A reader asked me which of my current portfolio positions I would include if I had to build a “top ten” list of holdings. The question got me thinking about what I would buy today if I wanted to create a small, diversified portfolio with exposure to technology, financial, industrial, consumer, transports and real estate stocks. Think of this exercise as building my very own customized mini index ETF.

I can see it in my mind’s eye. Some of you are asking why should I bother picking stocks when I could just buy an S&P 500 fund and be done with it. After all, what do I think I can possibly do that the S&P 500 can’t?

Answer: Plenty. The basic concept is that I can align my index to my own specific goals and beliefs in ways that the S&P 500 does not (and frankly, cannot). Here are seven specific things I’d do to build an index fund that’s tailored specifically to me:

(1) Unlike the S&P 500, I’d limit my index to companies with A rated credit or above. I don’t carry a lot of personal debt, so why would I invest in an index that includes companies that do?

(2) The S&P 500 includes companies with shaky (or no) dividend histories, but I prefer stocks that pay me dividends I can use to cover my living expenses (or that I can use to buy up more shares). How do I build an index better suited to my needs than the S&P 500? Simple. Only include stocks with lengthy dividend histories and what I see as solid future dividend prospects.

(3) Only US stocks comprise the S&P 500, which makes no sense to me whatsoever. Business tends to be fairly international in scope, so why limit myself to companies headquartered in the USA? I can improve on the S&P 500 simply by including companies incorporated or headquartered anywhere on Earth.

(4) I’d design the portfolio to have a higher dividend yield than the S&P 500. More dividends means more cash in my pocket, which, in my own view, is better than less cash in my pocket.

(5) I’d design the portfolio to have a far lower current P/E ratio than the S&P 500. The reason why is because all things being equal, I’d rather pay less for stock than pay more. That’s how I shop for everything else in life – socks, restaurants, multinational corporations. I’m very cheap and happy to spend far less on stocks than the average P/E ratio for the S&P 500.

(6) I’d maintain the portfolio positions permanently and have a lower turnover ratio than the S&P 500. Less selling means less opportunity to sell at the wrong time.

(7) I’d pay zero management and transactions fees, which means I’d keep all of the returns on my capital rather than sharing any with a deserving asset manager.

So, there you have it. Seven easy improvements that I can guarantee will materialize the nanosecond I invest in my own personal index of hand-picked stocks. Seven clear reasons utterly dismiss the conventional wisdom about index fund ETFs as little more than a marketing ploy to sucker investors into hearing what they want to hear: do less work but earn higher returns! Woo hoo! Now pay us some fees!

But back to my reader’s comment. The problem is that when I looked at my list of stocks, I couldn’t pick only 10. The smallest number I could go with happens to be 14 different companies, some weighted more heavily than others.

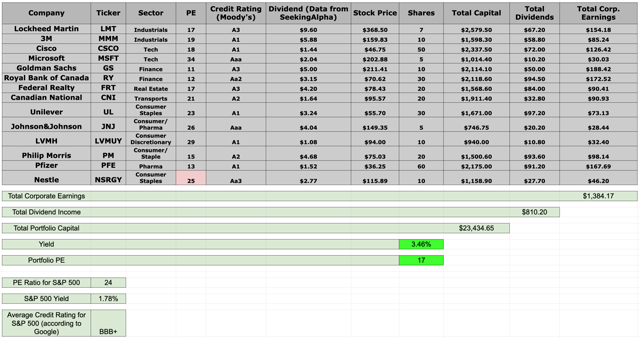

Here is a starting point for what I’d put into my very own personal passive index fund if I had to create one right now from scratch:

(Source: Investment Pancake’s Google Sheets Portfolio)

You can see that what I did was to build a spreadsheet that will automatically update the stock price and P/E ratio for each share while the market is open (except Nestlé’s (OTCPK:NSRGY) earnings, for which I had to input manually using data from Seeking Alpha). I input the average credit ratings which I pulled off Moodys.com, input the current dividends (which I pulled off Seeking Alpha) and then input the number of shares I want to buy for each of my 16 different positions. The spreadsheet then does all the rest and automatically calculates my total portfolio dividends, the company’s earnings per share for each of my positions (which I think of as my share of the company’s overall earnings) and the market value of each position. Feel free to copy my spreadsheet for yourself and adapt it to your own purposes.

Based on how I chose to weight each investment, how does the portfolio stack up against my seven earlier-stated financial goals and beliefs? Was I able to improve on the S&P 500 in the ways I thought I could? Let’s see.

(1) My overall portfolio P/E ratio for the portfolio is only 17, or about 71% of the current P/E ratio of 24 on the SPDR S&P 500 Index ETF (SPY), according to SPDR’s homepage. – Check.

(2) My current portfolio yield is 3.46%, a generous improvement over SPY’s current 1.78% yield. Check. – Or better yet, let’s say “cha ching!”

(3) Every single company in my personal ETF has a credit rating that anywhere from “high” to “prime” – substantially better than the average credit rating of BBB+ for the S&P 500 (according to a Google search result). – Check.

(4) My transaction fees? Zero if I use a commission-free account at any of the large discount brokers such as Vanguard, Schwab, Fidelity, etc. Management fees? None. Next.

(5) My turnover? Zero, as long as I don’t sell anything (and that’s entirely up to me rather than some fund advisory committee). – Check!

(6) International exposure? Yes. Moving on…

(7) Do all my companies have a track record for paying dividends? Oh yes, indeed they do. Hey, did you know that Royal Bank of Canada (RY) has paid a dividend every year since 1870, according to Simply Safe Dividends? There’s one great big ole “check” right smack dab in the middle of my spreadsheet right there, by cracky.

