend Capital and invested in CAR, Inc., too. It is reported that Warburg Pincus and Legend Capital have sold off ~$400 million and ~$210 million of CAR, Inc.’s stocks in Q2 and Q3 of 2015, respectively, roughly one year after CAR, Inc.’s IPO. After the sell-off, the stock price tumbled.

Table 9. Luckin’s principal shareholders. Source: prospectus.

Lu Zhengyao, Luckin’s founder and president of the broad, was the president of CAR Inc., and Qian Zhiya and Yang Fei, Luckin’s CEO and CMO, were COO and CMO of CAR Inc., according to the article Why It’s time to wake up and smell the coffee on Luckin.

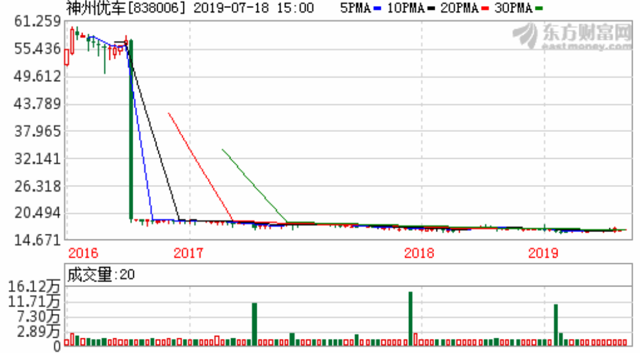

The historical stock prices of the two other companies founded by Luckin’s management are shown in Figures 7 and 8. The founder did not focus on managing only one company; instead, he founded two more companies and took them to IPOs. He founded CAR, Inc., a car rental business (HKG: 0699) and later founded UCAR (NEEQ: 838006), which is a Uber-type of business, and Luckin, a coffee business. This would be acceptable if he could manage all three types of businesses well and generate continuous returns for investors. However, he switched his focus twice, and the stock prices of the first two companies, CAR Inc. and UCAR, declined since their IPOs.

Figure 7. The historical stock price of Car, INC. (HKG: 0699)

Figure 8. The historical stock price of UCAR (NEEQ: 838006)

Investors need to be alerted on possible sell-offs by existing shareholders of Luckin after the lock-up period, given that the current return rate is high, and the investors who hold roughly 15% of Luckin sold off Mr. Lu’s past company CAR, Inc. approximately one year after the IPO.

Luckin did a great job telling its story for its IPO, including the estimated 26% CAGR in coffee business and per capita coffee consumption of Chinese consumers vs. western consumers. This made this candidate seem very attractive. However, there are many instances when a beautiful blueprint described by management did not come true, so the stock price declined. These include CAR, Inc. and UCAR. Moreover, investors need to be careful about buying into the concept that the coffee industry is promising in China. Coffee Box and U.B.C. coffee have made significant cuts to their numbers of stores to stay alive.

Luckin’s app has a large group of users. It ranks in the Top three in downloads in the food and drink category on iOS and Android OS. However, Luckin can quickly lose its customers to competitors’ couponing activities.

Luckin faces significant challenges. The biggest challenge is to raise the price of coffee to a breakeven level without losing customers, and to do this in a highly competitive market with consumers highly sensitive to price. Before Luckin can reach a breakeven price, we may see the number of stores decreasing or the existing shareholders start to liquidate their equity, once the lock-up period ends, thus suppressing its price.

Moreover, the coffee industry is not a fast-growing industry in China. China will not converge with the rest of the world on its coffee consumption because the culture is different and its choices of beverage are different, as shown by the thriving fusion-style milk tea business. Even though Luckin has launched its milk tea products, it will be difficult for Luckin to capture a noticeable market share in milk tea, considering that Hey Tea and other milk tea chains have a strong presence in the market. Hey Tea and other upcoming IPO companies in the milk tea market could be better candidates.

The market has high expectations for Luckin; with a 20x P/S, it is overvalued. Investors might not be aware that the milk tea chains in China are valued at ~6x sales in the primary market and are growing much more quickly than the coffee chains.

Luckin may raise additional funds by issuing new shares to continue its strategy, and it may be profitable after a very long time. However, investors will not keep investing in a company that is not showing profitability. Investors might also be deterred from buying Luckin shares by outside events, such as existing shareholders starting to sell off equity, or better IPOs in the same industry. With Luckin’s current liquidity, the chance that Luckin can present signs of profitability is low.

If my above analysis is correct, Luckin’s long-term stock trend would likely follow Uxin (UXIN) or NIO (NIO), the similar cash-burning businesses in China, and it is a good opportunity to short Luckin at 20x P/S.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.