Hormel Foods (NYSE:HRL) is my favorite blue chip stock, my largest personal holding, and also the company I just bought another big chunk in January as the price dropped.

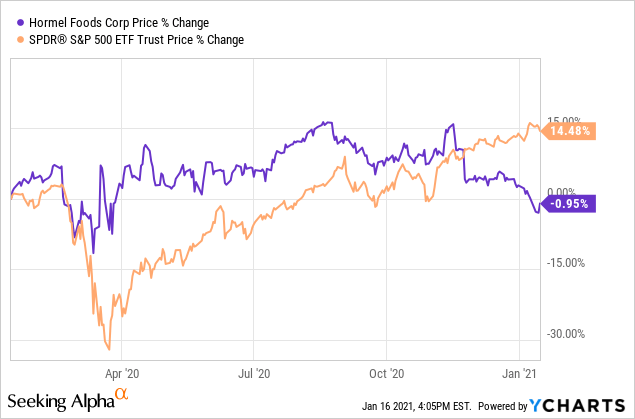

I know I’ve discussed Hormel frequently in the past. However, it’s worth summarizing the thesis and laying out the highlights again. HRL stock has dropped significantly off its highs, even as the rest of the stock market continues going straight up.

That’s set up a tremendous opportunity to lock in HRL stock here at the same price it was selling for last year, even as everything else has gotten more expensive. From this price, HRL stock should deliver double-digit total returns for at least the next decade, and do so at exceptionally low risk.

Why Hormel Is My Largest Holding

Hormel is unique in that it offers such strong returns — it crushes the market over any longer-term timeframe. And it manages to do so while having minimal downside risk. The company has no net debt, so its stock is immune to all short-term financial crises or liquidity shocks. Hormel is also able to (and often does) make acquisitions on good terms since it always has cash on hand and can close deals quickly without needing to raise funds.

The company’s products are not at risk of technological disruption nor significant changes in consumer demand. That may seem true of all consumer staples companies, but it’s actually not. Many firms have stuck to old brands that are no longer in fashion or on top of nutritional trends. Many dated product categories like cereal, soda, and crackers are in seemingly slow but irreversible long-term decline.

Hormel’s management team’s central mission is to avoid that fate. The company prides itself on generating 15% of its revenues from new products launched over the past five years. It invests heavily (by food company standards) in R&D and is always rolling out line extensions and new formats for existing products (it’s taken huge share in the emerging meat and dairy snacks category, for example, by figuring out that convenience store shoppers wanted an alternative to usual junk foods long before the rest of the market woke up to the nascent protein revolution).

The company also focuses on being agnostic — it wants to sell you whatever protein you want. If you want almond butter and plant protein-based “meat”, it’s happy to sell that. If you want organic high-end deli meats, it is now a leader in that. It just bought a major barbeque business. And they were first to jump into turkey on a national level almost two decades ago, helping to bolster turkey’s popularity as a leaner alternative to traditional offerings. Hormel anticipates what consumers will want five years from now and prepares accordingly.

Yes, Hormel is known for SPAM. Many people instinctively wince when they think about that product. But, you’re probably not the target audience for it. There’s a huge regional community within Asians and Latinos that like canned meat and SPAM in particular. Just as Hormel has bought specialty nut butters, organic meats, and the nation’s leading guacamole to appeal to certain consumers, it’s happy to sell SPAM and other products to different demographics.

As the CEO says, we are the protein company. As shareholders, it doesn’t matter which proteins are more popular any given day as long as we’re gaining market share. Also, for what it’s worth, SPAM sales have hit new record highs each of the past five years, so that’s not bad for a legacy product.

Hormel focuses on having all its brands as the #1 or #2 player in its category. And it tends to divest brands which it can’t get to that point. When you go to a grocery store, if you want to buy something that Hormel sells, they’re generally going to have the biggest shelf space of it. In some cases, it may be the only one of that type — how many brands of ready-to-eat guacamole, corned beef hash or chocolate hazelnut butter do you need? Particularly with the way shopping is shifting, you’d rather own 50% market share in a bunch of small categories with fat profit margins rather than being one of eight different cereal or ketchup sellers.

How Much Would You Invest In A Bond Fund That Averaged 13% Returns?

I see Hormel stock as my functional equivalent to fixed income. Not just Hormel, mind you, but many other such names likes Diageo (DEO), Hershey (HSY), McCormick (MKC) and so on. If you buy a stock like Hormel and decide not to sell it for at least a few years, in the vast majority of cases, you’ll end up with way more money than you invested.

