The announcement that the investors of Starbucks (NASDAQ:SBUX) should be more concerned about today should be that of the largest acquisition in the history of the company, rather than its third-quarter results. On one hand, analysts and market watchers have been pressing the management for actions to ameliorate the stagnating growth in the U.S. On the other hand, commentators are questioning the wisdom of the deal to acquire the other half of its East China joint venture which operates stores in three thriving Chinese provinces – Shanghai, Jiangsu, and Zhejiang. The three coastal provinces are among the richest in China (see the map from The Economist below), demonstrating the lucrative potential enjoyed by the JV. Even though the GDP growth in these provinces (6.8-7.8%) are not as impressive as those in the inner region such as Chongqing (10.7%) and Guizhou (10.5%), this is due to the effect of a larger base. In essence, the more than 6% GDP growth is very enviable when compared to other developed countries.

Based on reported figures, Starbucks Shanghai has a revenue of NT28 billion and a profit of NT4.13 billion (in New Taiwan dollars as the reporting shareholder were Taiwan-based Uni-President Enterprises Corp. and sister company President Chain Store Corp.). This gives a profit margin of 14.75%. In the deal, Starbucks will also be selling its operations in Taiwan to the two Taiwanese firms. From the angle of profit margin, this exchange, or streamlining exercise, is clearly more favorable to Starbucks. Shanghai Taiwan has a revenue of NT9.6 billion and a profit of NT770 million, giving a profit margin of just 8.02%, almost half that of the Shanghai counterpart.

While Starbucks Shanghai was swapped at a P/E of 9.7x (acquisition cost of NT40.11 billion) and Starbucks Taiwan changed hands at a lower P/E of 7.0x (acquisition cost of NT5.42 billion), Starbucks still got the longer end of the stick. This is because of the superior growth rate in East China, compared to Taiwan. Taiwan only managed to grow its economy (in terms of GDP) by 1.5% in 2016. For 2017, the country is expected to do better. However, the GDP is still only projected to rise by 2% despite strong global demand for its technology exports. As mentioned earlier, the three East China provinces were growing at 6.8-7.8% in terms of GDP.

In another sign that the deal is tilted in favor of Starbucks, the share prices of its Taiwanese partners, Uni-President Enterprises Corp. and President Chain Store Corp., were down 3.3% and 7.8% today respectively. It is unfair to compare with Starbucks’ 6% fall after-hours as in Starbucks’ case, the decline is largely attributed to the third-quarter results and forward guidance.

Source: Google Finance (TPE is the ticker code for President Chain Store Corp. while 1216 is the ticker code for Uni-President Enterprises Corp. – both are listed on the Taiwan Stock Exchange)

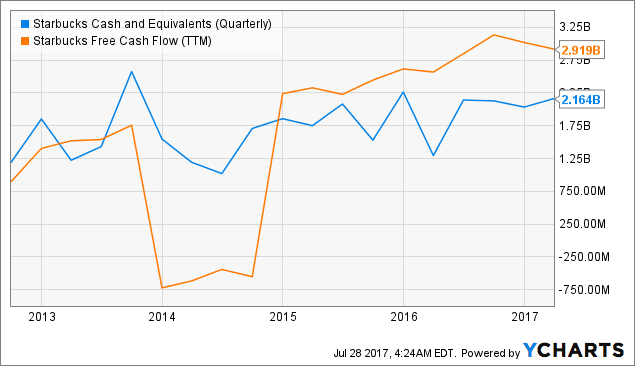

From the perspective of Starbucks’ cash holdings, the $1.3 billion deal is well within its “budget” considering the $2.16 billion cash and cash equivalents as well as a strong $2.9 billion free cash flow on a trailing-twelve-months basis. Money spent in exchange for growth.  SBUX Cash and Equivalents (Quarterly) data by YCharts

SBUX Cash and Equivalents (Quarterly) data by YCharts

On a one-year basis, the share price of McDonald’s (MCD) has rocketed 31.36% while Starbucks (SBUX) has only risen 2.85%, and this is before the 6% plunge in prices in after-hours trading yesterday. Comparatively, the S&P 500 has climbed 14%. Even the deemed laggard, PepsiCo (PEP) rose 9.17% in the same period. I appreciate that the two companies used in the discussion are not obvious comparables of Starbucks. However, which publicly listed companies could I use? It is also telling that there isn’t a clear competitor to Starbucks. SBUX data by YCharts

