Investment thesis

I recommend shorting Disney stock with a price target of $76, 49% below the current stock price of $148. Since announcing details about Disney+, the stock has run up 28%, adding $58 billions in value. The market is anticipating that Disney will be able lever their library of quality content to build a highly-profitable streaming business. I argue that the streaming model isn’t going to be highly profitable because it’ll be harder to retain subscribers, the model lacks pricing power, and production costs are rising. Even if Disney were to create a lucrative streaming model, the market isn’t pricing in the effects of cannibalization on their overall profitability.

Content is king…but the streaming world is democratic

The bull case on Disney is that they are special because they have the best content. I don’t disagree with this, but good content is becoming a commodity. Last year, there were 496 shows produced, double the amount in 2010.

Direct distribution has allowed non-traditional competitors like Amazon and Apple to enter the space. This parallels with how content quality skyrocketed when cable challenged the incumbent broadcasters (ABC, CBS, and NBC).

Everyone has access to bid on the same scripts and talent, which will narrow the quality gap over time. These new competitors have deeper pockets and other than economic reasons for entering the industry.

As the Economist magazine pointed out, over $100 billion will be invested in television content this year. For perspective, the term streaming wars is appropriate as this amount is more than the military budget of every country except America and China.

More broadly, television content competes with other forms of entertainment. Content on YouTube is practically infinite. The younger demographic is addicted to competitive video games like Fornite. Reed Hasting, CEO of Netflix, goes even further by saying that sleep is their greatest competitor.

We have already witnessed cracks in the quality thesis. Sports is an example of how high-quality content doesn’t translate into high profitability. Sports content is considered cultural just like Star Wars and The Simpsons. They tap into our emotional sense of identity and community. Their live nature makes them even more attractive for advertising. However, sports programming is facing deteriorating economics as distribution shifts. As part of Disney’s deal to acquire Fox, they were required to sell their 21 regional sports channels (RSNs) for antitrust reasons. Disney initially expected to sell them for $16-20 billion, but ultimately only got $11 billion for them.

Pricing power

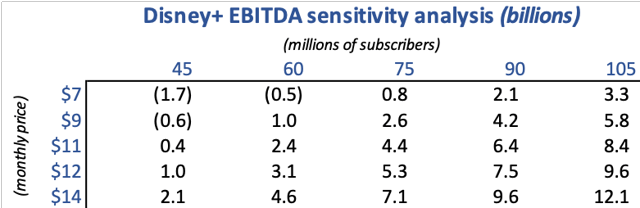

Content loses pricing power in the streaming model. While the Street is focusing on subscriber numbers, Disney will ultimately have to raise prices to reach high levels of profitability as shown in the sensitivity analysis on Disney+ below. I don’t doubt that Disney can achieve their subscriber targets. Netflix has already proven that a global subscriber base can be built, but even with 160 million subscribers, they are not profitable on a cash basis.

Even if Disney+ achieves the high end of their subscriber targets at 90 million, they’ll only generate $2 billion of EBITDA at the current price. For comparison, their legacy television is on pace to earn $8.5 billion in EBITDA next year. Price increases are going to be harder to realize in the streaming model because distribution becomes more competitive. The cable model was able to push pricing because consumers had no alternatives to watch their shows. Furthermore, they levered their control over distribution to force consumers to buy channels as a bundle, regardless of their viewership

Price increases are going to be harder to realize in the streaming model because distribution becomes more competitive. The cable model was able to push pricing because consumers had no alternatives to watch their shows. Furthermore, they levered their control over distribution to force consumers to buy channels as a bundle, regardless of their viewership

In the streaming model, distribution becomes fragmented. Consumers can now chose streaming services on an individual basis, effectively making networks compete against each other for subscribers, whereas they all had distribution given to them in the cable ecosystem.

There are limits to how much Disney can raise their prices given the multitude of streaming options. It doesn’t take many of these streaming services at their current prices to come close to the price of the expensive cable packages that they were intended to displace.

The Wall Street Journal estimates that Americans are willing to spend $44 on streaming per month. With some many options currently in the market, and many on their way, not everyone can win. It’s going to be a race to the bottom. Firms are spending hundreds of billions of dollars over the next few years on content to try to capture a slice of theirs audiences’ fixed budgets.

International price increases are going to be harder to achieve for Disney. International pricing is key as Disney expects two-thirds of their subscribers to come from abroad. While streaming is a cheaper option than cable in America, it’s a luxury in many places around the world. Domestically, the cost of Netflix is 10% of the cost of an average cable bill, while it is more than double the cost of cable in India. Netflix’s international pricing is 27% lower than their domestic.

Churn rate

The churn rate, the gross percentage of customers who cancel their service, in the streaming world is going to be significantly higher than in cable. Churn rate is important because investors rewarded television stocks with high valuations based on the reliability of their subscription fees. Unlike the cable companies who tied their customers with contracts and hardware, switching costs are low with streaming. Viewers can subscribe to Disney+ to watch The Mandalorians, cancel and then resubscribe in time for the next season.

In the second quarter, Netflix reported its first domestic subscriber loss in years. Their management attributed this loss to shifts in their content slate. Subsequently, the company grew subscribers in the third quarter, giving us a sense of how fickle consumer behavior will be as streaming matures.

Disney is trying to lower churn by bundling their streaming services. They are offering Disney+, ESPN+, and Hulu (with ads) for $13. This strategy will be incremental as the offering is an optional; it’s not forced on the consumer like the cable bundle. While Disney’s bundle offers diverse genres of movies and shows, it lacks news and regional sports that would make it universal.