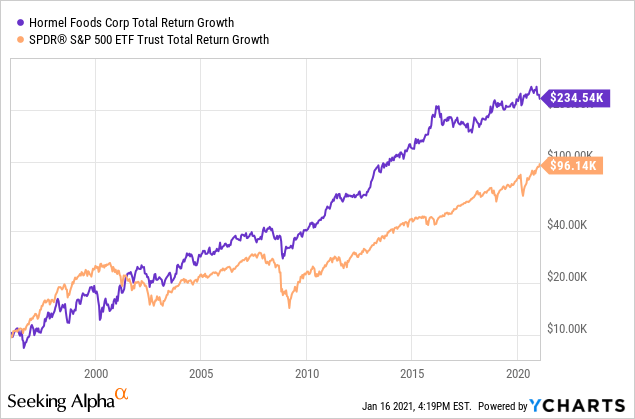

If you invested $10,000 in Hormel 25 years ago, you’d now have $234,000. That’s compared to $96,000 for the S&P 500. Not only did Hormel make owners twice as much money as the market, it did so with far less risk and volatility. At what point did Hormel stock ever make you uncomfortable as a long-term holder? The biggest drawdowns — in 2000 and 2008 — only gave back two or three years of previous gains.

Hormel always bounces back quickly as well. Look at the financial crisis, for example. By 2012, for example, the S&P was just barely getting back to where it was in 2007. Hormel, however, had already doubled its shareholders’ money versus the previous peak.

For great long-term returns, it’s vital to avoid drawdowns. If you lose 50% of your money, as the market did in 2008, you need to make 100% just to get back to even. If you drop 80%, you need a 400% gain to recover that lost ground. When you fill your portfolio with stocks that almost never draw down materially, it makes it far easier to keep the portfolio advancing steadily. As long as you keep losses small, the gains will take care of themselves.

Back to Hormel specifically. The company’s stock price is a nearly straight 45 degree line going up and to the right because that’s what the company’s earnings look like. It has grown earnings 28 out of the past 32 years, and has, in aggregate, consistently grown earnings at more than 10%/year compounded for decades. Management is incentivized to hit that number, and they are very good at their job.

It’s really hard for your stock price to go down for long when earnings reliably hit new record highs. In 2008, for example, Hormel’s earnings dipped by just a couple of percent. By contrast, the S&P 500 as a whole briefly became loss-making due to the financial crisis. Hormel gets you more returns than the market and keeps operating as business as usual even during 2008 and now Covid-19.

The stock market could drop 50% for whatever reason next year and Hormel would only go down 10 or maybe 20%. Why’s that? Because HRL stock is trading slightly cheap to its normal valuation now (I’ll debunk the myth that the stock is expensive in a second.) And its earnings will be higher next year than they are this year. If you don’t overpay for starting earnings and earnings almost always grow on a business with no debt, it’s really hard to lose any significant amount of money.

—

I know some folks complain about treating stocks as though they were bonds. And sure, many companies that people view that way are low-quality and will cut their dividends during hard times. Be wary of which companies you treat as money-good holdings.

That said, there are a select number of companies that will reliably grow earnings and thus your dividend each and every year and which are invulnerable to economic shocks. A food company that is obsessed with new products, which has no debt, and that can’t be manipulated by outsiders (because the Hormel Foundation owns half the company) is the absolute bluest of blue chips. Every year, they’re going to grow earnings by around 10% and put up a similar dividend hike. HRL stock yields more than bonds on a starting basis, and will grow your yield far more quickly than an income fund would.

But Isn’t It Expensive?

I know Hormel is still underappreciated because I don’t see many people adopting my view of the company despite my various attempts to improve peoples’ perceptions of the firm. Plus, it remains one of the most heavily-shorted companies in the S&P 500. Hormel has short interest of 8% of the float, which likely led to the brief sharp rally in HRL stock last week along with the other short squeeze names.

Back to the main point though. The core issue is that Hormel seems to have a high P/E ratio, generally in the low-to-mid 20s. On occasions, such as 2016, the P/E has gone over 30. This turns off most folks who take a cursory look at the stock.

However, there are two factors to consider here. One, Hormel has been underearning the past couple of years because the turkey market had its worst run ever. That is turning the corner now, so 25% of Hormel’s business will return to normal profitability soon. Also, margins on their guacamole business have been subpar due to a massive avocado shortage. Growing in new countries such as Peru and Colombia should soon replace the lost Mexican supply and fix profits there as well.

