Every year I like to ask myself “has dividend growth investing worked?” The answer always depends on how you define “worked.”

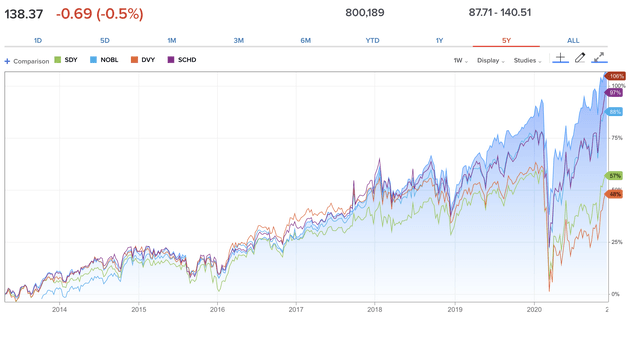

Let’s look at the Vanguard Dividend Appreciation Index ETF (NYSEARCA:VIG). NASDAQ (which is responsible for the design and maintenance of the underlying index) explains that the market-cap weighted index consists of US stocks with at least ten years of increasing regular dividend payments. Simple, limited, straightforward, easy-to-market criterion. Why pick (VIG)? The answer is because it’s one of the oldest dividend growth funds with the largest data set, and because (according to CNBC.com) over the past five years (VIG) has outperformed some of the other largest dividend growth ETFs such as (SDY), (NOBL), (SCHD) and (DVY). As an aside, it’s worth noting that since inception in 2011, (SCHD) has outperformed (VIG) on a dividend-reinvested basis by .34% annually according to Portfoliovisualizer, but studying (VIG) enables you to look back at the data all the way from 2006. (Source: CNBC)

(Source: CNBC)

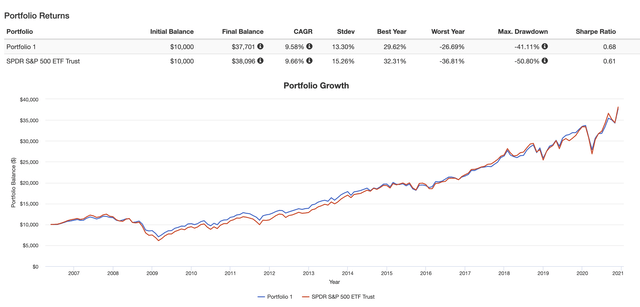

Question number one: how has (VIG) performed relative to the S&P 500? According to Portfoliovisualizer.com, (VIG) delivered CAGR of 9.58% per year since inception in 2006, assuming all dividends were reinvested. The SPDR S&P 500 Index ETF (SPY) produced a CAGR of 9.66% per year over the same time period, offering a very slight outperformance.

(Source: Portfoliovisualizer.com)

If you simply wanted to accumulate and reinvest dividends to build wealth over this fourteen year timeframe, (VIG) didn’t work quite as well as (SPY). The story changes, however, if your goal is to generate dividend growth. According to Dividendchannel.com, the total annual dividend for (VIG) starting in September of 2006 (shortly after the fund launched) comes to 80 cents compared to the most recent four quarterly payments that amount to a total of $2.23. That’s annualized dividend growth of 7.6%. By contrast, (SPY)’s dividends over the same time period grew from $2.76 to $5.68, representing annual dividend growth of only 5.3%. Your portfolio income would have grown by an extra 2.3% per year had you invested in (VIG) as opposed to (SPY) since 2006, and by even more than that if you factor in reinvested dividends.

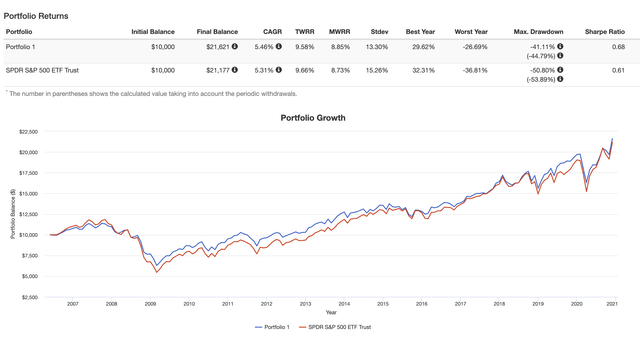

Suppose you wanted to retire, withdraw 4% from your portfolio each year for living expenses and you don’t care if your withdrawals come from dividends, principal or both. This scenario shows the benefit of investing in a slightly higher yielding portfolio with steadier dividend growth and lower price volatility. According to Portfoliovisualizer.com, (VIG) narrowly outperformed (SPY) since 2006 if you assume a 4% annual withdrawal rate (adjusted for inflation), delivering 5.46% average returns compared to 5.31%. Why might this be?

(Source: Portfoliovisualizer.com)

My theory is that thanks to the higher yield, an investor taking 4% withdrawals wouldn’t have to sell as many shares of (VIG) as she’d have to sell to support 4% withdrawals from a (SPY) portfolio. Retaining more shares means more income producing assets leading to more compounding, leading to higher income, leading to higher share retention and so on and so forth. The higher rate of dividend growth for (VIG) verses (SPY) only adds to that dynamic. Another theory: when the investor does need to sell shares to fund withdrawals, she’s less likely to suffer the agony of selling into weakness. (VIG), with a 13.3% standard deviation since 2006, is a less volatile portfolio than (SPY) which has a standard deviation of 15.26% over the same time period.

The historical data seem to suggest that a dividend growth strategy like the one (VIG) uses may make the most sense for investors who primarily (or exclusively) want to live off dividend income or who are going to take regular withdrawals from their portfolios. For investors with other goals (such as maximizing growth without regard to income), a broader index fund such as (SPY) could be the better choice over a long investment period.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor and nothing in this article is investment advice. I cannot guarantee the accuracy of the calculations and data results from Portfoliovisualizer.com.