Production costs are going up

The threshold to achieve adequate profitability will be higher as the costs embedded in Disney’s projections are understated. They are projecting $5.5 billion in fixed costs by 2024, comprised of $2.5 billion in original content spend, $2 billion in licensing movies from their own studios, foregoing revenue that they otherwise would have received from Netflix, and $1 billion in overhead expenses from technology costs related to distribution.

Production costs are soaring as the landscape becomes more competitive. “On a very competitive show, there has probably been 30% price escalation since last year” says Netflix’s chief content officer in an October conference call. An average scripted drama episode now cost $6 million, double the rate three years ago. Licensed content like Friends, South Park, The Office, and Seinfeld are commanding contracts of around $500 million each.

Disney is vulnerable to the debt-like nature of content costs. Shows have to be greenlighted in advance, and like debt, are contractual in nature. Disney doubled down on content with the acquisition of Fox which closed this year. Together, they will spend $18 billion on television content and another $8 billion on movies. Disney’s ESPN has a $15 billion multiyear contract for Monday Night Football that they have to pay regardless of how many subscribers they have.

Trading dimes for nickels

Even if Disney’s streaming offerings become highly profitable, the market is not factoring in the negative effects of cannibalization on their legacy cable business. As streaming grows, the rate of cord cutting will accelerate. Bob Iger, Disney’s boss, thinks that streaming is complementary to cable, but it’s clearly not. This was the same exhausted argument the cable companies used in defense of their businesses as Netflix first started gaining scale. On a net basis, the growth of streaming won’t be enough to offset the losses from their profitable cable business. Disney still has a lot of downside exposure to cable as the industry still has 86 million subscribers, though down from a peak of 100 million.

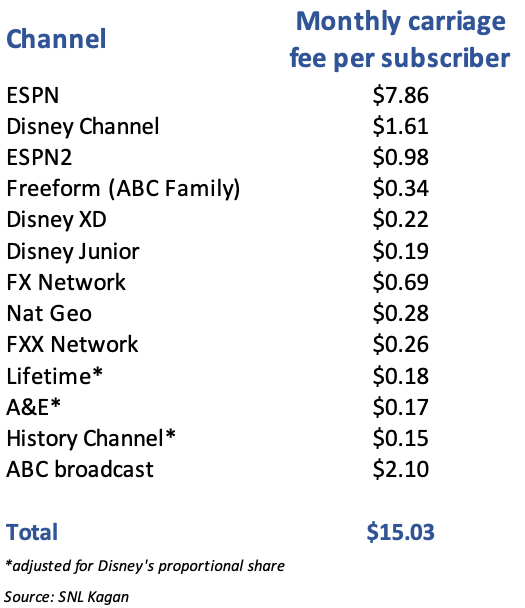

Looking at the unit economics as shown in the table below, I estimate that Disney makes at least $15 per month per cable subscriber from carriage fees. They also generate another $5 per subscriber from advertising. With content costs mostly fixed, every streaming subscriber Disney poaches from cable will be a net negative as their streaming offers are currently priced below $20.

Secondarily, although unlikely, there is a risk that cable companies drop coverage of Disney’s channels or demand to pay them lower carriage fees. Cable companies and networks have had a contentious relationship resulting in temporary blackouts of channels over the years. It’s reasonable to expect some strategic response from cable companies as the industry is dynamic and they are now competitors with Disney. As a precedent, and although on a smaller scale, DirectTV dropped WrestleMania from pay-per-view after WWE launched their streaming product.

Valuation

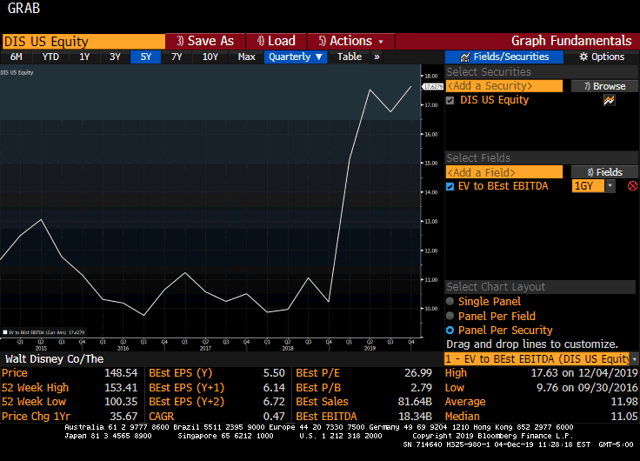

I estimate that Disney’s stock is worth a $76, 49% below the current stock price of $148. As shown in the chart below, Disney’s stock is the most expensive it has been in terms of valuation over the last five years. Valuation has expanded from 13x to 17x EBITDA because of excitement over Disney’s streaming strategy. This is significantly higher than its mean and median valuation of 12x and 11x respectively. Expectations are high, but valuation will contract when the market learns that streaming isn’t highly profitable. Existential questions on Disney’s future will arise at that point as Disney bet the farm on streaming, which will push the stock down to its valuation lows of 9.8x or $76 per share.

Timing / catalyst

Timing is important when it comes to shorting stocks. I haven’t initiated a position yet because positive sentiment will continue over the subsequent months. Management did a wonderful job marketing Disney+ with over 10 million subscribers signing up on the first day of launch. The subscriber numbers will be further inflated when we account for sign ups from Verizon subscribers who get free access to Disney+ for a year. About 18 million Verizon users qualify. The market will likely extrapolate the inflated trends and drive the stock up high, at which point, peak optimism will be the best time to short the stock.

Conclusion

In Bob Iger’s recently published biography, he mentions that Disney had little choice but to get into streaming. Disney is late to game and coming from a position of weakness. The stock has the sentiment of a tech company with the market focusing on subscriber numbers over profitability, but they are disrupting themselves.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.