That said short-term earnings noise is not too relevant to my view on Hormel. The bigger issue is that people don’t give it credit for the balance sheet.

Now let me show you the straight math that shows the importance of having no debt as compared to an average food or drinks company. Hormel operates at 0x Debt/EBITDA gearing, since, of course, it has a net cash position.

It’s pretty typical for packaged foods, alcohol, and other such staples to run around 2-3x Debt/EBITDA. Above 4x, you start getting into the danger zone if anything goes wrong. Around 5x, you risk losing your investment grade credit rating. AB-InBev (BUD) got up to 6x at one point during its shopping spree and we know what happened with the dividend and stock price there. Kraft reached a similar level, and McCormick briefly hit 5x when it made its French’s/Frank’s acquisition as well.

So that’s the outer limit. More generally, staples companies tend to like the 2-3x range. Diageo, for example, explicitly targets 2.5x and sets its dividend and share buyback policies expressly to help keep leverage right on that mark. They must be doing something right, as they’ve maintained the same “A” credit rating for the past 15 years.

Hormel earns roughly $1.5 billion in EBITDA every year. So at a Diageo level of leverage, it could add $4 billion in debt tomorrow and be in line with peers.

At today’s stock price, Hormel could, in turn use that $4 billion of borrowed funds to repurchase 90 million shares of HRL stock. (This wouldn’t work in practice as the stock would spike once they announced their plans to do this, but in theory…)

Hormel has 540 million shares of stock, so retiring 90 million of that would take out almost 20% of the outstanding supply of shares. Additionally, since the Hormel Foundation owns half the company and is never selling, there’s actually only 280 million shares available to the general public. Repurchasing 90 million shares out of a 280 million supply would set off a massive short squeeze, given that 25 million shares are short now and the stock is pretty tightly held.

But I digress. Where are we once Hormel has levered up to 2.5x Debt/EBITDA, like many other responsible consumer goods companies such as Diageo?

Hormel is going to earn $1.1 billion in net income next year, give or take $50 million. The market cap is currently $25 billion. But we just shrunk that to $21 billion by retiring 90 million shares with the money we borrowed from the bank at 1%/year. So Hormel is trading at less than 19x its earnings if it used the same leverage as companies like Diageo which have great credit ratings.

Let’s say Hormel decided to spice things up a bit and go up to 4x leverage, a la McCormick after its recent acquisition. Now Hormel can go borrow $6 billion, and repurchase 133 million shares of its stock (nearly 50% of the open float!). In this world, the market cap is now down to $19 billion and Hormel stock is trading at 17x earnings. Simply from using the same amount of debt as McCormick, we’ve turned Hormel into a value stock.

And remember, if you own McCormick (or another similarly levered company) you’re fine with this sort of financing. When you look at McCormick’s P/E ratio of 30x or whatnot now, it’s at that level even while baking in a massive chunk of debt. Yet, when you just compare P/E to P/E, you’re looking at companies that are lathered up in debt against one with no debt whatsoever. If you don’t do some math to equalize the two, you’re really not seeing the full picture.

If Hormel used the same amount of leverage as McCormick, it’s selling for around 17x earnings today. By contrast, if McCormick issued enough stock to pay off all its debt tomorrow and thus have the same balance sheet as Hormel, already pricey McCormick stock would go up to a stratospheric valuation.

Yet, on paper, Hormel only looks a little cheaper than McCormick today because comparing P/Es is easy and most people don’t stop and think beyond that. None of this is a criticism of McCormick by the way. I own a big position. But you don’t see me pounding the table on it recently either. McCormick is a fantastic company selling at a full price today and arguably is even significantly overvalued.

Hormel, by contrast, is just as cheap as it usually is (actually, it’s at a discount now), even in the midst of a stock market that has gone full-on bonkers to the upside.

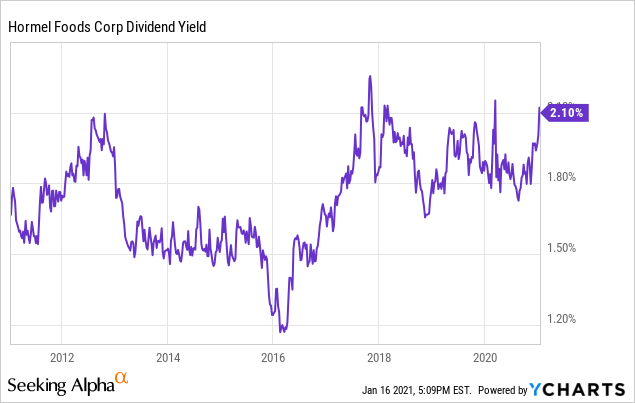

That’s right, Hormel’s dividend is nearly the most generous it’s been in the past decade:

When you buy Hormel, you get a 2% yield on purchase, and then they hike it 10% every year (so it becomes a 4% yield in seven years, an 8% yield in 2035 and so on).