Will my personal ETF outperform the S&P 500? I have no way to know that. Therefore, it does not matter. What I do know (and what, therefore, do matter) are my personal beliefs and goals. Being able to easily satisfy those is reason enough for me to scoff, make raspberry sounds and dismissively flap my hand like a freshly caught fish at any Nobel Prize-winning laureate who tells me that picking my own diversified, passive index of stocks is “irrational.” These guys probably think that stock picking means “short-term trading” or something. Did you hear that loud, obnoxious buzzer sound just go off?

But might I be understating the true cost of my hand-picked passive stock index? I mean, in terms of time. How much time would it take for me to “manage” this fourteen-stock portfolio? Answer: None. Because I won’t “manage” a damn thing. My index is a passive index. It’s not like the S&P 500 or Dow Jones have a monopoly on the right to be a passive index. And as with any passive index, I am not required to study news regarding each index constituent. Do any of you happen to own the SPDR Dow Jones Industrial Average ETF (DIA)? If so, do you carefully study each of the 30 stocks you (indirectly) own through that ETF? I didn’t think so. You’ve got the idea.

Now, to be clear, I’d certainly spend some time picking new companies to add to my index fund, but after buying them, I’d stay out of the way and let the companies I own do the work for me. Oh, and I’d reinvest dividends to turbocharge my portfolio’s compound income growth. I might spend some time reinvesting dividends into whichever stock I own is cheapest at the time. Or maybe by the time my mini index hits 30 or 40 different stocks, I’d just click the DRIP feature for each stock and then go away and do something else with my time for the rest of my entire life. The point is, I control how much time I spend, and it probably won’t be much. Mostly the time would be spent upfront, designing the index. But I’m not afraid of doing a little work. I scrub dishes. I scoop cat boxes. I vacuum. Point is, I’m not scared of doing a little work now and then.

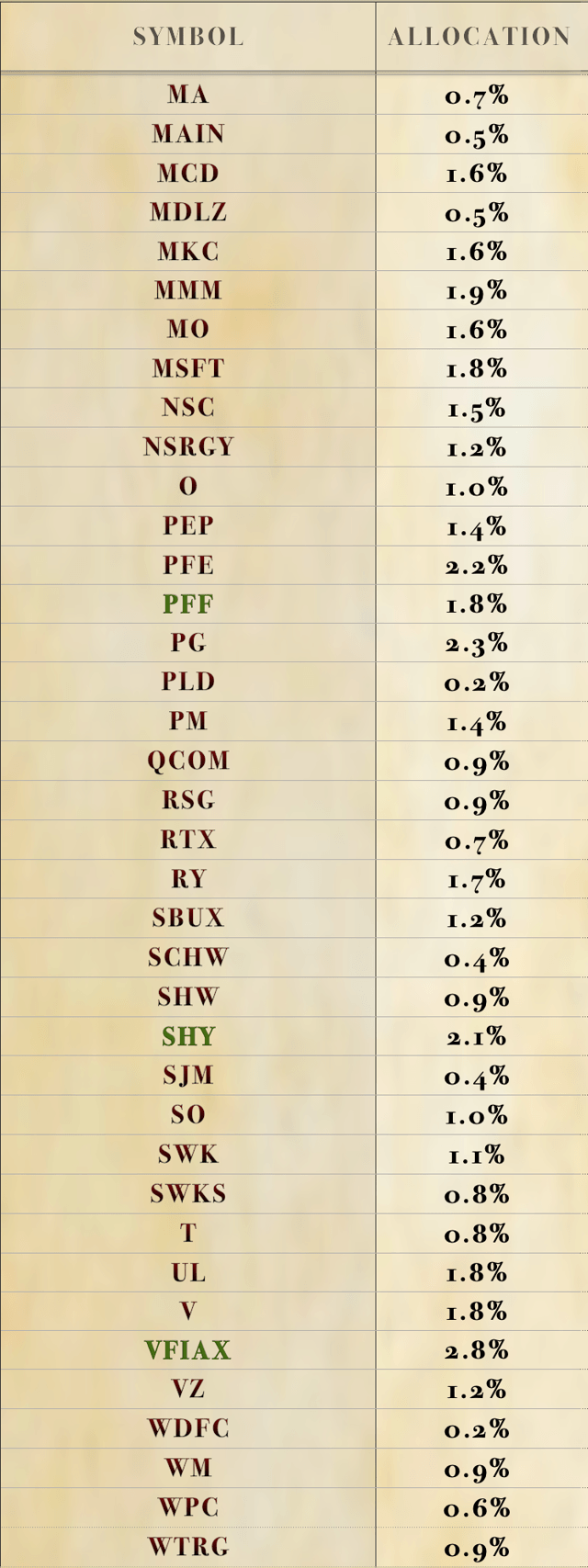

And now we arrive at the end of the article. Some of you are maybe familiar with the fact that I frequently howl about the disingenuous lack of transparency in the investment industry. Not wanting to appear the hypocrite, I therefore make it a habit of disclosing my entire portfolio and portfolio weighting.

This article was written by

Disclosure: I am/we are long VFIAX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long every position in the attached chart and have no other financial positions besides those. I am not an investment advisor and this is not investment advice. What that means is that nothing in this article (links included) is reliable and the whole thing should be enjoyed as one would enjoy, for example, a modestly dull soap opera with none of the romance and very scant amounts of drama.