SBUX data by YCharts

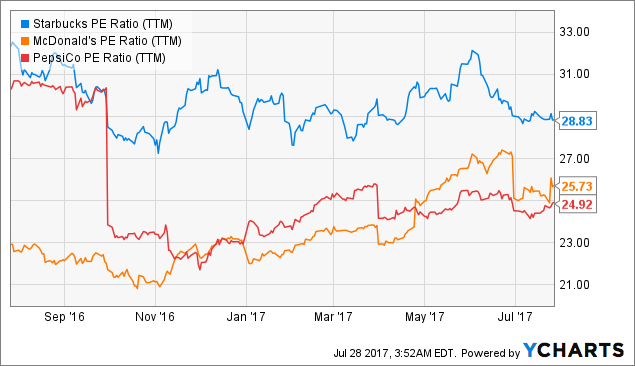

Well-meaning commentators have cautioned on the high price-earnings ratio of Starbucks. Despite the spectacular share price increase of McDonald’s in the past months, its P/E at 26x remained lower than Starbucks’ 29x. However, the multiples gap between the two companies has shrunk since November last year. Starbucks was trading at around 27x earnings while McDonald’s was trading at only 21x earnings. Mathematically, the multiples gap has fallen by half.  SBUX PE Ratio (TTM) data by YCharts

SBUX PE Ratio (TTM) data by YCharts

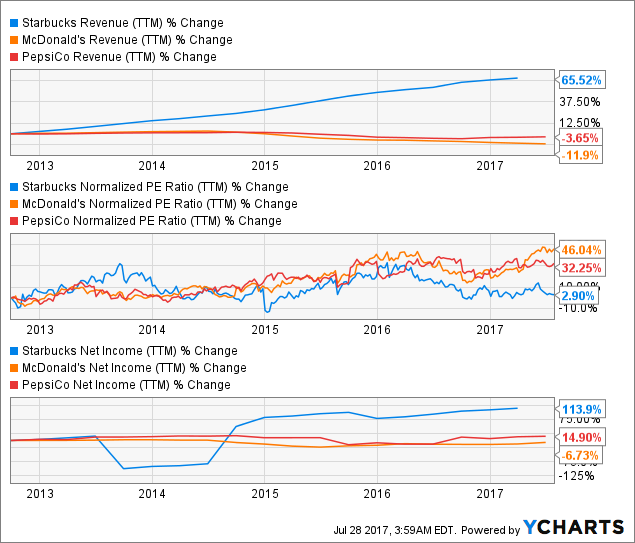

Looking at a longer time-frame, while the five-year revenue changes for McDonald’s and PepsiCo are negative, Starbucks rose an impressive 65.52% in that period (not yet factoring the 8% year-on-year increase reported for the third-quarter period announced yesterday). Starbucks is not a growth-at-all-costs company. In the five-year period, its net income expanded by 114%, compared to just 14.9% for PepsiCo and a negative 6.7% for McDonald’s. Despite the favorable set of performance, its earnings multiple was largely unchanged while the market rewarded the other two companies, McDonald’s and PepsiCo. It appears as though Starbucks was priced for perfection five years ago and after so long, it’s back to square one. This seems unfair to Starbucks considering its consistency.  SBUX Revenue (TTM) data by YCharts

SBUX Revenue (TTM) data by YCharts

The coffee drinking culture is spreading like wildfire in China. Coffee consumption in China has almost tripled in the past four years, based on a study by the United States Department of Agriculture. Shanghai-based China Market Research Group projected that the coffee consumption in China will grow about 20% annually, as the relatively well-off shift their spending from material goods like luxury bags to experiences such as coffee drinking. To harp on the point that few in China truly enjoy coffee relative to the percentage of the population that prefers tea is to miss on the tremendous growth opportunity that Starbucks is trying to capture. Travelers to China would notice the sprouting of locally branded cafes. If a Starbucks store is not available to fulfill the desire for premium coffee and a venue for casual gathering as well as business meetings in any location of critical mass, then a local equivalent would be happy to fill its shoes. Tourists are another group that Starbucks are attracting into its Chinese stores. Just as the Chinese stores of McDonald’s (MCD) and KFC (YUM) have traditionally served to provide the familiarity and comfort to tourists and expatriates, Starbucks is the next ideal alternative. Starbucks is wise to put its comfortable cash hoard to good use. Investors would do well to not miss the forest for the trees.

Note from author: Thank you for reading. My articles revolve around a subject or angle that I feel might have been overlooked. If you would like more of such articles and wish to be informed as soon as they are published, please click on the “Follow” button below the title near the top of this page and check the “Get email alerts.” If you have additional insights on the topic or contrasting views, please kindly share them in the comments section.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SBUX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.