Since the Foundation that owns half the company wants more income every year to run its charity, it’s highly motivated to keep management focused on long-term dividend growth. This is another key feature that makes Hormel (and other Foundation-led companies like Hershey) better than its optically similar peers).

Anyways, as you can see, aside from the three-month dip at the end of 2017 (when I was vigorously pounding the table for Hormel last time) this is the highest yield the stock has offered us over the past decade. The stock was legit expensive in 2016, and only offered a 1.2% dividend at that point.

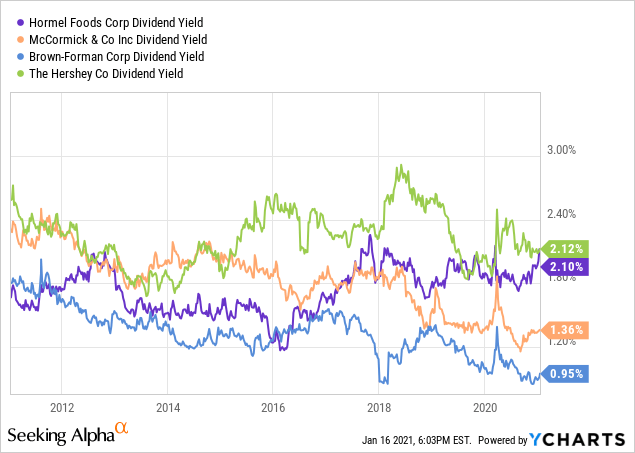

By comparison, as you can see above, many similar companies have seen their yields steadily drop over the past decade. B-F went from a 1.5% yield to 1.0%, for example. Hershey was above 2.5% on various occasions but now pays just the same as Hormel. Hershey should pay a higher yield because their management team is not great and they consistently bungle growth efforts outside the core chocolate business. And then you’ve got McCormick, whose yield has slumped from 2.4% a decade ago to just 1.4% now. Yet Hormel is actually paying a little more now than it did in 2011.

It seems the valuation-based quant strategies are based around P/Es without doing further work. Hormel stock has had a persistent 10% or so of the stock shorted ever since I started buying in the low $30s back in 2017. It didn’t matter what the company did in terms of earnings or share price, the short interest remains extremely elevated.

If you see Hormel as just another General Mills (GIS) selling old-fashioned products to an aging demographic, then I guess the huge short interest makes sense. But anyone that takes time to think through their product lineup and balance sheet would see that Hormel is a far superior company to the generic packaged foods firm.

—

Hormel Foods is not an exciting stock. And right now, many people are using the stock market for entertainment because they’re stuck at home. Throw in the misguided fears around spiking inflation as well, and I get why blue chip defensive yield stocks like Hormel, Kimberly-Clark (KMB), and so on are trending downward.

However, as always, you want to be picking up stuff that other folks don’t want at the moment. Hormel briefly became a trendy stock during the pandemic. Hence I sold HRL stock out of the Ian’s Insider Corner aggressive portfolio in April 2020 as its shares hit new all-time highs while the rest of the market was in tatters. I redeployed the capital into airports near the lows. That may have been lucky timing, regardless it was rooted in human psychology.

Once again, the market seems invincible. Stocks only go up, and no one cares about balance sheets, business quality, or downside risk.

However, as the adage goes, when everyone is greedy, it’s time to be fearful. I was happy to nab all the cheap airports, banks and other risky stuff last year when people were allergic to those sorts of things. Now that everyone else is euphoric, I’m starting to feel worried. And when I feel worried, I tend to buy staples and other defensive stocks.

If I fell into a coma tomorrow and woke up in 2030, I have little doubt that Hormel would be trading for at least double today’s price and be paying me twice as large a dividend as it does now. Given overall market valuations, there are few companies that meet that criteria at the moment. Hence, I’m going back to pounding the table for Hormel stock here.

This is an Ian’s Insider Corner report published in January for our service’s subscribers. If you enjoyed this, consider our service to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian’s Insider Corner service provides live chat, model portfolios, full access and updates to his “IMF” portfolio, along with a weekly newsletter which expands on these topics.

Disclosure: I am/we are long HRL, MKC, DEO, BF.B, HSY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.